Pizza Hut 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 27

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

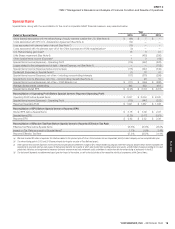

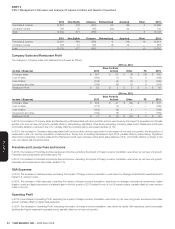

Corporate & Unallocated

% B/(W)

Income / (Expense) 2015 2014 2013 2015 2014

Corporate G&A expenses $ (204) $ (189) $ (207) (7) 9

Unallocated franchise and license expenses (71) — — NM —

Unallocated closures and impairments — (463) (295) NM (57)

Refranchising gain (loss) (See Note 4) (10) 33 100 NM (67)

Other unallocated (37) (11) (6) NM (78)

Interest expense, net (134) (130) (247) (4) 47

Income tax provision (See Note 16) (489) (406) (487) (20) 17

Effective tax rate (See Note 16) 27.3% 28.5% 31.4% 1.2 ppts. 2.9 ppts.

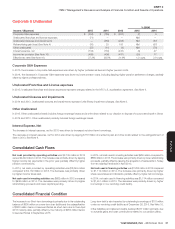

Corporate G&A Expenses

In 2015, the increase in Corporate G&A expenses was driven by higher professional fees and higher pension costs.

In 2014, the decrease in Corporate G&A expenses was driven by lower pension costs, including lapping higher pension settlement charges, partially

offset by higher professional fees.

Unallocated Franchise and License expenses

In 2015, Unallocated franchise and license expenses represent charges related to the KFC U.S. acceleration agreement. See Note 4.

Unallocated Closures and Impairments

In 2014 and 2013, Unallocated closures and impairments represent Little Sheep impairment charges. See Note 4.

Other Unallocated

In 2015, Other unallocated primarily includes foreign exchange losses and a write-down related to our decision to dispose of a corporate aircraft in China.

In 2014 and 2013, Other unallocated primarily includes foreign exchange losses.

Interest Expense, Net

The increase in interest expense, net for 2015 was driven by increased net short-term borrowings.

The decrease in interest expense, net for 2014 was driven by lapping $118million of premiums paid and other costs related to the extinguishment of

debt in 2013. See Note 4.

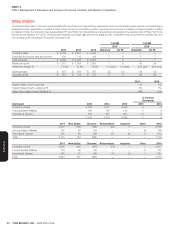

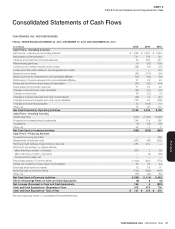

Consolidated Cash Flows

Net cash provided by operating activities was $2,139 million in 2015

versus $2,049 million in 2014. The increase was primarily driven by lapping

higher income tax payments in the prior year, partially offset by higher

pension contributions.

In 2014, net cash provided by operating activities was $2,049 million

compared to $2,139 million in 2013. The decrease was primarily driven

by higher income taxes paid.

Net cash used in investing activities was $682 million in 2015 compared

to $936 million in 2014. The decrease was primarily driven by higher

refranchising proceeds and lower capital spending.

In 2014, net cash used in investing activities was $936 million compared to

$886 million in 2013. The increase was primarily driven by lower refranchising

proceeds, partially offset by lapping the acquisition of restaurants in Turkey

from an existing franchisee in April 2013.

Net cash used in financing activities was $1,292 million in 2015 compared

to $1,114 million in 2014. The increase was primarily driven by higher

share repurchases and dividends, partially offset by higher net borrowings.

In 2014, net cash used in financing activities was $1,114 million compared

to $1,451 million in 2013. The decrease was primarily driven by higher

borrowings on our revolving credit facility.

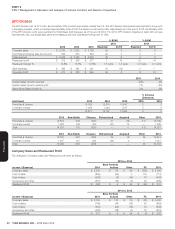

Consolidated Financial Condition

The increase in our Short-term borrowings is primarily due to the outstanding

balance of $600 million on a new term loan facility and the reclassification

of $300 million Senior Unsecured Notes as short-term due to their April

2016 maturity date, partially offset by the maturity of $250 million Senior

Unsecured Notes in September 2015.

Long-term debt is also impacted by outstanding borrowings of $701 million

under our revolving credit facility as of December 26, 2015. See Note 10.

Other liabilities and deferred credits declined $277 million primarily due

to actuarial gains and cash contributions related to our pension plans.