Pizza Hut 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

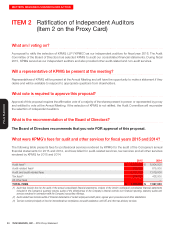

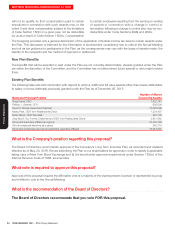

YUM! BRANDS, INC.-2016Proxy Statement 29

Proxy Statement

MATTERS REQUIRING SHAREHOLDER ACTION

only the number of shares of stock issued net of the shares

tendered shall be deemed delivered for purposes of the Plan.

After the Approval Date, no awards may be granted under

the YumBucks Plan, the 1997 Plan or the SharePower Plan.

On March 30, 2016, the last reported sale price of our

common stock on the New York Stock Exchange was

$82.25 per share.

Other Share Limitations

The following limitations shall apply under the Plan: (a) the

maximum number of shares that may be covered by stock

options or SARs granted to any one individual during any

five calendar-year period shall be 9,000,000; (b) in the case

of Full Value Awards that are intended to be Performance-

Based Compensation, no more than 3,000,000 shares of

common stock may be subject to such awards granted to

any one individual during any five-calendar-year period

(regardless of when such shares are deliverable); provided,

however, that, in the case of any Full Value Award that is a

performance unit award that is intended to be Performance-

Based Compensation, no more than $10,000,000 may be

subject to any such awards granted to any one individual

during any one-calendar-year period (regardless of when

such amounts are deliverable); and (c) no Outside Director

may be granted during any calendar year an award or

awards having a value determined on the grant date in

excess of $750,000.

Adjustments

If (1)any change in corporate capitalization, such as a stock

split, reverse stock split, or stock dividend, or (2)any

corporate transaction such as a reorganization,

reclassification, merger or consolidation or separation,

including a spin-off, or sale or other disposition by us of all

or a portion of our assets, (3)any other change in our

corporate structure, or (4)any distribution to shareholders

(other than a cash dividend that is not an extraordinary cash

dividend) results in (x) the outstanding shares of our common

stock, or any securities exchanged therefor or received in

their place, being exchanged for a different number or class

of shares or other securities of us or for shares of stock or

other securities of any other corporation (or new, different

or additional shares or other securities of us or of any other

corporation being received by the holders of outstanding

shares of our common stock), or (y) a material change in

the market value of the outstanding shares of our common

stock as a result of the change, transaction or distribution,

then equitable adjustments shall be made by the Committee,

as it determines are necessary and appropriate, in: (a) the

number and type of shares (or other property) with respect

to which awards may be granted under the Plan; (b) the

number and type of shares (or other property) subject to

outstanding awards; (c) the grant or exercise price with

respect to outstanding awards; (d) the limitations on shares

reserved for issuance under the Plan and the limitations on

the number of shares (or dollar amount) that can be subject

to awards granted to certain individuals or within a specified

time period; and (e) the terms, conditions or restrictions of

outstanding awards and/or award agreements. In the case

of any stock option that is an ISO, any adjustments in

accordance with the foregoing shall be accomplished so

that such stock option shall continue to be an ISO and

there are restrictions on the type and manner of adjustment

to awards to ensure compliance with Code Section 409A

(relating to nonqualified deferred compensation).

Awards under the Plan

Agreements

An award under the Plan shall be subject to such terms and

conditions, not inconsistent with the Plan, as the Committee

shall, in its sole discretion, prescribe. The terms and conditions

of any award to any participant shall be reflected in such

form of written document as is determined by the Committee.

A copy of such document shall be provided to the participant,

and the Committee may, but need not, require that the

participant sign a copy of such document.

Stock Options and SARs

The grant of a stock option under the Plan entitles the

participant to purchase shares of our common stock at an

exercise price and during a specified time established by

the Committee. Any stock option may be either an ISO or

an NQO, as determined in the discretion of the Committee.

An “ISO” is a stock option that is intended to satisfy the

requirements applicable to an “incentive stock option”

described in Code Section422(b) and may only be granted

to employees of us or our eligible subsidiaries. An “NQO”

is a stock option that is not intended to be an ISO. A stock

option will be deemed to be an NQO unless it is specifically

designated by the Committee as an ISO and/or to the extent

that it does not meet the requirements of an ISO. Any stock

option that is intended to constitute an ISO shall satisfy any

other requirements of Code Section 422 and, to the extent

such stock option does not satisfy such requirements, the

stock option shall be treated as a NQO.

A SAR entitles the participant to receive, in cash or stock,

value equal to (or otherwise based on) the excess of: (a)the

fair market value of a specified number of shares of our

common stock at the time of exercise; over (b)an exercise

price established by the Committee.

The Committee shall designate the participants to whom

stock options or SARs are to be granted and shall determine