Reebok 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

089

ANNUAL REPORT 2007 --- adidas Group

03

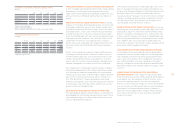

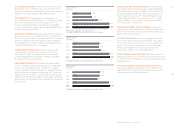

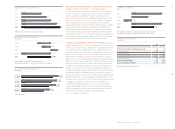

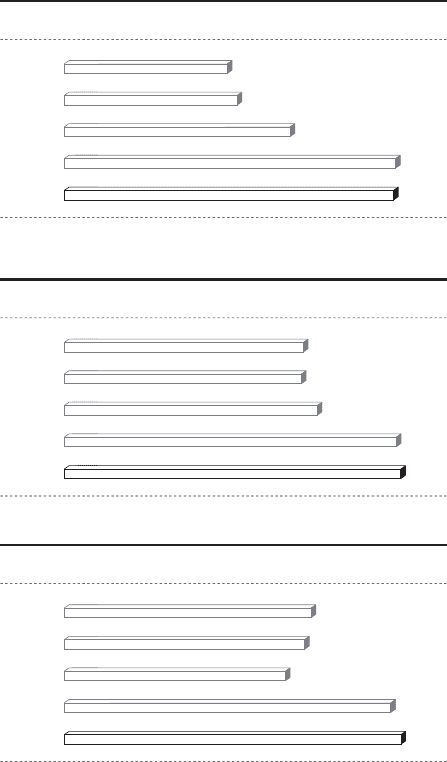

TOTAL ASSETS DECREASE 1 % At the end of 2007, total assets

decreased 1 % to € 8.325 billion versus € 8.379 billion in the

prior year, mainly due to currency effects which had a negative

impact on the Group’s US dollar-denominated assets.

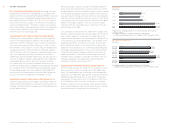

INVENTORIES UP 1 % Group inventories increased 1 % to

€ 1.629 billion at the end of 2007 versus € 1.607 billion in 2006.

On a currency-neutral basis, inventories grew 7 %. The

increase was driven by higher inventory levels in emerging

markets, refl ecting the Group’s high sales growth expectations

for these countries in particular.

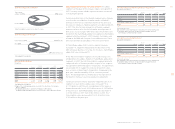

RECEIVABLES INCREASE 3 % At the end of 2007, Group receiv-

ables increased 3 % to € 1.459 billion (2006: € 1.415 billion).

On a currency-neutral basis, receivables grew 8 %. This is well

below sales growth in the fourth quarter of 2007 and refl ects

strict discipline in the Group’s trade terms management and

concerted collection efforts in all segments.

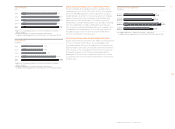

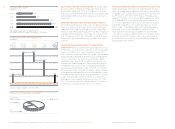

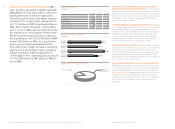

OTHER CURRENT ASSETS UP 28 % Other current assets

increased 28 % to € 529 million at the end of 2007 from

€ 413 million in 2006. This development was mainly due

to higher prepayments for promotion contracts and higher

fair values of fi nancial instruments.

FIXED ASSETS DECREASE 7 % Fixed assets decreased by

7 % to € 3.726 billion at the end of 2007 versus € 3.988 billion

in 2006. This was mainly due to € 286 million of negative

currency trans lation effects on fi xed assets held in currencies

other than the euro. In addition, the transfer of € 17 million of

fi xed assets to assets held-for-sale impacted this development.

Additions of € 295 million were partly offset by depreciation and

amortization of € 215 million as well as disposals in an amount

of € 37 million.

ASSETS HELD-FOR-SALE INCREASE 35 % Assets held-for-

sale mainly relate to the planned sale of land and buildings

in Herzogenaurach, Germany. In addition, two warehouses in

the UK and the Maxfl i trademark were reclassifi ed as assets

held-for-sale at the end of 2007. The Maxfl i trademark was

sold in February 2008. see Subsequent Events, p. 117 As a result

of these additions, assets held-for-sale increased 35 % to

€ 80 million (2006: € 59 million).

OTHER NON-CURRENT ASSETS INCREASE 8 % Other non-

current assets increased by 8 % to € 147 million at the end of

2007 from € 134 million in 2006, mainly driven by higher fair

values of fi nancial instruments.

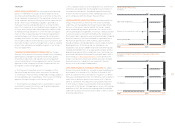

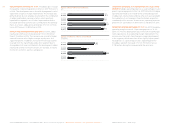

ACCOUNTS PAYABLE UP 13 % Accounts payable increased

13 % to € 849 million at the end of 2007 versus € 752 million

in 2006. On a currency-neutral basis, accounts payable were

up 22 %. The increase is primarily due to increased product

deliveries from suppliers in the last quarter of the year,

refl ecting the Group’s sales growth expectations.

OTHER CURRENT LIABILITIES GROW 15 % Other current lia -

bilities increased 15 % to € 266 million at the end of 2007 from

€ 232 million in 2006, primarily as a result of increased current

forward contracts.

OTHER NON-CURRENT LIABILITIES INCREASE 65 % Other

non-current liabilities increased 65 % to € 69 million at the

end of 2007 from € 43 million in 2006, primarily as a result of

increased non-current forward contracts.

TOTAL ASSETS

€

in million

s

INVENTORIES

€ in million

s

RECEIVABLES

€

in milli

o

n

s

2003

2004 1)

2005

2006 2)

2007

1

) Restated due to a

pp

lication of amendment to IAS 19

.

2) Includin

g

Reebok business se

g

ment from February 1, 2006 onwards.

2003

2004

2005

2006 1)

2007

1

) Including Reebok business segment from February 1, 2006 onwards.

2003

2004

2005

2006 1)

2007

1

) Including Reebok business segment from February 1, 2006 onwards.

4,434

1,155

1,046

5,750

1,230

965

8,379

1,607

1,415

8

,

3

25

1

,

629

1

,

45

9

4,188

1,164

1,075