Pizza Hut 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

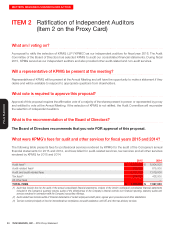

YUM! BRANDS, INC.-2016Proxy Statement32

Proxy Statement

MATTERS REQUIRING SHAREHOLDER ACTION

The Plan does not constitute a contract of employment or

continued service, and selection as a participant will not give

any participating employee or other individual the right to

be retained in the employ of us or a subsidiary or the right

to continue to provide services to us or a subsidiary, nor any

right or claim to any benefit under the Plan, unless such right

or claim has specifically accrued under the terms of the Plan.

Delivery of Stock Under the Plan

We shall have no liability to deliver any shares of stock under

the Plan or make any other distribution of benefits under

the Plan unless such delivery or distribution would comply

with all applicable laws and the applicable requirements of

any securities exchange or similar entity. To the extent that

the Plan provides for issuance of stock certificates to reflect

the issuance of shares of stock, the issuance may be effected

on a non-certificated basis, to the extent not prohibited by

applicable law or the applicable rules of any stock exchange.

Misconduct and Recoupment

The Committee, in its discretion, may impose such restrictions

on shares of stock acquired pursuant to the Plan, whether

pursuant to the exercise of a stock option or SAR, settlement

of a Full Value Award or otherwise, as it determines to be

desirable, including, without limitation, restrictions relating

to disposition of the shares and forfeiture restrictions based

on service, performance, stock ownership by the participant,

conformity with our recoupment, compensation recovery,

or clawback policies and such other factors as the Committee

determines to be appropriate. Unless otherwise specified

by the Committee, any awards under the Plan and any

shares of stock issued pursuant to the Plan shall be subject

to our compensation recovery, clawback, and recoupment

policies as in effect from time to time.

If the Committee determines that a present or former

employee has (a)used for profit or disclosed to unauthorized

persons, confidential or trade secrets of us or (b)breached

any contract with or violated any fiduciary obligation to us,

the Committee may cause that employee to forfeit his or

her outstanding awards under the Plan. This provision does

not apply during any period where there is a potential change

in control in effect or following a change in control.

Amendment and Termination of the Plan

The Board may, at any time, amend or terminate the Plan

(and the Committee may amend any award agreement);

provided, however, that no amendment or termination of

the Plan or amendment of any award agreement may, in

the absence of written consent to the change by the affected

participant (or, if the participant is not then living, the affected

beneficiary), adversely affect the rights of any participant

or beneficiary under any award granted under the Plan prior

to the date such amendment is adopted. Adjustments

pursuant to corporate transactions and restructurings are

not subject to the foregoing limitations. In addition,

amendments to the provisions of the Plan that prohibit the

repricing of stock options and SARS, amendments expanding

the group of eligible individuals, or amendments increases

in the aggregate number of shares reserved under the Plan,

the shares that may be issued in the form of ISOs, limitations

on certain types of Full Value Awards and amendments of

the individual limits on awards and the limitations on awards

to Outside Directors will not be effective unless approved

by our shareholders. No amendment shall be made to the

Plan without the approval of our shareholders if such approval

is required by law or the rules of any stock exchange on

which the common stock is listed.

The Plan will continue in effect, until terminated by the Board;

provided, however, that no award may be granted under

the Plan on or after May 20, 2026, which is the ten-year

anniversary of May 20, 2016, the date shareholders will vote

whether to approve the Plan as amended. However, any

awards that are outstanding on or after the date of Plan

termination will remain subject to the terms of the Plan. If

shareholders do not approve the Plan as amended, no

awards may be granted under the Plan after May 15, 2018.

It is our intention that, to the extent that any provisions of

the Plan or any awards granted under the Plan are subject

to Code Section 409A, the Plan and the awards comply

with the requirements of Code Section 409A and that the

Board shall have the authority to amend the Plan as it

deems necessary or desirable to conform to Code Section

409A. Notwithstanding the foregoing, neither we nor our

Subsidiaries guarantee that awards under the Plan will

comply with Code Section 409A and the Committee is

under no obligation to make any changes to any award to

cause such compliance.

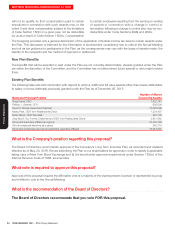

U.S. Federal Income Tax Implications of the Plan

The discussion that follows is a summary, based on U.S.

federal tax laws and regulations presently in effect, of some

significant U.S. federal income tax considerations relating

to awards under the Plan. The applicable laws and regulations

are subject to change, and the discussion does not purport

to be a complete description of the federal income tax

aspects of the Plan. This summary does not discuss state,

local or foreign laws.

Stock Options. The tax treatment of a stock option depends

on whether the option is a NQO or an ISO.

The grant of an NQO will not result in taxable income to the

participant. Except as described below, the participant will

realize ordinary income at the time of exercise in an amount

equal to the excess of the fair market value of the shares

of stock acquired over the exercise price for those shares

of common stock, and we will be entitled to a corresponding

deduction.