Pizza Hut 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

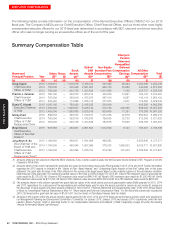

YUM! BRANDS, INC.-2016Proxy Statement 63

Proxy Statement

EXECUTIVE COMPENSATION

(5) Amounts in this column also represent the above market earnings as established pursuant to SEC rules which have accrued under each of their accounts

under the LRP for Messrs. Grismer, Pant and Niccol and the Third Country National Plan (“TCN”) for Mr.Creed of $23,096, which are described in more detail

beginning at page 69 under the heading “Nonqualified Deferred Compensation”.

Also listed in this column for Mr.Creed is the amount of aggregate changes in actuarial present value of his accrued benefits under the Retirement Plan during

the 2015 fiscal year (using interest rate and mortality assumptions consistent with those used in the Company’s financial statements). Mr.Creed is not an active

participant in the Retirement Plan but maintains a balance in the Retirement Plan from the two years (2002 and 2003) during which he was a participant and for

2015 the increase in actuarial value was $2,198. For Mr. Novak and Mr. Su the actuarial present value of their benefits under the Retirement Plan (for Mr. Novak)

and the YIRP (for Mr. Su), decreased $19,700 and $324,490, respectively, during the 2015 fiscal year. Under SEC rules, a decrease in the actuarial value cannot

be reported in the table. Mr. Grismer, Mr. Pant and Mr. Niccol were hired after September 30, 2001, and are ineligible for the Company’s Retirement Plan. See

the Pension Benefits Table at page 53 for a detailed discussion of the Company’s pension benefits.

(6) Amounts in this column are explained in the All Other Compensation Table and footnotes to that table, which follows.

(7) Mr.Niccol became a NEO in 2015. No amounts are reported for Mr.Niccol for 2013 and 2014 since he was not a NEO for those years.

(8) Mr. Su was Vice Chairman and Chairman and Chief Executive Officer of Yum Restaurants China until August 18, 2015; he was Executive Advisor to the Chief

Executive Officer of Yum Restaurants China for the remainder of the year. See “Compensation Discussion and Analysis” at page 39 for additional information.

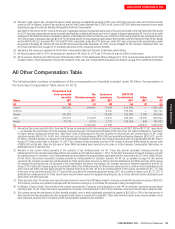

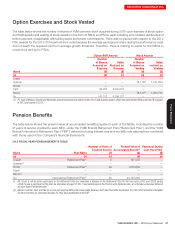

All Other Compensation Table

The following table contains a breakdown of the compensation and benefits included under All Other Compensation in

the Summary Compensation Table above for 2015.

Name

Perquisites and

other personal

benefits

($)(1)

Tax

Reimbursements

($)(2)

Insurance

premiums

($)(3)

LRP/TCN

Contributions

($)(4)

Other

($)(5)

Total

($)

(a) (b) (c) (d) (e) (f) (g)

Creed 598,881 364,951 17,056 412,500 — 1,393,388

Grismer — — 6,332 155,800 — 162,132

Novak 197,807 — 18,293 190,000 3,190 409,290

Pant 376,431 114,028 14,913 408,500 36,750 950,622

Niccol 47,718 2,215 3,172 126,350 906 180,361

Su — 5,190,420 21,286 — 243,942 5,455,648

(1) Amounts in this column include for Mr.Creed and Mr.Novak: incremental cost for the personal use of Company aircraft ($93,866 and $197,807 respectively)

— we calculate the incremental cost to the Company of any personal use of Company aircraft based on the cost of fuel, trip-related maintenance, crew travel,

on board catering, landing and license fees, “dead head” costs of flying planes to and from locations for personal use, and contract labor; for Mr.Creed:

relocation expense ($505,015); for Mr.Pant: relocation and cost of living allowance ($150,000) and expenditures/housing allowance ($226,431); and for

Mr.Niccol: relocation expense. As discussed in the Compensation Discussion and Analysis, the Company executed a letter of understanding with Mr. Grismer

during 2015 that provided that on February 19, 2016, the Company would accelerate a portion of Mr. Grismer’s unvested SARs having an intrinsic value

of $500,000 on that date. Since the fair value of those SARs has already been reported in prior years or in the Summary Compensation Table above, no

additional amount is reported here.

(2) Amounts in this column reflect payments to the executive of tax reimbursements. For Mr. Creed, this amount represents Company-provided tax

reimbursement for his relocation associated with his new position as CEO effective January 1, 2015. For Mr. Pant, this amount represents Company-provided

tax reimbursement for relocation, cost of living allowance and expenditure/housing allowance associated with his new position as CEO of the China Division.

For Mr. Niccol, this amount represents Company-provided tax reimbursement for relocation expense. For Mr.Su, as explained at page 54, this amount

represents the Company-provided tax reimbursement for China income taxes incurred on deferred income distributions and SARs exercises which exceed

the marginal Hong Kong tax rate. As discussed in the Compensation Discussion and Analysis, the Company executed a retirement agreement with Mr. Su

during 2015 in which the Company agreed to provide $5 million of tax reimbursements for China income taxes incurred on deferred income distributions and

stock option and SARs exercises which exceed the marginal Hong Kong tax rate. Mr. Su’s tax reimbursements in this column represents $1,927,747 paid

to him prior to his retirement and $3,262,673 paid to him pursuant to his retirement agreement during 2015. He is entitled to receive up to $1,737,327 of

additional tax reimbursements for China income taxes incurred which exceed the marginal Hong Kong tax rate on future deferred income distributions and

stock option and SARs exercises.

(3) These amounts reflect the income each executive was deemed to receive from IRS tables related to Company-provided life insurance in excess of $50,000.

The Company provides every salaried employee with life insurance coverage up to one times the employee’s salary plus target bonus.

(4) For Messrs. Grismer, Novak, Pant and Niccol this column represents the Company’s annual allocations to the LRP, an unfunded, unsecured account based

retirement plan. For Mr.Creed, this column represents the Company’s annual allocation to the TCN, an unfunded, unsecured account based retirement plan.

(5) This column reports the total amount of other benefits provided, none of which individually exceeded the greater of $25,000 or 10% of the total amount of

these benefits and the perquisites and other personal benefits shown in column (b) for each NEO. These other benefits include: home security expense, home

leave expenses, personal use of Company aircraft, tax preparation assistance and relocation.