Pizza Hut 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement34

Proxy Statement

MATTERS REQUIRING SHAREHOLDER ACTION

will not so qualify, so that compensation paid to certain

executives in connection with such awards may, to the

extent it and other compensation subject to the limitations

of Code Section 162(m) in a given year, not be deductible

by us as a result of Code Section 162(m). Compensation

to certain employees resulting from the earning or vesting

of awards in connection with a change in control or

termination following a change in control also may be non-

deductible under Code Sections 4999 and 280G.

The foregoing provides only a general description of the application of federal income tax laws to certain awards under

the Plan. This discussion is intended for the information of stockholders considering how to vote at the Annual Meeting

and not as tax guidance to participants in the Plan, as the consequences may vary with the types of awards made, the

identity of the recipients and the method of payment or settlement.

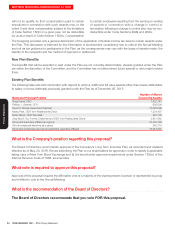

New Plan Benefits

The benefits that will be awarded or paid under the Plan are not currently determinable. Awards granted under the Plan

are within the discretion of the Committee, and the Committee has not determined future awards or who might receive

them.

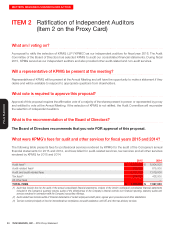

Existing Plan Benefits

The following table sets forth information with respect to options, SARs and full value awards (other than shares attributable

to salary or bonus deferrals) previously granted under the Plan as of December 26, 2015.

Name and Principal Position

NumberofShares

CoveredbyAwards

Greg Creed, CEO 1,932,141

Patrick J. Grismer, CFO 608,590

David C. Novak, Executive Chairman 10,025,299

Micky Pant, CEO Yum Restaurants China 1,224,407

Brian Niccol, CEO Taco Bell 524,738

Jing-Shy S. Su, Former Chairman and CEO Yum Restaurants China 2,841,882

All current executive officers as a group 23,433,780

All non-employee directors as a group 240,715

All current employees as a group (excluding executive officers) 15,281,891

What is the Company’s position regarding this proposal?

The Board of Directors recommends approval of the Company’s Long Term Incentive Plan, as amended and restated

effective as of May, 20, 2016. We are submitting the Plan to our shareholders for approval in order to satisfy (i) applicable

listing rules of New York Stock Exchange and (ii) the stockholder approval requirements under Section162(m) of the

Internal Revenue Code of 1986, as amended.

What vote is required to approve this proposal?

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy

and entitled to vote at the Annual Meeting.

What is the recommendation of the Board of Directors?

The Board of Directors recommends that you vote FOR this proposal.