Reebok 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

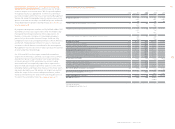

057

ANNUAL REPORT 2007 --- adidas Group

02

1)

Excluding goodwill and fi nance leases.

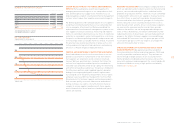

OPERATING MARGIN AS KEY PERFORMANCE INDICATOR

OF OPERATIONAL PROGRESS Operating margin (defi ned as

operating profi t as a percentage of net sales) is our Group’s

most important measure of operational success. It highlights

the quality of our top-line and operational effi ciency. The

primary drivers central to enhancing operating margin are:

- Sales and gross margin development: Management focuses

on identifying and exploiting opportunities that not only pro-

vide for future growth, but also have potential to increase gross

margin (defi ned as gross profi t as a percentage of net sales).

Major levers for sustaining and enhancing our Group’s sales

and gross margin include optimizing our product mix,

increasing the quality of distribution – with a particular focus

on controlled space – as well as supply chain effi ciency initia-

tives, and the minimization of clearance activities.

- Operating expense control: Tight control of operating

expenses is particularly important as we strive to leverage the

Group’s sales growth through to the bottom line. Marketing

working budget is our largest operating expense. It is one of

the most important mechanisms for driving top-line growth.

Therefore, we are committed to improving the utilization of

our marketing spend. This includes concentrating our commu-

nication efforts (including advertising, retail presentation and

public relations) on key global brand initiatives and focusing

our promotion spend on well-selected partnerships with top

events, leagues, clubs and athletes. We also aim to increase

operational effi ciency and reduce operating overhead expen ses

as a percentage of sales. Refi ning business proc esses, elimi-

nating redundancies and leveraging the scale of our orga-

nization are important drivers in this respect.

We strive to maximize revenues and minimize costs by detailed

target setting, and we constantly monitor deviations in rolling

forecasts on a monthly basis. If necessary, action plans are

implemented to optimize the development of the Group’s oper-

ating performance.

OPTIMIZATION OF NON-OPERATING COMPONENTS Our Group

also puts a high priority on the optimization of non-operating

components such as fi nancial expenses and taxes, as these

items strongly impact the Group’s cash outfl ows and therefore

the Group’s free cash fl ow. Financial expenses are managed

centrally by our Group Treasury department. see Treasury, p. 091

The Group’s current and future tax expenditures are optimized

globally by our Group Taxes department.

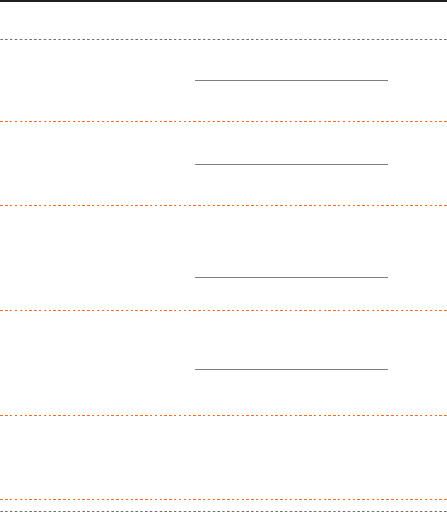

KEY FINANCIAL METRICS

Gross margin = Gross profi t

Net sales × 100

Operating margin = Operating profi t

Net sales × 100

Average operating

working capital =

Sum of operating working

capital at quarter-end

4

Operating working capital

in % of net sales =

Average operating

working capital

Net sales × 100

Capital expenditure1) =

Additions of property,

plant and equipment plus

intangible assets