Pizza Hut 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K62

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

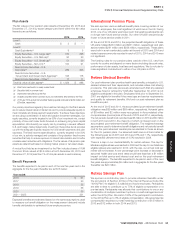

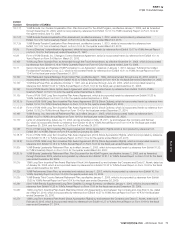

Identifiable Assets

2015 2014

China(f) $ 3,150 $ 3,202

KFC Division(i) 2,181 2,328

Pizza Hut Division(i) 707 710

Taco Bell Division(i) 1,127 1,084

India 84 118

Corporate(g)(i) 826 892

$ 8,075 $ 8,334

Long-Lived Assets(h)

2015 2014

China $ 2,033 $ 2,217

KFC Division 1,663 1,823

Pizza Hut Division 419 433

Taco Bell Division 911 920

India 35 72

Corporate 55 51

$ 5,116 $ 5,516

(a) U.S. revenues included in the combined KFC, Pizza Hut and Taco Bell Divisions totaled $3.1 billion in 2015 and $3.0 billion in both 2014 and 2013.

(b) Includes equity income from investments in unconsolidated affiliates of $41 million, $30 million and $26 million in 2015, 2014 and 2013, respectively.

(c) Amounts have not been allocated to any segment for performance reporting purposes.

(d) Represents 2014 and 2013 impairment losses related to Little Sheep. See Note 4.

(e) 2013 includes $118 million of premiums and other costs related to the extinguishment of debt. See Note 4.

(f) China includes investments in 4 unconsolidated affiliates totaling $61 million and $52 million for 2015 and 2014, respectively.

(g) Primarily includes cash, deferred tax assets and property, plant and equipment, net, related to our office facilities.

(h) Includes property, plant and equipment, net, goodwill, and intangible assets, net.

(i) U.S. identifiable assets included in the combined Corporate and KFC, Pizza Hut and Taco Bell Divisions totaled $2.3 billion and $2.0 billion in 2015 and 2014, respectively.

(j) Represents 2015 costs associated with the KFC U.S. Acceleration Agreement. See Note 4.

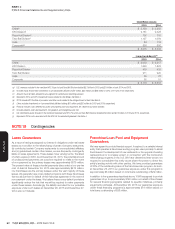

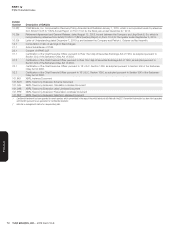

NOTE18 Contingencies

Lease Guarantees

As a result of having (a) assigned our interest in obligations under real estate

leases as a condition to the refranchising of certain Company restaurants;

(b) contributed certain Company restaurants to unconsolidated affiliates;

and (c) guaranteed certain other leases, we are frequently contingently

liable on lease agreements. These leases have varying terms, the latest

of which expires in 2065. As of December 26, 2015, the potential amount

of undiscounted payments we could be required to make in the event

of non-payment by the primary lessee was approximately $575 million.

The present value of these potential payments discounted at our pre-tax

cost of debt at December 26, 2015 was approximately $475 million.

Our franchisees are the primary lessees under the vast majority of these

leases. We generally have cross-default provisions with these franchisees

that would put them in default of their franchise agreement in the event of

non-payment under the lease. We believe these cross-default provisions

significantly reduce the risk that we will be required to make payments

under these leases. Accordingly, the liability recorded for our probable

exposure under such leases at December 26, 2015 and December 27,

2014 was not material.

Franchise Loan Pool and Equipment

Guarantees

We have agreed to provide financial support, if required, to a variable interest

entity that operates a franchisee lending program used primarily to assist

franchisees in the development of new restaurants or the upgrade of existing

restaurants and, to a lesser extent, in connection with the Company’s

refranchising programs in the U.S. We have determined that we are not

required to consolidate this entity as we share the power to direct this

entity’s lending activity with other parties. We have provided guarantees

of 20% of the outstanding loans of the franchisee loan program. As such,

at December 26, 2015 our guarantee exposure under this program is

approximately $6 million based on total loans outstanding of $29 million.

In addition to the guarantees described above, YUM has agreed to provide

guarantees of up to approximately $140 million on behalf of franchisees

for several financing programs related to specific initiatives, primarily

equipment purchases. At December 26, 2015 our guarantee exposure

under these financing programs is approximately $14 million based on

total loans outstanding of $38 million.