Reebok 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

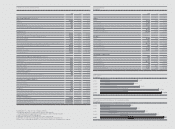

TARGETS AND RESULTS

ADIDAS GROUP KEY FIGURES

200820072007

TARGETS AND RESULTS

ADIDAS GROUP KEY FIGURES

TARGETS RESULTS TARGETS

---

Mid-single-digit

currency-neutral sales growth

---

Bring major new concepts,

technology evolutions and

revolutions to market

---

Currency-neutral sales

to grow at all brands

and in all regions

---

Gross margin range 45 – 47 %

---

Operating margin around 9 %

---

Reduce operating working capital

as a percentage of sales to below 25 %

---

Capital expenditure range € 300 million – € 400 million

---

Reduce year-end net borrowings

to below € 2 billion

---

Net income growth

to approach 15 %

---

Further increase shareholder value

---

Net sales reach € 10.3 billion;

Group currency-neutral sales grow 7 %

---

Major 2007 product launches:

adidas

new technologies in adiSTAR,

SuperNova and Response running shoe families,

Stella McCartney “Gym / Yoga” collection, TechFit™ apparel

Reebok

running shoes Trinity KFS II and HATANA,

Rbk EDGE Uniform System™ apparel collection

Rockport

fi rst footwear collection incorporating

adidas Torsion ® technology

TaylorMade-adidas Golf

r7 ® SuperQuad drivers, POWERBAND shoe,

Clima concept extended to Golf apparel

---

Currency-neutral sales increase 12 % at adidas,

remain stable at Reebok and grow 9 % on a like-for-like basis

at TaylorMade-adidas Golf; currency-neutral sales grow

in all regions except North America

---

Gross margin: 47.4 %

---

Operating margin: 9.2 %

---

Operating working capital as a percentage

of sales: 25.2 %

---

Capital expenditure: € 289 million

---

Net borrowings reduced to € 1.766 billion;

year-end fi nancial leverage: 58.4 %

---

Highest ever net income attributable

to shareholders at € 551 million (+ 14 %)

---

adidas AG share increased 36 %, outperforming DAX-30

and MSCI World Textiles, Apparel and Luxury Goods Index;

19 % dividend increase proposed; share buyback program initi-

ated in January 2008

---

High-single-digit

currency-neutral sales growth

---

Bring major new concepts,

technology evolutions and

revolutions to market

---

Currency-neutral sales to grow

at all brands and in all regions

except North America

---

Gross margin range 47.5 % and 48 %

---

Operating margin to be at least 9.5 %

---

Further reduce operating working capital

as a percentage of sales

---

Capital expenditure range € 300 million – € 400 million

---

Maintain or further reduce net borrowings

despite share buyback

---

Net income to grow

at least 15 %

---

Further increase shareholder value