Pizza Hut 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement62

Proxy Statement

EXECUTIVE COMPENSATION

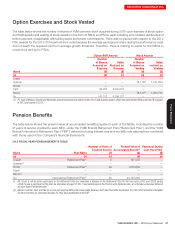

The following tables provide information on the compensation of the Named Executive Officers (“NEOs”) for our 2015

fiscal year. The Company’s NEOs are our Chief Executive Officer, Chief Financial Officer, and our three other most highly

compensated executive officers for our 2015 fiscal year determined in accordance with SEC rules and one former executive

officer who was no longer serving as an executive officer as of the end of the year.

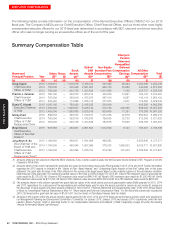

Summary Compensation Table

Name and

PrincipalPosition Year

Salary

($)(1)

Bonus

($)

Stock

Awards

($)(2)

Option/

SAR

Awards

($)(3)

Non-Equity

Incentive Plan

Compensation

($)(4)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)(5)

All Other

Compensation

($)(6)

Total

($)

(a) (b) (c) (d) (e) (f) (g) (h) (i)

Greg Creed

Chief Executive

Officer of YUM

2015 1,104,615 — 1,075,016 3,108,013 787,050 25,294 1,393,388 7,493,376

2014 750,000 — 325,048 2,561,957 945,750 45,680 345,068 4,973,503

2013 750,000 — 203,735 1,323,839 1,511,625 7,348 238,737 4,035,284

Patrick J. Grismer

Chief Financial

Officer of YUM

2015 790,192 — 420,070 1,680,012 445,200 12,861 162,132 3,510,467

2014 707,500 — 350,019 1,475,973 267,410 9,087 142,114 2,952,103

2013 638,462 — 114,098 1,765,138 277,875 3,977 179,480 2,979,030

David C. Novak

Executive Chairman

of YUM

2015 1,005,192 — 750,020 2,168,382 530,000 — 409,290 4,862,884

2014 1,450,000 — 1,925,037 5,228,142 512,720 202,360 689,028 10,007,287

2013 1,450,000 — 1,568,655 5,255,519 939,600 17,351 776,268 10,007,393

Micky Pant

Chief Executive

Officer of YUM

Restaurants China

2015 849,038 — 355,012 1,419,011 1,473,548 42,979 950,622 5,090,210

2014 750,000 — 350,019 1,475,973 799,500 32,735 313,356 3,721,583

2013 750,000 — 203,735 1,323,839 784,875 15,640 309,198 3,387,287

Brian Niccol

Chief Executive

Officer of Taco Bell

Division(7)

2015 697,688 — 250,031 2,091,503 1,512,000 8,123 180,361 4,739,706

Jing-Shyh S. Su

Vice Chairman of the

Board of YUM and

Chief Executive

Officer of YUM

Restaurants China(8)

2015 1,100,000 — 459,031 1,834,009 468,683 — 5,455,648 9,317,371

2014 1,100,000 — 450,045 1,907,966 378,235 1,956,023 5,035,711 10,827,980

2013 1,100,000 — 342,294 1,765,123 614,790 727,430 5,768,264 10,317,901

(1) Amounts shown are not reduced to reflect the NEOs’ elections, if any, to defer receipt of salary into the Executive Income Deferral (“EID”) Program or into the

Company’s 401(k) Plan.

(2) Amounts shown in this column represent the grant date fair values for performance share units (PSUs) granted in 2015, 2014 and 2013. Further information

regarding the 2015 awards is included in the “Grants of Plan- Based Awards” and “Outstanding Equity Awards at Year-End” tables later in this proxy

statement. The grant date fair value of the PSUs reflected in this column is the target payout based on the probable outcome of the performance condition,

determined as of the grant date. The maximum potential values of the PSUs is 200% of target. For 2015, Mr.Creed’s PSU maximum value at grant date fair

value would be $2,150,032; Mr.Grismer’s PSU maximum value would be $840,140; Mr.Novak’s PSU maximum value would be $1,500,040; Mr.Pant’s

PSU maximum value would be $710,024; Mr.Niccol’s PSU maximum value would be $500,062 and Mr.Su’s PSU maximum value would be $918,062.

(3) The amounts shown in this column represent the grant date fair values of the stock options and stock appreciation rights (SARs) awarded in 2015, 2014

and 2013, respectively. For a discussion of the assumptions and methodologies used to value the awards reported in column (e) and column (f), please see

the discussion of stock awards and option awards contained in Part II, Item 8, “Financial Statements and Supplementary Data” of the 2015 Annual Report

in Notes to Consolidated Financial Statements at Note 14, “Share-based and Deferred Compensation Plans.” For Mr.Niccol this column also includes his

2015 CEO Award with a grant date fair value of $1,091,491. See the Grants of Plan-Based Awards table for details.

(4) Amounts in this column reflect the annual incentive awards earned for the 2015, 2014 and 2013 fiscal year performance periods, which were awarded by

our Management Planning and Development Committee (“Committee”) in January 2016, January 2015 and January 2014, respectively, under the Yum

Leaders’ Bonus Program, which is described further in our Compensation Discussion and Analysis (“CD&A”) beginning at page 39 under the heading

“Annual Performance-Based Cash Bonuses”.