Pizza Hut 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

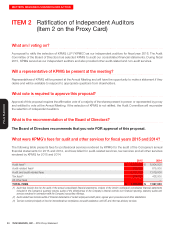

YUM! BRANDS, INC.-2016Proxy Statement 33

Proxy Statement

MATTERS REQUIRING SHAREHOLDER ACTION

The grant of an ISO will not result in taxable income to the

participant. The exercise of an ISO will not result in taxable

income to the participant provided that the participant was,

without a break in service, an employee of us and our eligible

subsidiaries (determined under tax rules) during the period

beginning on the date of the grant of the ISO and ending

on the date three months prior to the date of exercise (one

year prior to the date of exercise if the participant is disabled,

as that term is defined in the Code).

The excess of the fair market value of the shares of common

stock at the time of the exercise of an ISO over the exercise

price is an adjustment that is included in the calculation of

the participant’s alternative minimum taxable income for

the tax year in which the ISO is exercised. For purposes of

determining the participant’s alternative minimum tax liability

for the year of disposition of the shares of common stock

acquired pursuant to the ISO exercise, the participant will

have a basis in those shares of common stock equal to the

fair market value of the shares of common stock at the time

of exercise.

If the participant does not sell or otherwise dispose of the

shares of common stock within two years from the date of

the grant of the ISO or within one year after receiving the

transfer of such shares of common stock, then, upon

disposition of such shares of common stock, any amount

realized in excess of the exercise price will be taxed to the

participant as capital gain, and we will not be entitled to

any deduction for Federal income tax purposes.

If the foregoing holding period requirements are not met,

the participant will generally realize ordinary income, and a

corresponding deduction will be allowed to us, at the time

of the disposition of the shares of common stock, in an

amount equal to the lesser of (a)the excess of the fair

market value of the shares of common stock on the date

of exercise over the exercise price, or (b)the excess, if any,

of the amount realized upon disposition of the shares of

common stock over the exercise price.

Special rules apply if an option is exercised through the

exchange of previously acquired stock.

SARs. A participant will not be deemed to have received

any income upon the grant of a SAR. Generally, when a

SAR is exercised, the excess of the market price of common

stock on the date of exercise over the exercise price will

be taxable to a participant as ordinary income. We are

entitled to a deduction in the year of exercise equal to the

amount of income taxable to the individual.

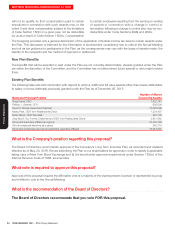

Full Value Awards. The federal income tax consequences

of a Full Value Award will depend on the type of award. The

tax treatment of the grant of shares of common stock

depends on whether the shares are subject to a substantial

risk of forfeiture (determined under Code rules) at the time

of the grant. If the shares are subject to a substantial risk

of forfeiture, the participant will not recognize taxable income

at the time of the grant and when the restrictions on the

shares lapse (that is, when the shares are no longer subject

to a substantial risk of forfeiture), the participant will recognize

ordinary taxable income in an amount equal to the fair

market value of the shares at that time. If the shares are

not subject to a substantial risk of forfeiture or if the participant

elects to be taxed at the time of the grant of such shares

under Code Section83(b), the participant will recognize

taxable income at the time of the grant of shares in an

amount equal to the fair market value of such shares at that

time, determined without regard to any of the restrictions.

If the shares are forfeited before the restrictions lapse, the

participant will be entitled to no deduction on account

thereof. The participant’s tax basis in the shares is the

amount recognized by him or her as income attributable to

such shares. Gain or loss recognized by the participant on

a subsequent disposition of any such shares is capital gain

or loss if the shares are otherwise capital assets.

In the case of other Full Value Awards, such as restricted

stock units or performance stock units, the participant

generally will not have taxable income upon the grant of

the award provided that there are restrictions on such

awards that constitute a substantial risk of forfeiture under

applicable Code rules. Participants will generally recognize

ordinary income when the restrictions on awards lapse, on

the date of grant if there are no such restrictions or, in certain

cases, when the award is settled. At that time, the participant

will recognize taxable income equal to the cash or the then

fair market value of the shares issuable in payment of such

award, and such amount will be the tax basis for any shares

received. In the case of an award which does not constitute

property at the time of grant (such as an award of units),

participants will generally recognize ordinary income when

the award is paid or settled.

We generally will be entitled to a tax deduction in the same

amount, and at the same time, as the income is recognized

by the participant.

Section 162(m). Compensation that qualifies as Performance-

Based Compensation is excluded from the $1 million

deductibility cap of Code Section 162(m), and therefore

remains fully deductible by the company paying it. Generally,

stock options and SARs granted with an exercise price at

least equal to 100% of fair market value of the underlying

stock at the date of grant and performance awards to

employees that the Committee designates as Performance-

Based Compensation are intended to qualify as such

“performance-based compensation”. A number of

requirements must be met in order for particular compensation

to so qualify, however, so there can be no assurance that

such compensation under the Plan will be fully deductible

under all circumstances. In addition, other awards under

the Plan, such as non-performance-based awards, generally