Pizza Hut 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

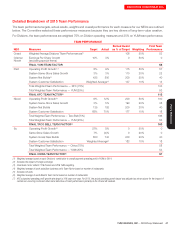

YUM! BRANDS, INC.-2016Proxy Statement38

Proxy Statement

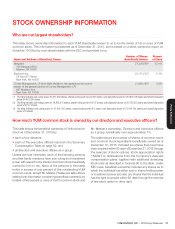

STOCK OWNERSHIP INFORMATION

Beneficial Ownership

Name

Number

of Shares

Beneficially

Owned(1)

Options/

SARS

Exercisable

within

60Days(2)

Deferral

PlansStock

Units(3)

Total

Beneficial

Ownership

Additional

Underlying

Stock

Units(4) Total

Greg Creed 38,681 310,939 9,775 359,395 69,807 429,202

Michael J. Cavanagh 10,000 177 — 10,177 7,379 17,556

Brian C. Cornell — — — — 487 487

David W. Dorman 56,901 10,618 — 67,519 5,254 72,773

Massimo Ferragamo 53,429 10,618 43,130 107,177 34,532 141,709

Mirian M. Graddick-Weir — 431 — 431 9,681 10,112

Jonathan S. Linen 33,110(5) 10,618 — 43,728 35,641 79,369

Keith Meister 21,040,195(6) — — 21,040,195 346 21,040,541

Thomas C. Nelson 8,288 5,646 — 13,934 36,051 49,985

Thomas M. Ryan 45,174(7) 10,618 9,400 65,192 22,599 87,791

ElaneB. Stock — — — — 2,494 2,494

Robert D. Walter 108,301 6,951 — 115,252 23,586 138,838

PatrickJ. Grismer 20,212(8) 135,247 — 155,459 25,082 180,541

David C. Novak 337,650 1,447,823 1,334,279 3,119,752 1,088,257 4,208,009

Micky Pant 15,403 325,765 — 341,168 92,189 433,357

Brian Niccol 6,664 50,544 13,891 71,099 29,241 100,340

Jing-Shyh S. Su 380,437(9) 1,311,666 — 1,692,103 194,595 1,886,698

All Directors and Executive

Officers as a Group (23persons) 22,267,328 4,321,067 1,503,675 28,092,070 1,947,556 30,039,626

(1) Shares owned outright. These amounts include the following shares held pursuant to YUM’s 401(k) Plan as to which each named person has sole voting power:

• Mr.Novak, 33,816 shares

• Mr.Grismer, 8,612 shares

• Mr.Pant, 2,587 shares

• Mr.Niccol, 5,497 shares

• all executive officers as a group, 53,249 shares

(2) The amounts shown include beneficial ownership of shares that may be acquired within 60days pursuant to stock options and SARs awarded under our employee or

director incentive compensation plans. For stock options, we report shares equal to the number of options exercisable within 60days. For SARs, we report the shares

that would be delivered upon exercise (which is equal to the number of SARs multiplied by the difference between the fair market value of our common stock at year-end

and the exercise price divided by the fair market value of the stock).

(3) These amounts shown reflect units denominated as common stock equivalents held in deferred compensation accounts for each of the named persons under our

Director Deferred Compensation Plan or our Executive Income Deferral Program. Amounts payable under these plans will be paid in shares of YUM common stock at

termination of directorship/employment or within 60days if so elected.

(4) The amounts shown include units denominated as common stock equivalents held in deferred compensation accounts which become payable in shares of YUM

common stock at a time (a)other than at termination of directorship/employment or (b)after 60 days. For Messrs.Novak and Su, these amounts also include vested

restricted stock units.

(5) This amount includes 23,616 shares held in a trust.

(6) These shares are held for the account of certain private investment funds for which Corvex Management LP, a Delaware limited partnership (“Corvex”), acts as

investment advisor. The general partner of Corvex is controlled by Mr.Meister.

(7) These shares are held in a trust.

(8) This amount includes 11,600 shares held in trusts.

(9) This amount includes 278,361 shares held indirectly.