Reebok 2007 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

173

ANNUAL REPORT 2007 --- adidas Group

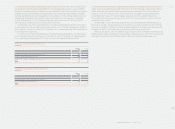

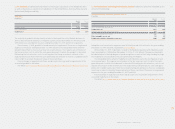

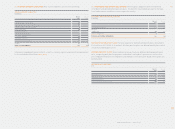

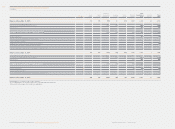

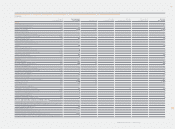

CONSTITUTION OF PLAN ASSETS

€

in million

s

Dec

3

1

.

2007

Equity instruments

Bonds

Pension plan reinsurance

Other assets

Fair value of

p

lan assets

28

5

16

11

6

0

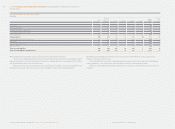

HISTORICAL DEVELOPMENT

€

in milli

o

n

s

Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31

2

007

2006 2005 2004 2003

Present value of defi ned benefi t obligation

Fair value of plan assets

Non-deductible plan assets

Defi cit in plan

Experience adjustments

171

170 131 118 100

6

0

46 — — —

(

4

)

(2) — — —

131 118 100

8

115 126

6

(

1

)

4 1 — —

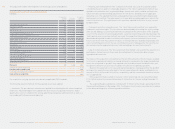

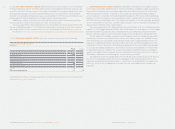

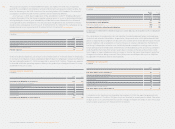

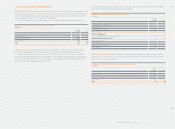

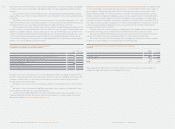

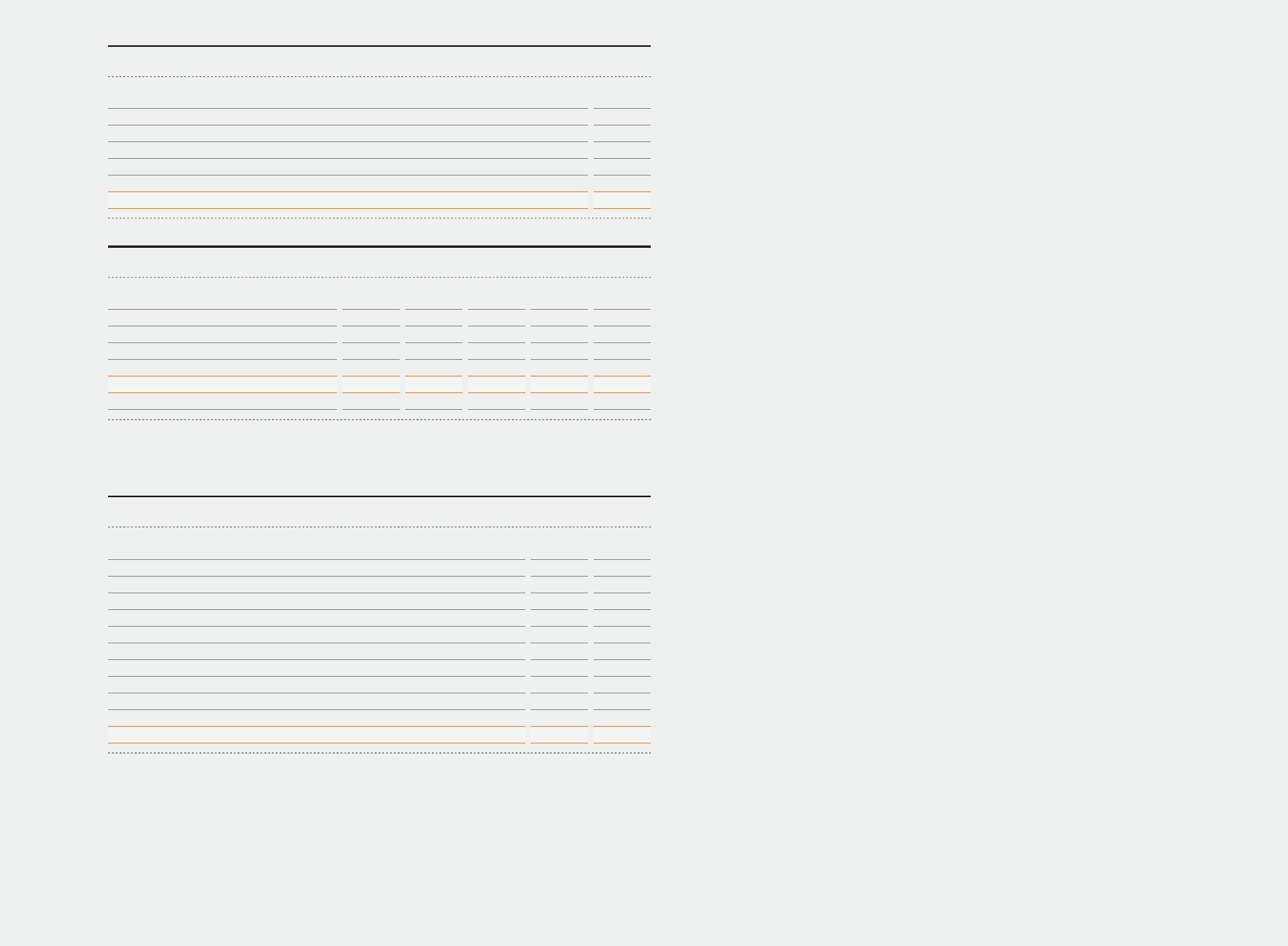

19 OTHER NON-CURRENT LIABILITIES Other non-current liabilities consist of the following:

OTHER NON-CURRENT LIABILITIES

€

in milli

o

n

s

D

ec.

3

1 Dec. 31

2007 2006

Financial lease obligations

Liabilities due to personnel

Deferred income

Financial liabilities

Interest rate derivatives

Currency options

Forward contracts

Other fi nancial liabilities

Sundry

O

th

e

r n

o

n-

cu

rr

e

nt li

ab

iliti

es

3

5

6

4

14

12

1

0

12

16

1

1

6

—

1

1

3

8

69 43

3

Information regarding fi nance lease obligations, forward contracts as well as currency options

and interest rate derivatives is also included in these Notes. see Notes 22 and 23

Liabilities due after more than fi ve years amounted to € 15 million at December 31, 2007

(2006: € 15 million).

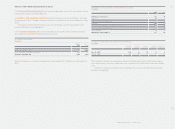

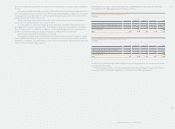

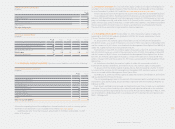

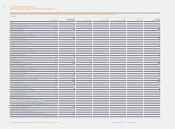

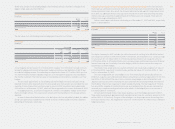

20 MINORITY INTERESTS This line item within equity comprises the equity of third parties in

a number of our consolidated companies. Minority interests are attributable to three subsidiar-

ies as at December 31, of both 2007 and 2006. see Shareholdings (Attachment II to these Notes)

These subsidiaries were mainly purchased as part of the acquisition of the Reebok business.

In accordance with IAS 32, the following minority interests are not reported within minority

interests: GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG (Germany), as the com-

pany is a limited partnership, and adidas Hellas A. E. (Greece), as this minority is held with a put

option. The fair value of these minorities is shown within other liabilities. The difference between

the fair value and the minority interests is shown as goodwill less accumulated amortization.

The result for these minorities is reported within fi nancial expenses.

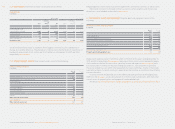

21 SHAREHOLDERS’ EQUITY On December 31, 2006, the nominal capital of adidas AG

amounted to € 203,536,860 and was divided into 203,536,860 no-par-value bearer shares

(“shares”) and was fully paid in.

In January 2007, the nominal capital increased to a total of € 203,567,060 divided into

203,567,060 shares, as a result of the exercise of a total of 7,550 stock options in November 2006

and the issuance of 30,200 shares associated with the Management Share Option Plan (MSOP) of

adidas AG. Capital reserves thus increased by € 175,296.

Furthermore, in July 2007, the nominal capital increased to a total of € 203,625,060 divided

into 203,625,060 shares, as a result of the exercise of a total of 14,500 stock options in May 2007

and the issuance of 58,000 shares associated with the Management Share Option Plan. In Octo-

ber 2007, the nominal capital again increased as a result of the exercise of a total of 975 stock

options in August 2007 and the issuance of 3,900 shares associated with the Management Share

Option Plan.

At the balance sheet date, the nominal capital of adidas AG amounted to a total of

€ 203,628,960 and was divided into 203,628,960 shares. The nominal capital is fully paid in.

In January 2008, the nominal capital of adidas AG was then increased by a further € 16,000

as a result of the exercise of 4,000 stock options in November 2007 and the issuance of 16,000

shares associated with the Management Share Option Plan.

On February 15, 2008, the nominal capital of adidas AG therefore amounted to € 203,644,960

and was divided into 203,644,960 shares.

The corresponding adjustment of the amount of the nominal capital resulting from the above

transactions up to and including January 2008 was registered with the Commercial Register on

February 4, 2008.

Each share is entitled to one vote and, starting from the year it was issued, is also entitled to

a dividend. Treasury shares held directly or indirectly and repurchased based on the authoriza-

tion of the Executive Board granted by resolution of the Annual General Meeting on May 10, 2007,

are not entitled to a dividend payment in accordance with § 71 b German Stock Corporation Act

(AktG – Aktiengesetz).

05