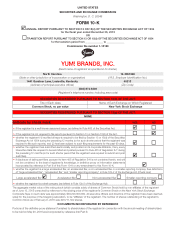

Pizza Hut 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 85

Proxy Statement

APPENDIX A

3.2 Restrictions on Full Value Awards. Each Full Value

Award shall be subject to the following:

(a) Any Full Value Award shall be subject to such conditions,

restrictions and contingencies as the Committee shall

determine.

(b) Except for Full Value Awards that are granted (i) in lieu of

other compensation, (ii) as a form of payment of earned

performance awards or other incentive compensation,

(iii) to new hires, or (iv) as retention awards outside the

United States, if the right to become vested in a Full

Value Award granted to an employee is conditioned

on the completion of a specified period of service with

YUM! and the Subsidiaries, without achievement of

Performance Measures or other performance objectives

being required as a condition of vesting, then the

required period of service for full vesting of the Full Value

Award shall be not less than three years (provided that

the required period for full vesting shall, instead, not

be less than two years in the case of annual incentive

deferrals payable in restricted shares), subject to pro

rated vesting over the applicable minimum service period

and to acceleration of vesting, to the extent permitted by

the Committee, in the event of the Participant’s death,

disability, retirement, change in control or involuntary

termination). Awards to Directors are not subject to

this paragraph 3.2(b).

3.3 Performance-Based Compensation. The Committee

may designate a Full Value Award granted to any

Participant as “Performance-Based Compensation”

within the meaning of Code Section 162(m) and

regulations thereunder. To the extent required by Code

Section 162(m), any Full Value Award so designated

shall be conditioned on the achievement of one or more

Performance Measures determined by the Committee

and the following additional requirements shall apply:

(a) The performance targets established for the performance

period established by the Committee shall be objective

(as that term is described in regulations under Code

Section 162(m)) and shall be established in writing by

the Committee not later than ninety (90) days after the

beginning of the performance period (but in no event

after 25% of the performance period has elapsed),

and while the outcome as to the performance targets

is substantially uncertain. The performance targets

established by the Committee may be with respect to

YUM!, a Subsidiary, operating unit, division, or group or

individual performance (or any combination thereof) and

shall be based on one or more Performance Measures.

(b) A Participant otherwise entitled to receive a Full Value

Award for any performance period shall not receive a

settlement or payment of the Award until the Committee

has determined that the applicable performance target(s)

have been attained. To the extent that the Committee

exercises discretion in making the determination required

by this paragraph 3.3(b), such exercise of discretion

may not result in an increase in the amount of the

payment.

Nothing in this subsection 3.3 shall preclude the Committee

from granting Full Value Awards under the Plan that are not

intended to constitute Performance-Based Compensation;

provided, however, that, at the time of grant of Full Value

Awards by the Committee, the Committee shall designate

whether such Awards are intended to constitute Performance-

Based Compensation.

Section 4 Stock Reserved and Limitations

4.1. Shares Reserved/Limitations. The shares of Stock

for which Awards may be granted under the Plan shall

be subject to the following:

(a) The shares of Stock with respect to which Awards

may be made under the Plan shall be shares currently

authorized but unissued or currently held or subsequently

acquired by YUM! as treasury shares (to the extent

permitted by law), including shares purchased in the

open market or in private transactions.

(b) Subject to the following provisions of this subsection

4.1, the maximum number of shares of Stock that may

be delivered to Participants and their beneficiaries under

the Plan shall be 92,600,000 (which number includes all

shares delivered under the Plan since its establishment

in 1999, determined in accordance with the terms of

the Plan). For purposes of applying the limitations of

this paragraph 4.1(b), each share of Stock delivered

pursuant to Section 3 (relating to Full Value Awards)

shall be counted as covering two shares of Stock, and

shall reduce the number of shares of Stock available

for delivery under this paragraph 4.1(b) by two shares

except, however, in the case of restricted shares or

restricted units delivered pursuant to the settlement of

earned annual incentives, each share of Stock shall

be counted as covering one share of Stock and shall

reduce the number of shares of Stock available for

delivery by one share.

(c) To the extent provided by the Committee, any Award may

be settled in cash rather than Stock. To the extent any

shares of Stock covered by an Award are not delivered

to a Participant or beneficiary because the Award is

forfeited or canceled, or the shares of Stock are not

delivered because the Award is settled in cash or used

to satisfy the applicable tax withholding obligation, such