Pizza Hut 2015 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 39

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

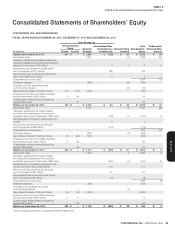

Consolidated Statements of Shareholders’ Equity

YUM! BRANDS, INC. AND SUBSIDIARIES

FISCAL YEARS ENDED DECEMBER 26, 2015, DECEMBER 27, 2014 AND DECEMBER 28, 2013

(in millions)

Yum! Brands, Inc.

Noncontrolling

Interests

Total

Shareholders’

Equity

Redeemable

Noncontrolling

Interest

Issued Common

Stock Retained

Earnings

Accumulated Other

Comprehensive

Income (Loss)Shares Amount

Balance at December 29, 2012 451 $ — $ 2,286 $ (132) $ 99 $ 2,253 $ 59

Net Income (loss) 1,091 (5) 1,086 (22)

Translation adjustments and gains (losses) from

intra-entity transactions of a long-term investment

nature (net of tax impact of $2 million)

4 2 6 2

Pension and post-retirement benefit plans

(netof tax impact of $115 million) 189 189

Net unrealized gain on derivative instruments

(net of tax impact of $1 million) 3 3

Comprehensive Income (loss) 1,284 (20)

Dividends declared (635) (18) (653)

Acquisition of Little Sheep store-level

noncontrolling interests (15) (15)

Repurchase of shares of Common Stock (11) (110) (640) (750)

Employee stock option and SARs exercises

(includes tax impact of $42 million) 3 49 49

Compensation-related events (includes tax

impact of $8 million) 61 61

Balance at December 28, 2013 443 $ — $ 2,102 $ 64 $ 63 $ 2,229 $ 39

Net Income (loss) 1,051 (1) 1,050 (29)

Translation adjustments and gains (losses)

from intra-entity transactions of a long-term

investment nature (net of tax impact of $4million) (143) (1) (144) (1)

Reclassification of translation adjustments into

income 2 2

Pension and post-retirement benefit plans

(net of tax impact of $69 million) (113) (113)

Comprehensive Income (loss) 795 (30)

Dividends declared (691) (4) (695)

Repurchase of shares of Common Stock (11) (95) (725) (820)

Employee stock option and SARs exercises

(includes tax impact of $37 million) 2 33 33

Compensation-related events (includes tax

impact of $5 million) 62 62

Balance at December 27, 2014 434 $ — $ 1,737 $ (190) $ 57 $ 1,604 $ 9

Net Income (loss) 1,293 6 1,299 (1)

Translation adjustments and gains (losses)

from intra-entity transactions of a long-term

investment nature (net of tax impact of $3million) (250) (4) (254) (2)

Reclassification of translation adjustments into

income (net of tax impact of $3 million) 112 112

Pension and post-retirement benefit plans

(net of tax impact of $57 million) 97 97

Net unrealized loss on derivative instruments

(net of tax impact of $1 million) (8) (8)

Comprehensive Income (loss) 1,246 (3)

Dividends declared — (756) (756)

Acquisition of Little Sheep store-level

noncontrolling interests 1 (1) —

Repurchase of shares of Common Stock (16) (76) (1,124)(1,200)

Employee stock option and SARs exercises

(includes tax impact of $43 million) 2 11 11

Compensation-related events (includes tax

impact of $7 million) 64 64

Balance at December 26, 2015 420 $ — $ 1,150 $ (239) $ 58 $ 969 $ 6

See accompanying Notes to Consolidated Financial Statements.