Reebok 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

079

ANNUAL REPORT 2007 --- adidas Group

03

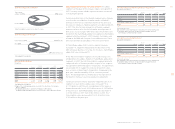

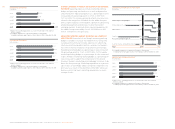

MIXED DEVELOPMENT OF GLOBAL SPORTING GOODS INDUSTRY

In 2007, the global sporting goods industry had a mixed regional

development. The European sporting goods industry was

stable, while the US market remained highly competitive. Asia

and Latin America contributed signifi cantly to our industry’s

growth.

EUROPEAN SPORTING GOODS INDUSTRY STABLE In Europe,

revenues in the largest sporting goods markets were basically

unchanged compared to the prior year. Slightly weaker sales

in Western Europe were offset by stronger sales in the region’s

emerging markets. Lower sales in Western Europe primarily

resulted from the non-recurrence of positive effects related

to the 2006 FIFA World Cup™ and a continuously diffi cult retail

landscape in the UK. Footwear sales remained stable in 2007

compared to the previous year. Apparel sales, however,

decreased at a low-single-digit rate, largely driven by the non-

recurrence of the 2006 FIFA World Cup™ jersey and replica

volumes.

From a country perspective, growth in Spain and France was

offset by promotional market conditions in other countries.

The UK market in particular saw continued contraction, with

volumes declining. Nevertheless, average prices started to

recover over the course of the year. Average selling prices for

footwear and apparel in the other countries also stabilized.

On a category basis, the European market continues to be posi-

tively infl uenced by growth in the outdoor and lifestyle catego-

ries. Running was negatively impacted by the ongoing trend

towards sport fusion styles, and the football category declined

due to the non-recurrence of positive effects related to the

2006 FIFA World Cup™. Channel develop ment was mixed.

General sporting goods stores were the major growth channel

on the footwear side, while the volume channel was the only

growth channel on the apparel side.

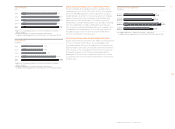

US SPORTING GOODS INDUSTRY HIGHLY COMPETITIVE

The sporting goods industry in North America continued to be

dominated by the shift towards new sport fusion styles. These

styles gained strongly on the back of signifi cant losses in the

classics and basketball categories.

The footwear market grew at a mid-single-digit rate in 2007.

Sales in the apparel market were largely unchanged versus

the prior year. Average selling prices increased marginally across

the industry. Sport fusion and vulcanized footwear styles in-

creased markedly. The region’s retail environment continued

to be very challenging, driven by price competition in the ath-

letic specialty channel. Retail growth was strongest in the

sporting goods and family footwear channels.

ASIAN SPORTING GOODS MARKET FLOURISHES In Asia, the

sporting goods sector grew at a high-single-digit rate in 2007.

Stagnation in Japan was more than compensated by strong

growth in the region’s emerging markets, in particular China.

In these markets, footwear sales grew at a double-digit rate

with running, basketball and training being the main contrib-

utors. Apparel sales also increased at a double-digit rate,

mainly due to growth in the training category. Average selling

prices were stable throughout the region.

LATIN AMERICAN SPORTING GOODS MARKET INCREASES

In Latin America, the sporting goods industry developed in

line with the overall economy and grew at a mid-single-digit

rate compared to the prior year. Both apparel and footwear

sales increased modestly in 2007 compared to the previous

year, refl ecting higher consumer spending in the region.

Average selling prices increased in Argentina and Venezuela

due to high infl ation rates and were stable in the region’s other

countries.

ADIDAS GROUP OUTPACES INDUSTRY AND OVERALL

ECONOMIC GROWTH In 2007, adidas Group revenues grew

faster than both the economy and the sporting goods industry

in all regions, with the exception of North America. From

a macroeconomic perspective, the two most important

indi cators of how conducive a region’s economic development

is to our business are GDP growth and consumer confi dence.

Performance in the sporting goods industry, however, is

often more infl uenced by product category trends, develop-

ment of key retail partners as well as pricing and volume

trends in the sector.

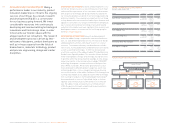

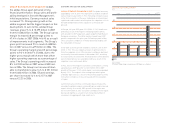

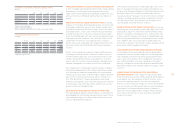

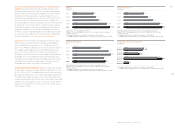

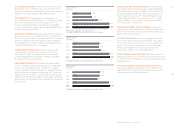

EXCHANGE RATE DEVELOPMENT 1)

€

1 equals

Average Q1 Q2 Q3 Q4

Avera

g

e

rate 2006 2007 2007 2007 2007 r

a

t

e

2007

7

USD

GBP

JPY

1

)

Spot rates at quarter-end.

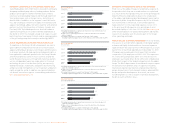

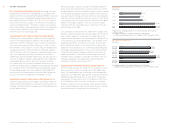

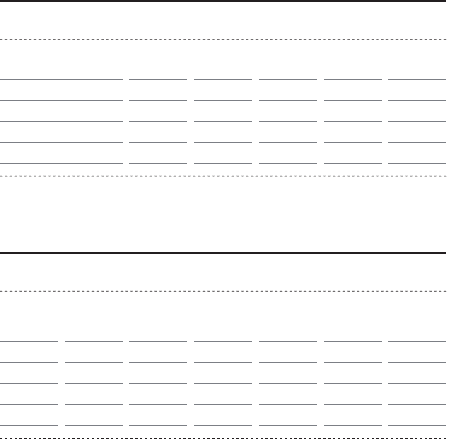

Q4 Q1 Q2 Q3 Q4

2006 2007 2007 2007 2007

USA 1)

Euro Zone 2)

Japan 3)

1

)

Source: Conference Board

.

2) Source: Euro

p

ean Commission

.

3

) Source: Economic and Social Research Institute, Government of Ja

p

an.

1.2562 1.3318 1.3505 1.4179 1.4721

1

.

3

70

9

0.6820 0.6798 0.6740 0.6968 0.7334 0.684

5

146.08 157.32 166.63 163.55 164.93

16

1.1

9

110.0 108.2 105.3 99.5 90.6

(6) (4) (2) (6) (9)

47.3 46.7 44.3 43.9 38.9

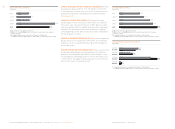

QUARTERLY CONSUMER CONFIDENCE DEVELOPMENT

by re

gi

on