Pizza Hut 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K54

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

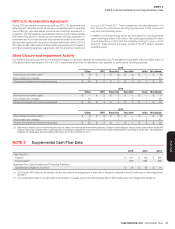

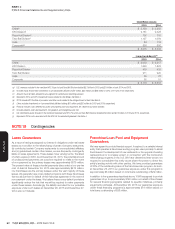

Components of net periodic benefit cost:

Net periodic benefit cost 2015 2014 2013

Service cost $ 18 $ 17 $ 21

Interest cost 55 54 54

Amortization of prior service cost(a) 1 1 2

Expected return on plan assets (62) (56) (59)

Amortization of net loss 45 17 48

Net periodic benefit cost $ 57 $ 33 $ 66

Additional (gain) loss recognized due to:

Settlements(b) $ 5 $ 6 $ 30

Special termination benefits $ 1 $ 3 $ 5

(a) Prior service costs are amortized on a straight-line basis over the average remaining service period of employees expected to receive benefits.

(b) Settlement losses result when benefit payments exceed the sum of the service cost and interest cost within a plan during the year. During 2013 the Company allowed certain former employees

with deferred vested balances an opportunity to voluntarily elect an early payout of their pension benefits. The majority of these payouts were funded from existing pension plan assets.

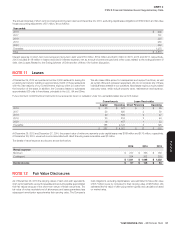

Pension gains (losses) in Accumulated other comprehensive income (loss):

2015 2014

Beginning of year $ (319) $ (124)

Net actuarial (gain) loss 124 (220)

Curtailments 2 2

Amortization of net loss 45 17

Amortization of prior service cost 1 1

Prior service cost (28) (1)

Settlement charges 5 6

End of year $ (170) $ (319)

Accumulated pre-tax losses recognized within Accumulated Other Comprehensive Income:

2015 2014

Actuarial net loss $ (138) $ (314)

Prior service cost (32) (5)

$ (170) $ (319)

The estimated net loss that will be amortized from Accumulated other comprehensive income (loss) into net periodic pension cost in 2016 is $6 million.

The estimated prior service cost that will be amortized from Accumulated other comprehensive income (loss) into net periodic pension cost in 2016 is

$5 million.

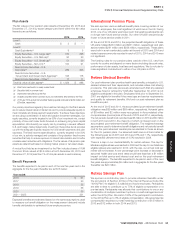

Weighted-average assumptions used to determine benefit obligations at the measurement dates:

2015 2014

Discount rate 4.90% 4.30%

Rate of compensation increase 3.75% 3.75%

Weighted-average assumptions used to determine the net periodic benefit cost for fiscal years:

2015 2014 2013

Discount rate 4.30% 5.40% 4.40%

Long-term rate of return on plan assets 6.75% 6.90% 7.25%

Rate of compensation increase 3.75% 3.75% 3.75%

Our estimated long-term rate of return on plan assets represents the weighted-average of expected future returns on the asset categories included in

our target investment allocation based primarily on the historical returns for each asset category.