Pizza Hut 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

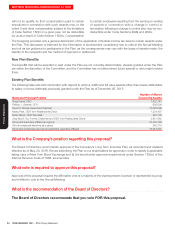

YUM! BRANDS, INC.-2016Proxy Statement40

Proxy Statement

EXECUTIVE COMPENSATION

I. Executive Summary

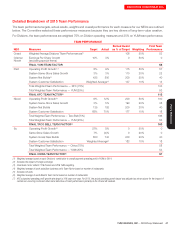

A. Yum 2015 Performance(1)

In 2015 YUM’s overall performance was below expectations.

Although our three global brand Divisions (excluding the

China and India Divisions) collectively grew operating profit

8% which is in-line with our ongoing growth model target,

our China Division’s results did not meet our expectations.

As a result, total operating profit grew 7%. These results,

combined with the negative impact of foreign currency,

resulted in earnings per share (“EPS”) growth of 3% in 2015.

While these overall results were disappointing, YUM delivered

the following results, which will help build long-term

shareholder value and enhanced shareholder returns:

•

Worldwide systems sales grew 5% and restaurant margin

increased 1.5 percentage points.

•Opened 2,365 new restaurants including 1,972 outside

the U.S., with 80% of the international development

occurring in emerging markets.

•

The China Division grew system sales 2%, and operating

profit 8% with impressive cost management partially

offsetting weaker than originally anticipated sales results.

•

The KFC Division grew system sales 7%, same-store

sales 3% and operating profit 8%.

•

The Taco Bell Division delivered exceptional results,

continuing to roll-out innovative products and building on

its breakfast menu, fueling 8% system sales growth, 5%

same-store sales growth and 12% operating profit growth.

•

Increased the quarterly dividend by 12%, marking the

eleventh consecutive year of dividend increases at a

double-digit percentage rate.

In October, 2015 we announced our intent to separate

YUM’s China business from YUM into an independent,

publicly-traded company by the end of 2016. This transaction,

which is expected to be a tax-free spin-off of our China

business, will create two powerful, independent, focused

growth companies with distinct strategies, financial profiles

and investment characteristics. The new China entity will

become a licensee of YUM in mainland China, with exclusive

rights to the KFC, Pizza Hut and Taco Bell concepts and

90% company-owned restaurants currently. Upon completion

of the planned spin-off, YUM will become more of a “pure

play” franchisor with more stable earnings, higher profit

margins, lower capital requirements and stronger cash flow

conversion. Consistent with this strategy YUM is targeting

96% franchisee ownership of its restaurants by the end

of2017.

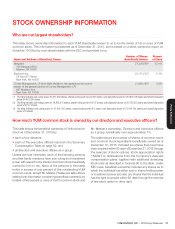

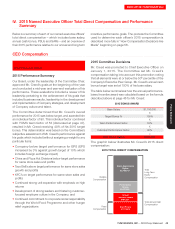

B. Named Executive Officers

Greg Creed became the Company’s new CEO on January 1, 2015, succeeding David C. Novak. The named executive

officers (“NEOs”) for 2015 discussed in this CD&A are as follows:

Name Title

Greg Creed Chief Executive Officer

Patrick J. Grismer Chief Financial Officer

David C. Novak Executive Chairman of the Board of Directors

Micky Pant Chief Executive Officer of YUM Restaurants China

Brian Niccol Chief Executive Officer of Taco Bell Division

Jing-Shyh S. Su Former Chief Executive Officer of YUM Restaurants China

Although Mr.Su retired as Vice Chairman and as Chairman and Chief Executive Officer of YUM Restaurants China on

August 18, 2015, he is included because his 2015 total compensation would have placed him among the three most

highly-compensated executive officers after the CEO and CFO.

(1) Note: All comparisons are versus the same period a year ago and exclude Special Items unless noted. System sales and operating profit figures in this section exclude

the impact of foreign currency translation and restaurant margin figures are as reported.