Pizza Hut 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

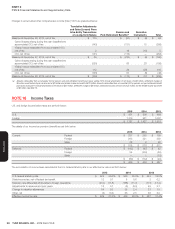

YUM! BRANDS, INC.-2015 Form10-K 59

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

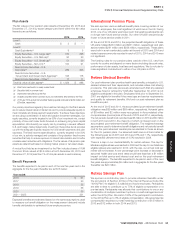

Statutory rate differential attributable to foreign operations. This item includes

local taxes, withholding taxes, and shareholder-level taxes, net of foreign

tax credits. The favorable impact is primarily attributable to a majority of our

income being earned outside of the U.S. where tax rates are generally lower

than the U.S. rate.

Adjustments to reserves and prior years. This item includes: (1) changes in

tax reserves, including interest thereon, established for potential exposure

we may incur if a taxing authority takes a position on a matter contrary to our

position; and (2) the effects of reconciling income tax amounts recorded in our

Consolidated Statements of Income to amounts reflected on our tax returns,

including any adjustments to the Consolidated Balance Sheets. The impact

of certain effects or changes may offset items reflected in the ‘Statutory rate

differential attributable to foreign operations’ line.

In 2014, this item was favorably impacted by the resolution of uncertain tax

positions in certain foreign jurisdictions.

In 2013 the Company recorded incremental reserves related to an IRS-proposed

adjustment to increase the taxable value of rights to intangibles used outside

the U.S. that YUM transferred to certain of its foreign subsidiaries. The

Company and the IRS reached a final agreement on this valuation issue,

which impacted tax returns for fiscal years 2004–2013, during 2014. As a

result of this agreement, we closed out our 2004–2006 and 2007-2008 audit

cycles and made cash payments in 2014 to the IRS of $200 million, which

were effectively fully reserved, to settle all issues for these audit cycles. The

agreement also resolved the valuation issue for all later impacted years. While

additional cash payments related to the valuation issue will be required upon

the closure of the examinations of future impacted fiscal years, the amounts

will not be significant and have been fully reserved.

Change in valuation allowances. This item relates to changes for deferred

tax assets generated or utilized during the current year and changes in our

judgment regarding the likelihood of using deferred tax assets that existed

at the beginning of the year. The impact of certain changes may offset items

reflected in the ‘Statutory rate differential attributable to foreign operations’ line.

In 2015, $54 million of net tax expense was driven by $30 million for valuation

allowances recorded against deferred tax assets generated in the current

year and $24 million in net tax expense resulting from a change in judgment

regarding the future use of certain deferred tax assets that existed at the

beginning of the year.

In 2014, $35 million of net tax expense was driven by $41 million for valuation

allowances recorded against deferred tax assets generated during the current

year, partially offset by $6 million in net tax benefit resulting from a change in

judgment regarding the future use of certain deferred tax assets that existed

at the beginning of the year.

In 2013, $23 million of net tax expense was driven by $32 million for valuation

allowances recorded against deferred tax assets generated during the current

year, partially offset by a $9 million net tax benefit resulting from a change in

judgment regarding the future use of certain deferred tax assets that existed

at the beginning of the year.

Other. This item primarily includes the impact of permanent differences related

to current year earnings as well as U.S. tax credits and deductions.

In years 2014 and 2013, this item was negatively impacted by the $160million

and $222 million, respectively, of non-cash impairments of Little Sheep goodwill,

which resulted in no related tax benefit. See Note 4.

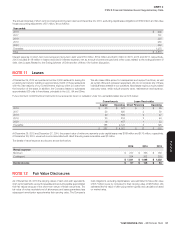

The details of 2015 and 2014 deferred tax assets (liabilities) are set forth below:

2015 2014

Operating losses $ 239 $ 271

Tax credit carryforwards 282 162

Employee benefits 154 238

Share-based compensation 126 119

Self-insured casualty claims 36 42

Lease-related liabilities 112 119

Various liabilities 82 73

Property, plant and equipment 33 39

Deferred income and other 86 102

Gross deferred tax assets 1,150 1,165

Deferred tax asset valuation allowances (250) (228)

Net deferred tax assets $ 900 $ 937

Intangible assets, including goodwill $ (130) $ (148)

Property, plant and equipment (56) (63)

Other (70) (104)

Gross deferred tax liabilities $ (256) $ (315)

Net deferred tax assets (liabilities) $ 644 $ 622

Reported in Consolidated Balance Sheets as:

Deferred income taxes $ 676 $ 653

Other liabilities and deferred credits (32) (31)

$ 644 $ 622

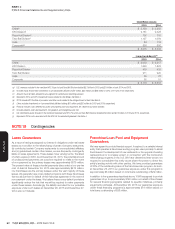

We have investments in foreign subsidiaries where the carrying values for

financial reporting exceed the tax basis. We have not provided deferred tax

on the portion of the excess that we believe is indefinitely reinvested, as we

have the ability and intent to indefinitely postpone these basis differences

from reversing with a tax consequence. We estimate that our total temporary

difference upon which we have not provided deferred tax is approximately

$2.3billion at December 26, 2015. A determination of the deferred tax

liability on this amount is not practicable. A portion of the above temporary

difference relates to carrying value for financial reporting in excess of tax

basis for the investment in our China business.

In October, 2015 YUM announced its intent to separate its China business

into an independent publicly-traded company by the end of 2016. This

transaction is intended to qualify as a tax-free reorganization for U.S. income

tax purposes. As such, any reversal of this temporary difference would not

result in U.S. tax.