Pizza Hut 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 41

Proxy Statement

EXECUTIVE COMPENSATION

II. Compensation Overview

A. Compensation Philosophy and Practices

Our compensation program is designed to support our long-term growth model, while holding our executives accountable

to achieve key annual results year after year. YUM’s compensation philosophy for the NEOs is reviewed annually by the

Committee and has the following objectives:

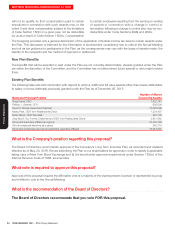

Pay Element

Objective

Base Salary

Annual

Performance-Based

Cash Bonuses

Long-Term Equity

Performance-

Based Incentives

Retain and reward the best talent to achieve superior

shareholder results—To be consistently better than our competitors,

we need to recruit and retain superior talent who are able to drive

superior results. We have structured our compensation programs to be

competitive and to motivate and reward high performers.

✓ ✓ ✓

Reward performance—The majority of NEO pay is performance

based and therefore at risk. We design pay programs that incorporate

team and individual performance, customer satisfaction and

shareholder return.

✓ ✓

Emphasize long-term value creation—Our belief is simple: if we create

value for shareholders, then we share a portion of that value with those

responsible for the results. Stock Appreciation Rights/Options (‘‘SARs/

Options’’) reward value creation generated from sustained results and

the favorable expectations of our shareholders. Performance Share Unit

(‘‘PSU’’) awards reward for superior relative performance as compared to

the S&P 500.

✓

Drive ownership mentality—We require executives to personally

invest in the Company’s success by owning a substantial amount of

Company stock. ✓

We employ compensation and governance best practices that provide a foundation for our pay-for-performance program

and align Company and shareholder interests.

We Do We Don’t Do

✓Independent compensation committee (Management Planning

& Development Committee), which oversees the Company’s

compensation policies and strategic direction

✘Employment agreements

✓Directly link Company performance to pay outcomes ✘Re-pricing of SARs/Options

✓Executive ownership guidelines reviewed annually against

Company guidelines ✘Grants of SARs/Options with exercise price

less than fair market value of common stock

on date of grant

✓“Clawback” compensation if executive’s conduct results in

significant financial or reputational harm to Company ✘Permit executives to hedge or pledge

Company stock

✓Make a substantial portion of NEO target pay “at risk” ✘Payment of dividends or dividend equivalents

on PSUs unless or until they vest

✓Double-trigger vesting of equity awards upon change in control ✘Excise tax gross-ups upon change in control

✓Utilize independent Compensation Consultant ✘Excessive executive perquisites like car

allowances or country club memberships

✓Incorporate comprehensive risk mitigation into plan design

✓Periodic review of Executive Peer Group to align appropriately

with Company size and complexity

✓Evaluate CEO and executive succession plans

✓Conduct annual shareholder engagement program to obtain

feedback from shareholders for consideration in annual

compensation program design