Reebok 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

085

ANNUAL REPORT 2007 --- adidas Group

03

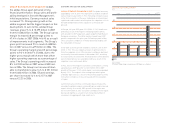

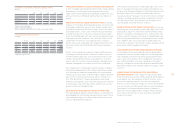

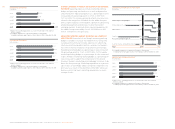

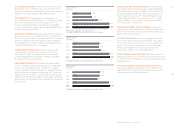

OPERATING OVERHEADS INCREASE AS A PERCENTAGE OF

SALES Group operating overheads include overhead costs

related to marketing, sales, logistics, research and develop-

ment as well as central fi nance and administration functions.

Operating over head expenses as a percentage of sales in-

creased 2.2 percentage points to 26.0 % in 2007 from 23.8 %

in the prior year. This was primarily a result of higher own-

retail expenditures, which increased in line with the expansion

of the Group’s own-retail activities. Central fi nance and ad-

ministration expenses also grew overproportionately due to

integration expenses in the Group’s Headquarter functions.

However, research and development expenditure decreased

as a result of the combination of certain adidas and Reebok

research capabilities. see Research and Development, p. 072

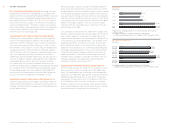

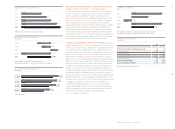

EBITDA UP 8 % The Group’s earnings before interest, taxes,

depreciation and amortization of tangible and intangible

assets (EBITDA) increased 8 % to € 1.165 billion in 2007

(2006: € 1.078 billion). Depreciation and amortization expense

for tangible and intangible assets with limited useful lives

grew 1 % to € 211 million in 2007 (2006: € 209 million). In

accordance with International Financial Reporting Standards,

intangible assets with unlimited useful lives (goodwill and

trademarks) are tested annually and additionally when there

are indications of potential impairment. No impairment of

intangible assets was incurred in 2007 and 2006.

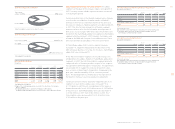

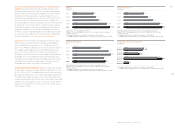

OPERATING MARGIN REACHES 9.2 % The operating margin

of the adidas Group increased 0.5 percentage points to 9.2 %

in 2007 (2006: 8.7 %). This development was in line with initial

Management expectations of an operating margin around 9 %.

The operating margin increase is a result of the Group’s gross

margin improvement, which more than offset higher operating

expenses as a percentage of sales. As a result, Group operat-

ing profi t increased 8 % in 2007 to reach € 949 million versus

€ 881 million in 2006.

EBITDA

€

in million

s

2003

2004 1) 2)

2005 2)

2006 3)

2007

1

) Adjusted to refl ect the application of IAS 32

.

2) Fi

g

ures refl ect continuin

g

operations as a result of the divestiture of the Salomon

b

usiness se

g

ment

.

3

)

Including Reebok business segment from February 1, 2006 onwards.

I

ncluding Greg Norman apparel business from February 1, 2006 to November 30, 2006.

OPERATING MARGIN

in %

OPERATING PROFIT

€

in millions

2003 1)

2004 2)

2005 2)

2006 3)

2007

1)

Excludin

g

royalty and commission income as well as

g

oodwill amortization

.

2

)

Fi

g

ures refl ect continuin

g

operations as a result of the divestiture of the Salomon

b

us

i

ness segment

.

3) Including Reebok business segment from February 1, 2006 onwards.

I

ncludin

g

Gre

g

Norman apparel business from February 1, 2006 to November

3

0, 2006.

2003 1)

2004 2)

2005 2)

2006 3)

200

7

1

) Excluding royalty and commission income as well as goodwill amortization

.

2

) Fi

g

ures refl ect continuin

g

operations as a result of the divestiture of the Salomo

n

business se

g

ment.

3)

Including Reebok business segment from February 1, 2006 onwards.

Including Greg Norman apparel business from February 1, 2006 to November 30, 2006

.

1,078

1

,

165

10.0

584716

10.7

707806

8.7

881

9.

2

949

7.8

490652

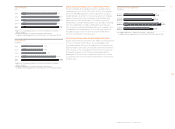

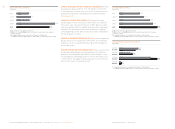

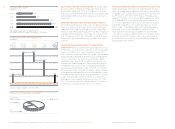

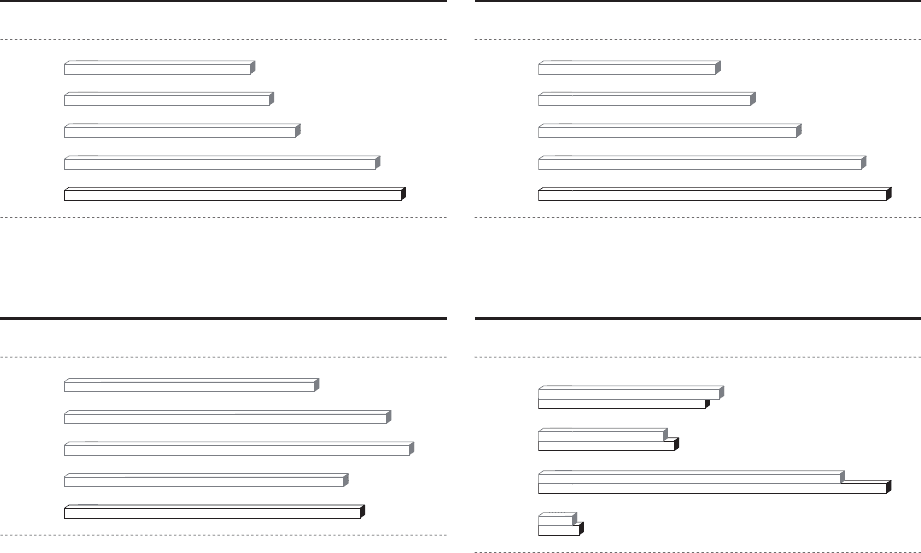

OPERATING PROFIT BY QUARTER 1)

€

in milli

o

n

s

Q1 2006

Q

1 200

7

Q2 2006

Q

2 200

7

Q3 2006

Q3

200

7

Q4 2006

Q

4 200

7

1)

Includin

g

Reebok business se

g

ment from February 1, 2006 onwards.

Including Greg Norman apparel business from February 1, 2006 to November 30, 2006

.

471

409

1

88

173

229

248

61

52