Pizza Hut 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 25

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

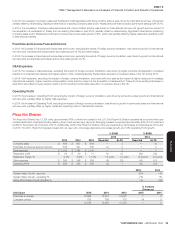

Taco Bell Division

The Taco Bell Division has 6,400 units, the vast majority of which are in the U.S. The Company owns 15% of the Taco Bell units in the U.S., where the

brand has historically achieved high restaurant margins and returns. For 2015, Taco Bell targeted about 150 net new units, low-single-digit same-store

sales growth and Operating Profit growth of 6%.

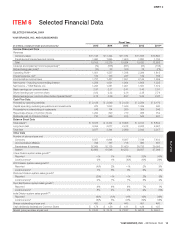

% B/(W) % B/(W)

2015 2014

2015 2014 2013 Reported Ex FX Reported Ex FX

Company sales $ 1,541 $ 1,452 $ 1,474 6 6 (2) (2)

Franchise and license fees and income 447 411 395 9 9 4 4

Total revenues $ 1,988 $ 1,863 $ 1,869 7 7 — —

Restaurant profit $ 343 $ 274 $ 287 25 25 (5) (5)

Restaurant margin % 22.3% 18.9% 19.5% 3.4 ppts. 3.4 ppts. (0.6) ppts. (0.6) ppts.

G&A expenses $ 228 $ 185 $ 206 (23) (23) 10 10

Operating Profit $ 539 $ 480 $ 456 12 12 5 5

2015 2014

System Sales Growth, reported 8% 4%

System Sales Growth, excluding FX 8% 4%

Same-Store Sales Growth % 5% 3%

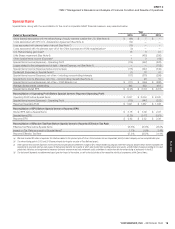

% Increase

(Decrease)

Unit Count 2015 2014 2013 2015 2014

Franchise & License 5,506 5,273 5,157 4 2

Company-owned 894 926 891 (3) 4

6,400 6,199 6,048 3 2

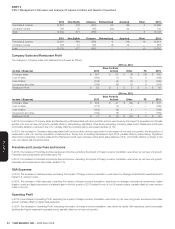

2014 New Builds Closures Refranchised Acquired Other 2015

Franchise & License 5,273 239 (80) 65 — 9 5,506

Company-owned 926 37 (4) (65) — — 894

Total 6,199 276 (84) — — 9 6,400

2013 New Builds Closures Refranchised Acquired Other 2014

Franchise & License 5,157 209 (90) 3 (12) 6 5,273

Company-owned 891 27 (1) (3) 12 — 926

Total 6,048 236 (91) — — 6 6,199

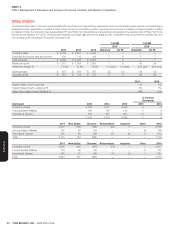

Company Sales and Restaurant Profit

The changes in Company sales and Restaurant profit were as follows:

Income / (Expense)

2015 vs. 2014

2014

Store Portfolio

Actions Other 2015

Company sales $ 1,452 $ 38 $ 51 $ 1,541

Cost of sales (431) (10) 20 (421)

Cost of labor (414) (12) (1) (427)

Occupancy and other (333) (11) (6) (350)

Restaurant Profit $ 274 $ 5 $ 64 $ 343

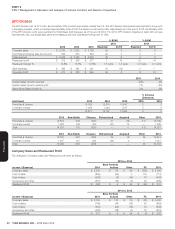

Income / (Expense)

2014 vs. 2013

2013

Store Portfolio

Actions Other 2014

Company sales $ 1,474 $ (47) $ 25 $ 1,452

Cost of sales (424) 14 (21) (431)

Cost of labor (419) 14 (9) (414)

Occupancy and other (344) 12 (1) (333)

Restaurant Profit $ 287 $ (7) $ (6) $ 274