Pizza Hut 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 75

Proxy Statement

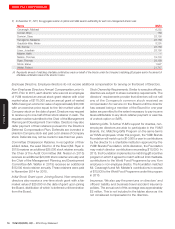

DIRECTOR COMPENSATION

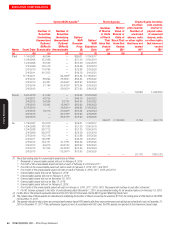

The table below summarizes compensation paid to each non-employee director during 2015.

The Company primarily uses stock-based incentive

compensation to attract and retain qualified candidates to

serve on the Board. In setting director compensation, the

Company considers the significant amount of time that

directors expend in fulfilling their duties to the Company as

well as the skill level required by the Company of members

of the Board. The Board typically reviews each element of

director compensation every two years.

In 2015, the Management Planning and Development

Committee of the Board (“Committee”) benchmarked the

Company’s director compensation against director

compensation from the Company’s Executive Peer Group

discussed at page 36 as well as published survey data from

the National Association of Corporate Directors for the

largest 200 companies in the S&P 500. Data for this review

was prepared for the Committee by its independent

consultant, Meridian Compensation Partners LLC. This

data revealed that the Company’s director compensation

was below the 50th percentile against both benchmarks

and that the retainers paid to the Lead Director and the

Chairpersons of the Audit Committee and the Management

Planning and Development Committee were consistent

with market practice. Following its review, the Board elected

to increase non-employee director annual compensation

to $240,000 which was approximately at the 50

th

percentile

of the Company’s Executive Peer Group (directors will

receive a stock grant retainer with a fair market value of

$200,000 and an annual SARs grant with an economic

value of approximately $40,000). This change became

effective in February 2016 and was paid beginning in February

2016. Previously, directors were paid in November of each

year. This change in timing to February 2016 means that

directors did not receive a stock retainer award or a SARs

award during 2015, and, therefore, no stock retainer award

or SARs award is reported below, except in the case of

Messrs. Cornell and Meister who received initial stock

retainer awards of $25,000 upon joining the Board in 2015.

In addition, Mr.Cornell received a prorated stock retainer

and SARs award for joining the Board two months prior to

the Board adopting the changes described above.

The Board elected not to change retainers paid to the

Chairpersons or Lead Director.

Name

Fees Earned or

Paid in Cash

($)

Stock

Awards

($)(1)

Option/SAR

Awards

($)(2)(3)

All Other

Compensation

($)(4)

Total

($)

(a) (b) (c) (d) (e) (f)

Cavanagh, Michael — — — 15,172 15,172

Cornell, Brian — 39,167 2,807 — 41,973

Dorman, Dave — — — 10,000 10,000

Ferragamo, Massimo — — — — —

Graddick-Weir, Mirian — — — 7,500 7,500

Hill, Bonnie — — — — —

Linen, Jonathan — — — 10,000 10,000

Meister, Keith — 25,000 — 25,000 50,000

Nelson, Thomas — — — 1,000 1,000

Ryan, Thomas — — — 2,500 2,500

Stock, Elane — — — 1,000 1,000

Walter, Robert — — — 5,000 5,000

(1) Amounts in column (c) represent the grant date fair value for annual stock retainer awards granted to directors in 2015.

(2) Amounts in column (d) represent the grant date fair value for annual SARs granted in fiscal 2015. For a discussion of the assumptions used to value the

awards, see the discussion of stock awards and option awards contained in Part II, Item 8, “Financial Statements and Supplementary Data” of the 2015

Annual Report in Notes to Consolidated Financial Statements at Note 14, “Share-based and Deferred Compensation Plans.”