Pizza Hut 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

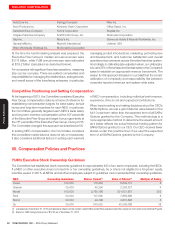

YUM! BRANDS, INC.-2016Proxy Statement60

Proxy Statement

EXECUTIVE COMPENSATION

Compensation Recovery Policy

Pursuant to the Company’s Compensation Recovery Policy

(i.e., “clawback”), the Committee may require executive

officers (including the NEOs) to return compensation paid

or may cancel any award or bonuses not yet vested or

earned if the executive officers engaged in misconduct or

violation of Company policy that resulted in significant

financial or reputational harm or violation of Company policy,

or contributed to the use of inaccurate metrics in the

calculation of incentive compensation. Under this policy,

when the Board determines that recovery of compensation

is appropriate, the Company could require repayment of

all or a portion of any bonus, incentive payment, equity-

based award or other compensation, and cancellation of

an award or bonus to the fullest extent permitted by law.

Hedging and Pledging of Company Stock

Under our Code of Conduct, no employee or director is

permitted to engage in securities transactions that would

allow them either to insulate themselves from, or profit from,

a decline in the Company stock price. Similarly, no employee

or director may enter into hedging transactions in the

Company’s stock. Such transactions include (without

limitation) short sales as well as any hedging transactions

in derivative securities (e.g. puts, calls, swaps, or collars)

or other speculative transactions related to YUM’s stock.

Pledging of Company stock is also prohibited.

Deductibility of Executive Compensation

The provisions of Section 162(m) of the Internal Revenue

Code limit the tax deduction for compensation in excess

of $1 million paid to certain NEOs. Performance-based

compensation is excluded from the limit, however, so long

as it meets certain requirements. The Committee intends

that the annual bonus, SARs/Options, RSU and PSU awards

satisfy the requirements for exemption under Internal Revenue

Code Section 162(m).

For 2015, the annual salary paid to Mr.Creed exceeded

$1 million. The other NEOs were in each case paid salaries

of $1 million or less, except for Mr.Su whose salary exceeded

$1 million; however, the Committee noted that Mr.Su’s

compensation is not subject to United States tax rules and,

therefore, the $1 million limitation does not apply in his case.

The 2015 annual bonuses were all paid pursuant to our

annual bonus program and, therefore, we expect will be

deductible. For 2015, the Committee set the maximum

individual award opportunity based on a bonus pool for the

CEO and the next two highest paid executive officers, other

than Messrs. Creed, Su and Grismer. (Mr.Grismer is not

included for purposes of our pool since under IRS rules the

Chief Financial Officer is not subject to these limits.) The

bonus pool for 2015 was equal to 1.5% of operating profit

(adjusted to exclude special items believed to be distortive

of consolidated results on a year-over-year basis — these

are the same items excluded in the Company’s annual

earnings releases). The maximum payout opportunity for

each executive was set at a fixed percentage of the pool.

Based on the Company’s operating profit, before special

items of $2.0 billion, the bonus pool was set at approximately

$30 million and the maximum 2015 award opportunity for

each NEO was based on their applicable percentage of the

pool (Mr.Creed=30%, Mr.Novak=20%, Mr.Pant=20% and

Mr.Niccol=10% and Mr.Su=10%), (Under the terms of the

shareholder approved plan no executive may earn a bonus

in excess of $10 million for any year.) The Committee then

exercised its discretion in determining actual incentive

awards based on team performance and individual

performance measures as described above.

Due to the Company’s focus on performance-based

compensation plans, we expect most compensation paid

to the NEOs to continue to qualify as tax deductible, but

the Committee may approve compensation that is not

deductible under 162(m).