Reebok 2007 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176

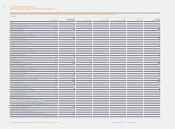

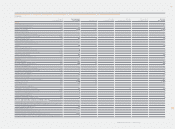

ANNUAL REPORT 2007 --- adidas Group CONSOLIDATED FINANCIAL STATEMENTS - Notes to the Consolidated Balance Sheet

CONVERTIBLE BOND adidas International Finance B.V. issued a convertible bond with a nominal

value of € 400,000,000 on October 8, 2003 divided into 8,000 convertible bonds with a nominal

value of € 50,000 each. The convertible bond is due for repayment on October 8, 2018, if not

previously repaid or converted into adidas AG shares. adidas AG has assumed the unconditional

and irrevocable guarantee with respect to payments of all amounts payable under the convert-

ible bond by adidas International Finance B.V. for this convertible bond. Furthermore, adidas AG

has also taken over the obligation to the holders of the convertible bond to supply shares to be

delivered following conversion of a bond. The convertible bond entitles the holder to acquire

shares in adidas AG at a conversion price of an original € 102 per share, whereby the conversion

ratio results from dividing the nominal amount of a bond (€ 50,000) by the conversion price rul-

ing at the exercise date. The conversion price has been meanwhile adjusted to € 25.50 following

the stock split undertaken in 2006. The conversion right can be exercised by a bond holder

between November 18, 2003 and September 20, 2018, whereby certain conversion restrictions

apply. When the conversion is exercised, the shares are to be obtained from contingent capital

established by resolution of the Annual General Meeting of adidas AG on May 8, 2003 in the ver-

sion of the resolution of the Annual General Meeting held on May 11, 2006. adidas International

Finance B.V. is entitled to repay the convertible bond fully on or after October 8, 2009 although,

in the period from October 8, 2009 through October 7, 2015 only to the extent the market value

of the shares of adidas AG amounts to at least 130 % (period from October 8, 2009 through Octo-

ber 7, 2012) or 115 % (period from October 8, 2012 through October 7, 2015) of the conversion

price valid at that time over a certain reference period of time (as set out in the bond conditions).

The convertible bond was issued as a bearer bond and subscription rights of shareholders to the

bearer bonds were excluded. The shareholders have no subscription rights per se to the shares

for which the holders of the bonds have rights, due to security provided by contingent capital.

There were 7,999 bonds outstanding at December 31, 2007 and February 15, 2008, respectively.

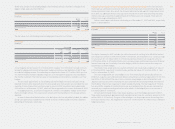

CHANGES IN THE PERCENTAGE OF VOTING RIGHTS (ANNOUNCEMENTS PURSUANT TO § 160

SEC. 1 NO 8 AKTG) INVESCO Asset Management Deutschland GmbH, Frankfurt / Main, informed

the Company on March 20 and March 21, 2007, pursuant to § 21 sec. 1 sent. 1 WpHG (German

Securities Trading Act), that on March 13, 2007 the voting interest of AMVESCAP PLC, London,

UK, in adidas AG exceeded the threshold of 5 % and amounted to 5.087 % of the voting rights

(10,356,271 shares) on this date. 5.087 % of the voting rights (10,356,271 shares) are attributable

to AMVESCAP PLC, in accordance with § 22 sec. 1 sent. 1 no. 6 WpHG in connection with sent. 2

and 3 WpHG. The chain of controlled undertakings through which the voting rights are held is:

5.0739 % of the voting rights (10,328,700 shares) AVZ CALLCO INC., AMVESCAP Inc., AIM Canada

Holdings Inc. and AIM Fund Management Inc. The remaining 0.0131 % of voting rights (27,571

shares) are held by other subsidiaries of AMVESCAP PLC.

Fidelity International, Tadworth, UK, informed the Company by letter dated December 20,

2007, in accordance with § 21 sec. 1 WpHG, that on December 19, 2007 the voting interest of

Fidelity Management & Research Company, Boston, Massachusetts, USA, in adidas AG exceeded

the threshold of 3 % and amounted to 3.06 % of the voting rights (6,223,900 shares) on this date.

All of these voting rights are attributable to Fidelity Management & Research Company, Boston,

Massachusetts, USA pursuant to § 22 sec. 1 sent. 1 no. 6 WpHG.

In addition, Fidelity International, Tadworth, UK, informed the Company by letter of the same

day, pursuant to § 21 sec. 1 WpHG, that on December 19, 2007, the voting interest of FMR LLC,

Boston, Massachusetts, USA, in adidas AG exceeded the threshold of 3 % and amounted to 3.06 %

of the voting rights (6,230,600 shares) on this date. All of these voting rights are attributable to

FMR LLC, Boston, Massachusetts, USA, pursuant to § 22 sec. 1 sent. 1 no. 6 in conjunction with

sent. 2 WpHG.

Capital Research and Management Company, Los Angeles, USA, informed the Company by

letter dated February 4, 2008, in accordance with § 21 sec. 1 WpHG that its voting interest in

adidas AG exceeded the threshold of 3 % on January 31, 2008, and amounted to 3.089 % of the

voting rights (6,290,497 shares) on this date. All of these voting rights are attributable to Capital

Research and Management Company pursuant to § 22 sec. 1 sent. 1 no. 6 WpHG.

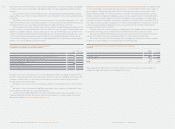

CAPITAL MANAGEMENT The Group’s policy is to maintain a strong capital base so as to maintain

investor, creditor and market confi dence and to sustain future development of the business.

The Group seeks to maintain a balance between the higher returns that might be possible

with higher levels of borrowings and the advantages and security afforded by a solid capital

position. The primary Group’s fi nancial leverage target is below 50 % net debt to equity. In addition,

it is intended to largely use future excess cash for a buyback of adidas AG shares.

There were no changes in the Group’s approach to capital management during the year.