Pizza Hut 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

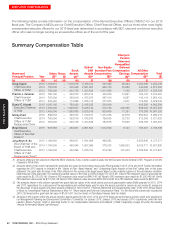

YUM! BRANDS, INC.-2016Proxy Statement 65

Proxy Statement

EXECUTIVE COMPENSATION

(5) Amounts in this column reflect the full grant date fair value of the PSU awards shown in column (g) and the SARs/stock options shown in column (i). The

grant date fair value is the amount that the Company is expensing in its financial statements over the award’s vesting schedule. For PSUs, fair value is

calculated by multiplying the per unit value of the award ($73.93) by the target number of units corresponding to the most probable outcome of performance

conditions on the grant date. For SARs/stock options, fair value of $15.94 was calculated using the Black-Scholes value on the February 6, 2015 grant date.

For additional information regarding valuation assumptions of SARs/stock options, see the discussion of stock awards and option awards contained in Part II,

Item 8, “Financial Statements and Supplementary Data” of the 2015 Annual Report in Notes to Consolidated Financial Statements at Note 14, “Share-based

and Deferred Compensation Plans.”

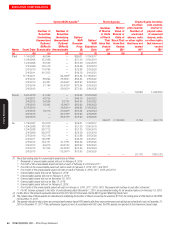

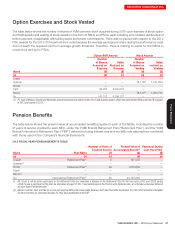

Outstanding Equity Awards at Year-End

The following table shows the number of shares covered by exercisable and unexercisable stock options, SARs, and

unvested RSUs and PSUs held by the Company’s NEOs on December31, 2015.

Name Grant Date

Option/SAR Awards(1) Stock Awards Equity

incentive

plan awards:

Number of

unearned

shares, units

or other rights

that have not

vested

(#)(4)

Equity incentive

plan awards:

market or

payout value

of unearned

shares, units

or other rights

that have not

vested

($)(3)

Number of

Securities

Underlying

Unexercised

Options/

SARs (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options/

SARs (#)

Unexercisable

Option/

SAR

Exercise

Price

($)

Option/

SAR

Expiration

Date

Number

of Shares

or Units

of Stock

That

Have Not

Vested

(#)(2)

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

($)(3)

(a) (b)

(c) (d)

(e) (f) (g) (h) (i)

Creed 1/24/2008 107,085 — $37.30 1/24/2018

2/5/2009 169,148 — $29.29 2/5/2019

2/5/2010 172,118 — $32.98 2/5/2020

2/4/2011 122,200 — $49.30 2/4/2021

2/8/2012 62,066 20,689(i) $64.44 2/8/2022

2/6/2013 45,461 45,462(ii) $62.93 2/6/2023

2/5/2014 19,512 58,538(iii) $70.54 2/5/2024

2/5/2014 — 68,767(vi) $70.54 2/5/2024

2/6/2015 — 194,982(iv) $73.93 2/6/2025

— — 38,298 2,797,669

Grismer 1/19/2007 19,938 — $29.61 1/19/2017

5/17/2007 16,262 — $33.20 5/17/2017

1/24/2008 20,079 — $37.30 1/24/2018

2/5/2009 33,830 — $29.29 2/5/2019

5/21/2009 15,853 — $33.21 5/21/2019

2/5/2010 34,424 — $32.98 2/5/2020

2/5/2010 43,030 — $32.98 2/5/2020

2/4/2011 24,440 — $49.30 2/4/2021

2/8/2012 24,826 8,276(i) $64.44 2/8/2022

2/6/2013 37,885 37,885(ii)(xi) $62.93 2/6/2023

2/6/2013 — 45,462(v)(xi) $62.93 2/6/2023

2/5/2014 21,145 63,438(iii)(xi) $70.54 2/5/2024

2/6/2015 — 105,396(iv)(xi) $73.93 2/6/2025

— — 21,288 1,555,088

Novak 1/19/2007 490,960 — $29.61 1/19/2017

1/24/2008 428,339 — $37.30 1/24/2018

2/5/2009 575,102 — $29.29 2/5/2019

2/5/2010 623,925 — $32.98 2/5/2020

2/4/2011 496,254 — $49.30 2/4/2021

2/8/2012 282,996 94,332(i) $64.44 2/8/2022

2/6/2013 180,478 180,478(ii) $62.93 2/6/2023

2/5/2014 74,901 224,706(iii) $70.54 2/5/2024

2/6/2015 — 136,034(x) $73.93 2/6/2025

— — 74,870 5,469,254