Reebok 2007 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes to the Consolidated Balance Sheet

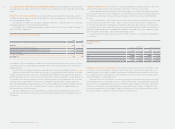

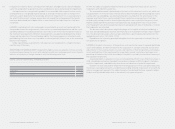

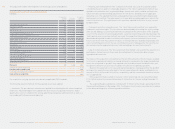

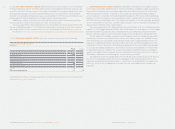

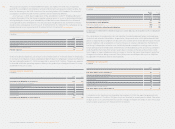

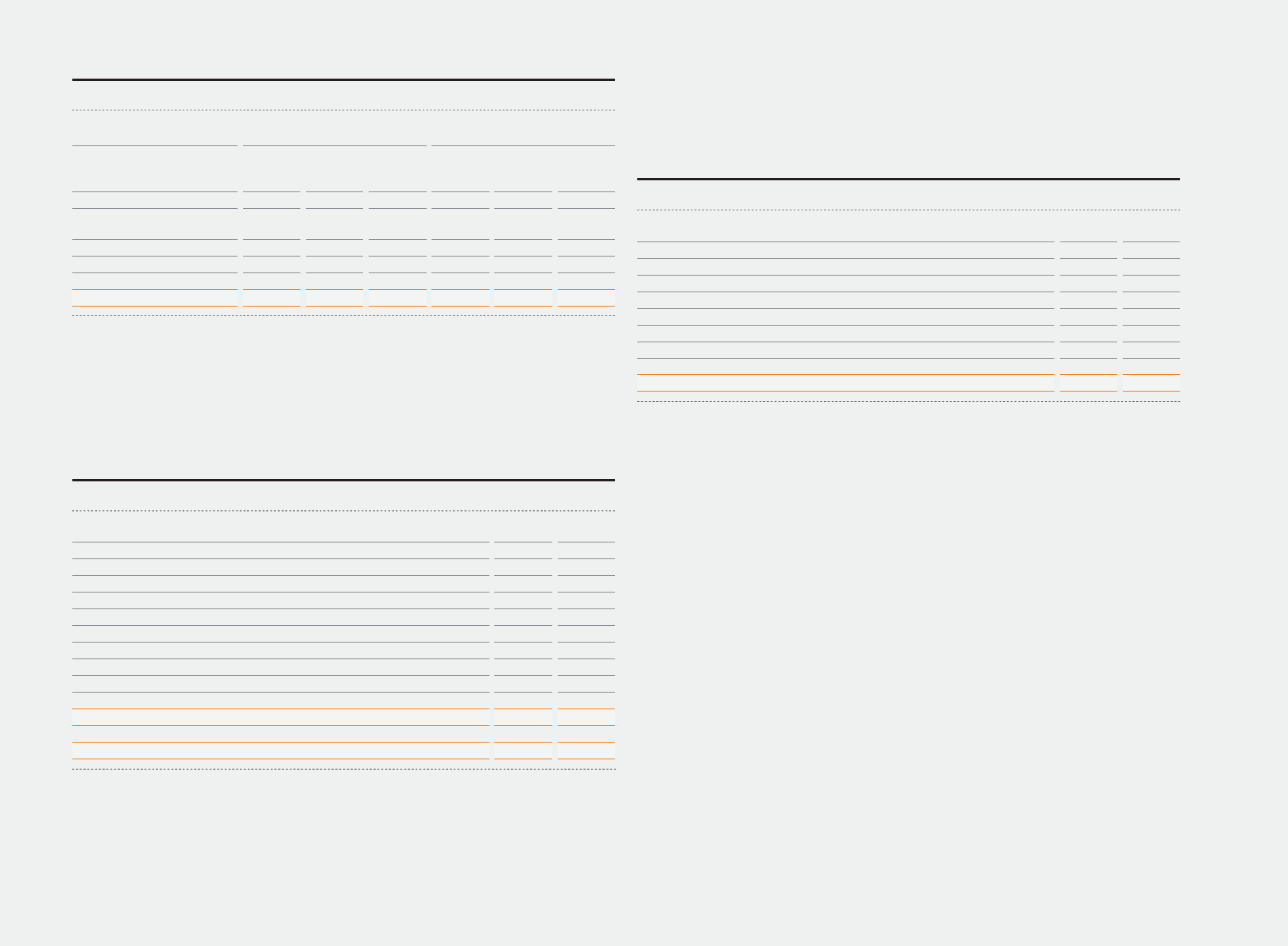

8 INVENTORIES Inventories by major classifi cation are as follows:

INVENTORIES

€

in milli

o

n

s

D

ec.

3

1, 200

7

Dec. 31, 2006

A

ll

o

w

a

n

ce

Allowance

for

for

Gross obsoles- Net

Gross obsoles- Net

value cence value

value cence value

Finished goods and

merchandise on hand

Goods in transit

Raw materials

Work in progress

I

nventories, net

1,187 75 1,112

1,208 86 1,122

4

68

—

4

68

428 — 428

40 3 37

46 2 44

12

—

1

2

13 — 13

1,707 78 1,629 1,695 88 1,607

Goods in transit mainly relate to shipments from suppliers in the Far East to subsidiaries in

Europe, Asia and the Americas. The allowance for obsolescence mainly relates to inventories on

hand which amounted to € 431 million and € 349 million as at December 31, 2007 and 2006,

respectively. see also Note 2

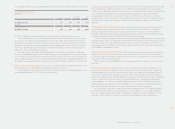

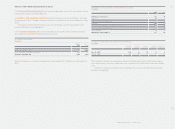

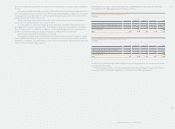

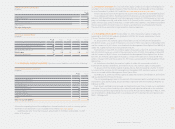

9 OTHER CURRENT ASSETS Other current assets consist of the following:

OTHER CURRENT ASSETS

€ in millions

Dec.

31

Dec. 31

2

007 2006

Prepaid expenses

Tax receivables other than income tax

Financial Assets

Interest rate derivatives

Currency options

Forward contracts

Security deposits

Other fi nancial assets

Sundry

O

ther current assets,

g

ross

Less: allowance

Other current assets

,

net

2

74 213

68

74

—

—

2

3

6

11

7

3

8 28

50 29

67

56

53

1 41

3

2

—

529 413

Prepaid expenses relate mainly to promotion agreements and service contracts as well as rents.

Information in relation to forward contracts as well as currency options and interest rate

derivatives is also included in these Notes. see Note 23

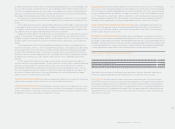

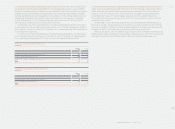

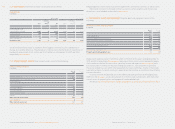

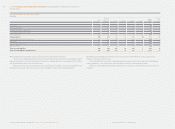

10 PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment consist of the

following:

PROPERTY, PLANT AND EQUIPMENT

€

in million

s

D

ec.

3

1 Dec. 31

200

7

2006

Land and buildings

Technical equipment and machinery

Other equipment, furniture and fi ttings

Less: accumulated depreciation

Construction in progress, net

Property, plant and equipment, ne

t

4

30

484

115

118

629

567

1

,174

1

,16

9

9

514

498

660

671

42

18

702 689

9

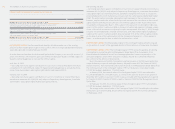

Depreciation expenses were € 145 million and € 129 million for the years ending December 31,

2007 and 2006, respectively see also Note 24. Impairment losses which are included within depre-

ciation and amortization (shown in other operating income and expenses see also Note 24) were

€ 3 million and € 11 million for the years ending December 31, 2007 and 2006, respectively.

These are related to assets within other equipment, furniture and fi ttings, mainly in the Group’s

own-retail activities, for which contrary to expectations there will be an insuffi cient fl ow of future

economic benefi ts.

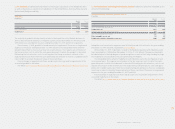

In connection with the planned sale of the GEV Grundstücksgesellschaft Herzogenaurach

mbH & Co. KG see Note 3, assets amounting to € 17 million were transferred in 2006 from other

current assets to property, plant and equipment (Land and buildings).

For details see Statement of Movements of Tangible and Intangible Assets and Financial Assets (Attachment I to these Notes)