Pizza Hut 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 67

Proxy Statement

EXECUTIVE COMPENSATION

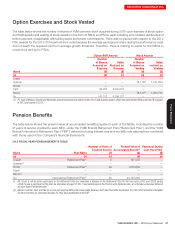

Option Exercises and Stock Vested

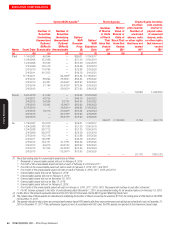

The table below shows the number of shares of YUM common stock acquired during 2015 upon exercise of stock option

and SAR awards and vesting of stock awards in the form of RSUs and PSUs, each including accumulated dividends and

before payment of applicable withholding taxes and broker commissions. There was no payout with respect to the 2012

PSU awards for the 2012-2014 performance cycle because the average earnings per share during the performance cycle

did not reach the required minimum average growth threshold. Therefore, there is nothing to report for the NEOs in

columns(d) and (e) for PSUs.

Name

Option/SAR Awards Stock Awards

Number

of Shares

Acquired on

Exercise

(#)

Value

Realized on

Exercise

($)

Number

of Shares

Acquired on

Vesting

(#)

Value

realized on

Vesting

($)

(a) (b) (c) (d) (e)

Creed — — — —

Grismer — — 16,118(1) 1,191,604

Novak — — — —

Pant 63,282 5,062,676 — —

Niccol — — 16,512(1) 1,220,732

Su 147,170 9,299,137 — —

(1) For each of Messrs. Grismer and Niccol this amount represents the deferral of the 2012 cash incentive award, which was deferred into RSUs under the EID program

in 2013 and vested in 2015.

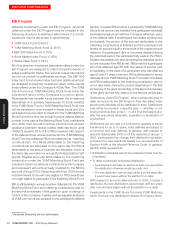

Pension Benefits

The table below shows the present value of accumulated benefits payable to each of the NEOs, including the number

of years of service credited to each NEO, under the YUM! Brands Retirement Plan (“Retirement Plan”), and the YUM!

Brands International Retirement Plan (“YIRP”) determined using interest rate and mortality rate assumptions consistent

with those used in the Company’s financial statements.

2015 FISCAL YEAR PENSION BENEFITS TABLE

Name Plan Name

Number of Years of

Credited Service

(#)

Present Value of

Accumulated Benefit(4)

($)

Payments During

Last Fiscal Year

($)

(a) (b) (c) (d) (e)

Creed(i) Retirement Plan(1) 2 157,033 —

Grismer(ii) — — — —

Novak Retirement Plan(1) 29 1,578,656 —

Pant(ii) —— — —

Niccol(ii) — — — —

Su International Retirement Plan(2) 26 20,135,280 —

(i) Mr.Creed is not an active participant in the Retirement Plan but maintains a balance in the Retirement Plan for the two years (2002 and 2003) during

which he was a participant in the plan. As discussed at page 55, Mr.Creed participates in the Third Country National plan, an unfunded, unsecured deferred

account-based retirement plan.

(ii) Messrs. Grismer, Pant, and Niccol are not accruing benefits under these plans because each was hired after September 30, 2001 and is therefore ineligible

for these benefits. As discussed at page 55, they each participate in the LRP.