Pizza Hut 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 27

Proxy Statement

MATTERS REQUIRING SHAREHOLDER ACTION

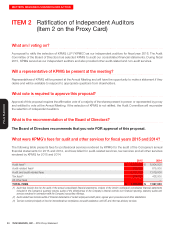

Selected Plan Data

The following table includes information regarding outstanding equity awards and shares available for future awards under

the Company’s equity plans as of December 31, 2015 (and without giving effect to approval of the amended Plan under

this Proposal):

The Plan

Other

Plans(1)

Total shares underlying outstanding options and SARs(2) 8,278,913 413,909

Weighted average exercise price of outstanding options and SARs 50.91 61.09

Weighted average remaining contractual life of outstanding options

and SARs

5.30 6.37

Total shares underlying outstanding unvested time-based RSUs 469,429 0

Total shares underlying outstanding performance-based RSUs 169,194 0

Total shares underlying outstanding deferral shares 4,500,989 0

Total shares currently available for grant(3) 3,204,537 9,348,882(4)

(1) Other Plans are the YUM Brands 1997 Plan, the YumBucks Plan and the SharePower Plan

(2) Shares shown here represent resulting shares upon exercise of outstanding options and SARs at December 31, 2015. For SARs, we report the shares that would be

delivered upon exercise (which is equal to the number of SARs multiplied by the difference between the fair market value of our common stock at year-end and the

exercise price divided by the fair market value of the stock). The total number of outstanding options and SARs is 25,922,722 (23,657,306 were issued under the Plan

and 2,265,416 issued under the Other Plans).

(3) Under the Plan, stock based awards are granted from a pool of available shares, with stock options and SARs counting as 1 share and full value awards (RSUs and

performance share units, etc) counted as 2 shares except for shares underlying deferral shares which count as 1 share

(4) Upon shareholder approval of the Plan these shares will not be available for grant (except for approximately 400,000 shares underlying options and SARs granted early

in 2016)

Year

Options/SARs

Granted

Time-Based

RSUs

Granted

Performance-

Based RSUs

Earned

Total

Granted

Weighted

Average

Number of

Common Shares

Outstanding

Burn Rate =

Total Granted

/ Common

Shares

Outstanding

2015 3,811,598 205,581 0 4,017,179 436,000,000 0.92%

2014 3,619,536 204,687 0 3,824,223 444,000,000 0.86%

2013 3,767,552 562,339 0 4,329,891 452,000,000 0.96%

Overview of Plan Awards

The Plan authorizes the award of stock options (including ISOs and non-qualified stock options (“NQOs”)), SARs, and

“Full Value Awards” (including restricted stock awards, restricted stock unit awards, performance shares, and performance

unit awards), each as described below.

Prohibition on Repricing

The Plan provides that, except for adjustments in connection

with corporate transactions (discussed below) or as approved

by our shareholders, the exercise price of an outstanding

stock option or SAR may not be decreased after the date

of grant, nor may an outstanding stock option or SAR be

surrendered to us in consideration for the grant of a

replacement stock option or SAR with a lower exercise price

or a Full Value Award. Except as approved by our shareholders,

in no event may any stock option or SAR granted under the

Plan be surrendered to us in consideration for a cash payment

if, at the time of such surrender, the exercise price of the

stock option or SAR is greater than the then current fair

market value of a share of our commonstock.