Pizza Hut 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K58

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

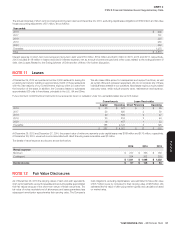

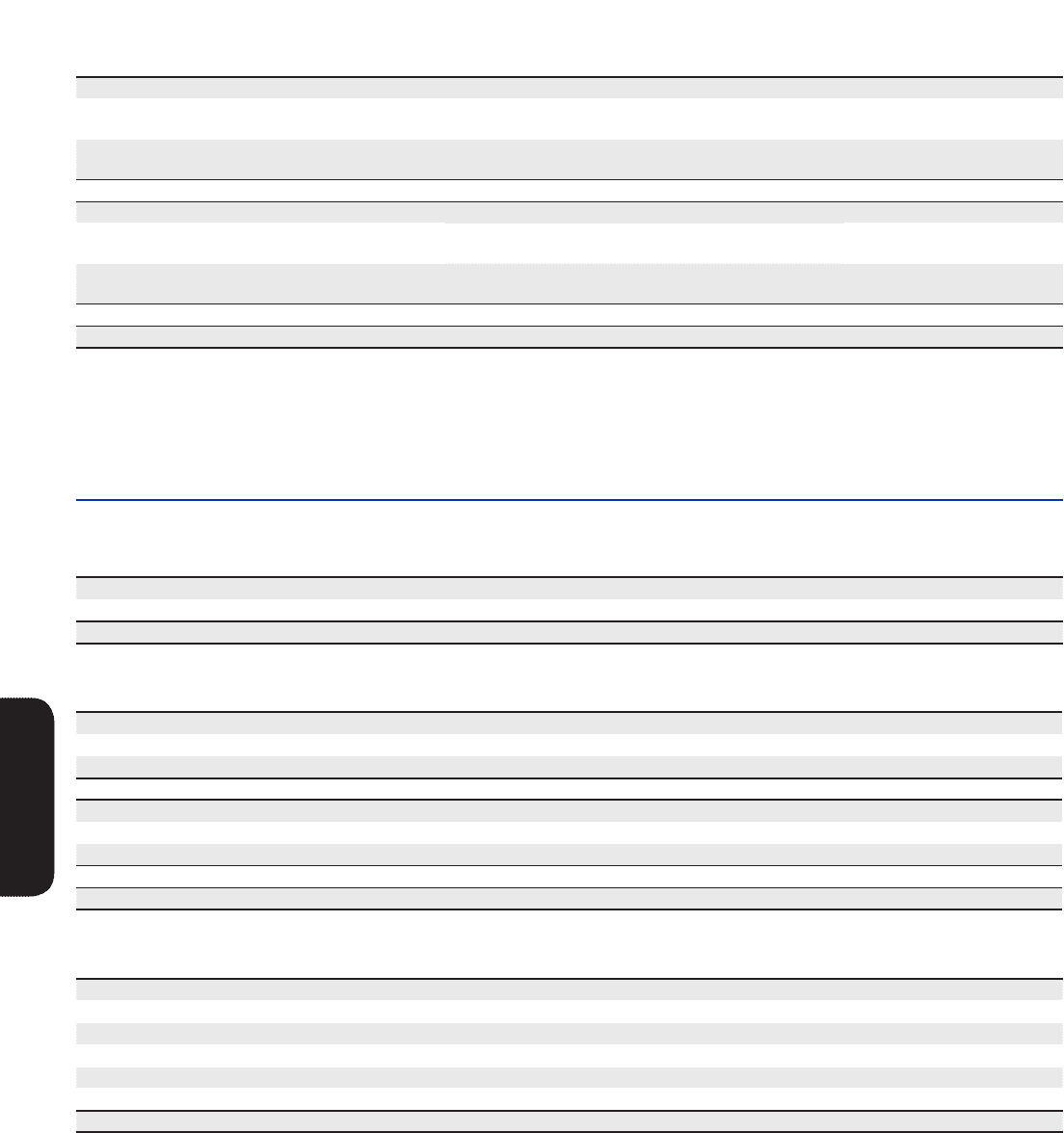

Changes in accumulated other comprehensive income (loss) (“OCI”) are presented below.

Translation Adjustments

and Gains (Losses) From

Intra-Entity Transactions

of a Long-Term Nature

Pension and

Post-Retirement Benefits(a)

Derivative

Instruments Total

Balance at December 28, 2013, net of tax $ 170 $ (97) $ (9) $ 64

Gains (losses) arising during the year classified into

accumulated OCI, net of tax (143) (131) 15 (259)

(Gains) losses reclassified from accumulated OCI,

net of tax 2 18 (15) 5

OCI, net of tax (141) (113) — (254)

Balance at December 27, 2014, net of tax $ 29 $ (210) $ (9) $ (190)

Gains (losses) arising during the year classified into

accumulated OCI, net of tax (250) 63 28 (159)

(Gains) losses reclassified from accumulated OCI,

net of tax 112 34 (36) 110

OCI, net of tax (138) 97 (8) (49)

Balance at December 26, 2015, net of tax $ (109) $ (113

)

$ (17) $ (239)

(a) Amounts reclassified from accumulated OCI for pension and post-retirement benefit plan losses during 2015 include amortization of net losses of $46 million, settlement charges of

$5million, amortization of prior service cost of $2 million and related income tax benefit of $20 million. Amounts reclassified from accumulated OCI for pension and post-retirement benefit

plan losses during 2014 include amortization of net losses of $20 million, settlement charges of $6 million, amortization of prior service cost of $1 million and the related income tax benefit

of $9 million. See Note 13.

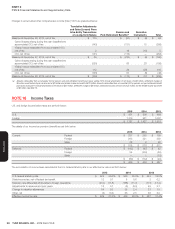

NOTE16 Income Taxes

U.S. and foreign income before taxes are set forth below:

2015 2014 2013

U.S. $ 471 $ 506 $ 464

Foreign 1,316 921 1,087

$ 1,787 $ 1,427 $ 1,551

The details of our income tax provision (benefit) are set forth below:

2015 2014 2013

Current: Federal $ 287 $ 255 $ 159

Foreign 263 321 330

State 28 2 22

$ 578 $ 578 $ 511

Deferred: Federal $ (143) $ (67) $ 42

Foreign 54 (106) (53)

State — 1 (13)

$ (89) $ (172) $ (24)

$ 489 $ 406 $ 487

The reconciliation of income taxes calculated at the U.S. federal statutory rate to our effective tax rate is set forth below:

2015 2014 2013

U.S. federal statutory rate $ 625 35.0% $ 500 35.0% $ 543 35.0%

State income tax, net of federal tax benefit 12 0.7 8 0.6 3 0.2

Statutory rate differential attributable to foreign operations (210) (11.8) (168) (11.7) (177) (11.4)

Adjustments to reserves and prior years 12 0.7 (5) (0.3) 49 3.1

Change in valuation allowances 54 3.0 35 2.4 23 1.5

Other, net (4) (0.3) 36 2.5 46 3.0

Effective income tax rate $ 489 27.3% $ 406 28.5% $ 487 31.4%