Reebok 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

036

ANNUAL REPORT 2007 --- adidas Group TO OUR SHAREHOLDERS - Our Share

OUR SHARE The adidas A

G

share developed stron

g

ly in

2

007, increasing 36% and outperforming

both the DAX-

30

and the

MSCI

World Textiles, Apparel

&

Luxury

G

oods Index.

O

utstanding

fi

nancial results throughout the year and growing confi dence in the

G

roup’s medium-term

s

trategy were the drivers of this outperformance. The Group’s

A

DR

a

n

d

co

nv

e

rti

b

l

e

bo

n

d

a

l

so

a

ppreciated si

g

nifi cantly in

2

007. As a result of the Group’s stron

g

operational per formance in

2007

, we

i

ntend to propose a h

ig

her d

i

v

i

dend at the

2008

Annual

G

eneral Meetin

g

.

O

ur

s

hareholder base is becoming increasingly international and analyst support

f

or the adidas

AG

s

hare has strength ened signifi cantly versus the prior year

.

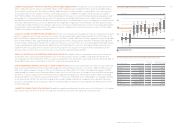

SIGNIFICANT SHARE PRICE INCREASE After trading sideways at the beginning of the year, our share gained signifi cantly follow-

ing the release of our 2006 full year results in early March. Management’s fi nancial guidance for 2007 and the confi rmation of our

Group’s medium-term targets strengthened investor sentiment. Buoyant merger and acquisition activity in our industry as well as

shareholder notifi cation and speculation around adidas AG also supported our share price development. In mid-2007, our share

price declined in line with the DAX-30 and our sector as a result of the US subprime mortgage crisis. Our share price also suffered

as a result of concerns about the short-term Reebok business outlook, the weak state of the US mall-based channel as well as

several earnings announcements from suppliers and retailers which were below market expectations. Despite the positive reac-

tion to our quarterly earnings release in early August, which exceeded consensus estimates, our share price trended downwards,

in line with the overall market. Later in the month, our share price regained slightly after our Investor Day held in Canton,

Massachusetts, USA, due to widespread positive response to the Group’s medium-term strategic initiatives. Positive news fl ow

from our sector in September and October helped drive improvements in our share. At the beginning of November, our well-

received nine months results supported a share rally throughout the remainder of the year. The adidas share closed 2007 at its

all-time high of € 51.26. As a result of this develop ment, our market capitalization increased signifi cantly to € 10.4 billion at the end

of 2007 versus € 7.7 billion at the end of 2006.

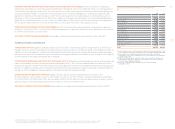

ADIDAS AG SHARE A MEMBER OF IMPORTANT INDICES The adidas AG share is included in a variety of high-quality indices around

the world, most importantly the DAX-30 and the MSCI World Textiles, Apparel & Luxury Goods Index. The DAX-30 is a blue chip stock

market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The MSCI World Textiles,

Apparel & Luxury Goods Index comprises our Group’s major competitors. At December 31, 2007, our weighting in the DAX-30, which

is calculated on the basis of free fl oat market capitalization and 12-month share turnover, was 1.31 % (2006: 1.12 %). Our increased

weighting compared to the prior year was largely a result of the signifi cant increase in our market capitalization. In addition,

average daily trading volume of the adidas AG share (excluding bank trades) rose from 2.0 million in 2006 to more than 2.2 million in

2007. Within the DAX-30, we ranked 21st on market capitalization (2006: 24) and 22nd on turnover (2006: 21) at year-end 2007.

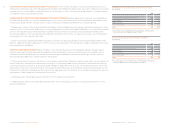

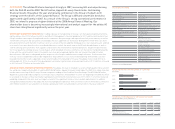

THE ADIDAS AG SHARE

Number of shares outstanding

2007 average 203,594,975

At year-end 2007 203,628,960 1)

Type of share No-par-value share

Free fl oat 100 %

Initial Public Offering November 17, 1995

Share split June 6, 2006 (in a ratio of 1:4)

Stock exchange All German stock exchanges

Stock registration number (ISIN) DE0005003404

Stock symbol ADS, ADSG.DE

Important indices DAX-30

MSCI World Textiles,

Apparel & Luxury Goods

Deutsche Börse

Prime Consumer

Dow Jones STOXX

Dow Jones EURO STOXX

Dow Jones Sustainability

FTSE4Good Europe

Ethibel Pioneer

Ethibel Excellence

Vigeo ASPI Eurozone

1)

All shares carry full dividend rights

.

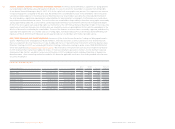

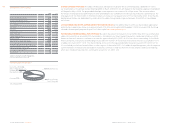

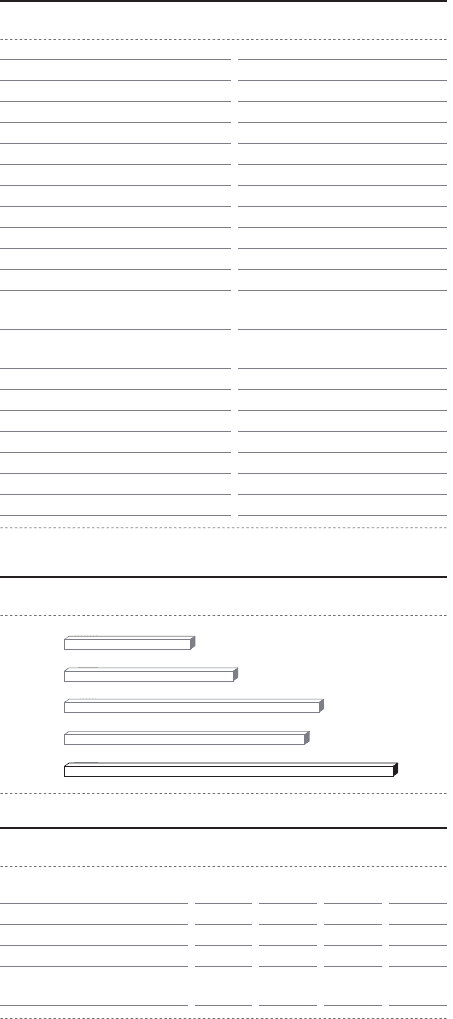

ADIDAS AG MARKET CAPITALIZATION AT YEAR-END

€

in million

s

2003

2004

2005

2006

2007

5,446

8,122

7,679

10,43

8

4,104

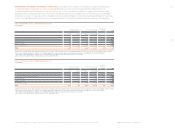

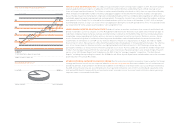

HISTORICAL PERFORMANCE OF THE ADIDAS AG SHARE

a

nd Im

p

ortant Indices at Year-End 2007 in

%

1 year 3 years 5 years since IPO

adidas AG

DAX-30

MSCI World Textiles,

Apparel & Luxury Goods

36 73 149 490

22 90 179 266

8 50 170 167