Pizza Hut 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K26

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

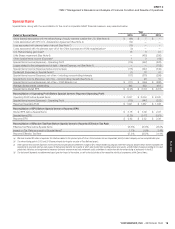

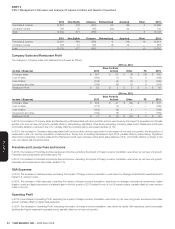

In 2015, the increase in Company sales and Restaurant profit associated with store portfolio actions was driven by net new unit growth. Significant other

factors impacting Company sales and/or Restaurant profit were company same-store sales growth of 4% and commodity deflation.

In 2014, the decrease in Company sales and Restaurant profit associated with store portfolio actions was driven by refranchising, partially offset by net

new unit growth. Significant other factors impacting Company sales and/or Restaurant profit were commodity inflation and higher food and labor costs

due to the launch of breakfast in the U.S., partially offset by company same-store sales growth of 2%.

Franchise and License Fees and Income

In 2015, the increase in Franchise and license fees and income was driven by franchise and license same-store sales growth of 5%, net new unit growth

and lapping franchise incentives provided in the first quarter of 2014 related to the national launch of breakfast.

In 2014, the increase in Franchise and license fees and income was driven by same-store sales growth of 3%, refranchising and net new unit growth,

partially offset by franchise incentives provided in the first quarter of 2014 related to the launch of breakfast.

G&A Expenses

In 2015, the increase in G&A expenses was driven by higher incentive compensation costs, investment spending on strategic growth and technology

initiatives, higher U.S. pension costs, higher litigation costs and the creation of the Live Más Scholarship.

In 2014, the decrease in G&A expenses was driven by lower U.S. pension costs and lower incentive compensation costs.

Operating Profit

In 2015, the increase in Operating Profit was driven by same-store sales growth and net new unit growth, partially offset by higher G&A expenses.

In 2014, the increase in Operating Profit was driven by same-store sales growth, lower G&A expenses and net new unit growth, partially offset by higher

restaurant operating costs.

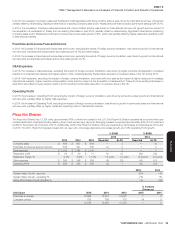

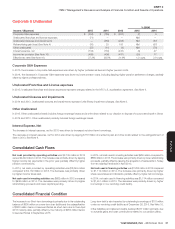

India Division

The India Division has 811 units, predominately KFC and Pizza Hut restaurants. Effective January, 2016 the India Division was segmented by brand,

integrated into the global KFC, Pizza Hut and Taco Bell Divisions, and is no longer a separate operating segment. While our consolidated results will

not be impacted, we will restate our historical segment information during 2016 for consistent presentation.

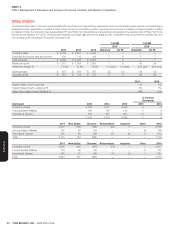

% B/(W) % B/(W)

2015 2014

2015 2014 2013 Reported Ex FX Reported Ex FX

Total revenues(a) $ 115 $ 141 $ 127 (18) (14) 11 16

Operating Profit (loss) $ (19) $ (9) $ (15) (108) (118) 39 35

2015 2014

System Sales Growth, reported(a) (9)% (1)%

System Sales Growth, excluding FX(a) (5)% 3%

Same-Store Sales Growth (Decline)% (13)% (5)%

% Increase

(Decrease)

Unit Count 2015 2014 2013 2015 2014

Franchise & License 693 623 514 11 21

Company-owned 118 210 191 (44) 10

811 833 705 (3) 18

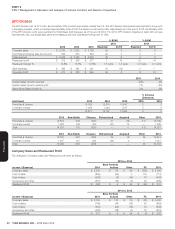

2014 New Builds Closures Refranchised Acquired 2015

Franchise & License 623 54 (70) 86 — 693

Company-owned 210 — (6) (86) — 118

Total 833 54 (76) — — 811

2013 New Builds Closures Refranchised Acquired 2014

Franchise & License 514 110 (21) 20 — 623

Company-owned 191 46 (7) (20) — 210

Total 705 156 (28) — — 833

(a) Effective the beginning of 2014, results from our Mauritius stores are included in KFC and Pizza Hut Divisions as applicable. Prior year units have been adjusted for comparability while

division System Sales Growth, Total Revenues and Operating Profit (loss) have not been restated due to the immaterial dollar impact of this change. While there was no impact to our

consolidated results, this change negatively impacted India’s 2014 System Sales Growth, reported and excluding FX, by 10% and 11%, respectively. This change negatively impacted India’s

2014 Total revenues by 2% and Operating Profit (loss) by $1 million.