Pizza Hut 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186

|

|

YUM! BRANDS, INC.-2016Proxy Statement44

Proxy Statement

EXECUTIVE COMPENSATION

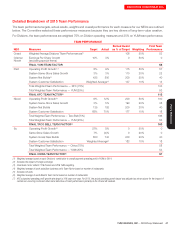

EPS growth during the 2012 - 2014 performance cycle did not reach the required minimum threshold of seven percent

(see discussion of PSUs at page 48).

Total Value Granted(1) 3-Year EPS

CAGR Target

3-Year EPS

CAGR Actual Realized Value

$1.6MM 10% 2.5%

ALL NEO PSU VALUE FOR 2012 – 2014 PERFORMANCE CYCLE

(1) Amount is the sum of the grant date values awarded to each NEO as follows: Mr.Creed ($240,000), Mr.Novak ($773,000), Mr.Pant ($250,000), and Mr.Su ($385,000).

Mr. Grismer and Mr. Niccol did not receive PSU grants in 2012. Mr. Grismer began participating in the Performance Share Plan in 2013, and Mr.Niccol began

participating in 2015.

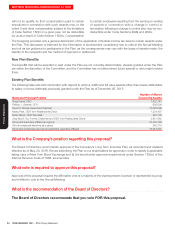

CEO Cash Compensation was Below Target

Our CEO’s cash compensation tracks EPS growth, which is our primary business performance metric. As demonstrated

below, our EPS growth in each of the last three years was below our targets of 10%, 20%, and 10% and resulted in our

CEO’s actual cash compensation being below target.

Cash

Compensation

in $ millions

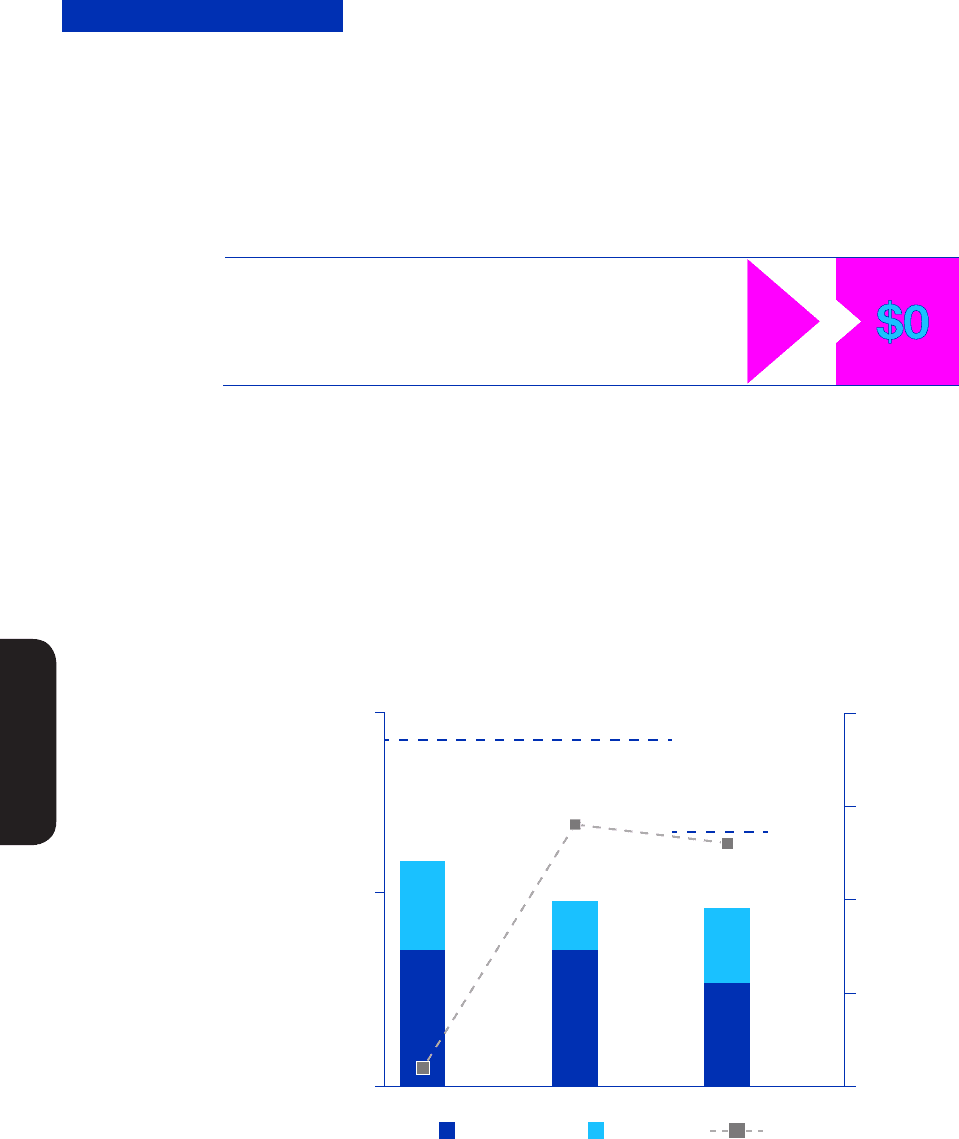

CEO CASH COMPENSATION VS. EPS GROWTH

EPS

Growth

2013 2014 2015

Base Salary Bonus

4%

3%

EPS

(9%)

-10%

-5

0%

5%

10%

0

2

4

Novak Target

Creed Target

9%

CEO Total Direct Compensation reflects Performance

Similarly with cash compensation, our CEO’s actual direct compensation (comprised of base salary, bonus and annual

long-term incentive value at grant date) for the last three years was below target reflecting the below target performance

of the Company. The SARs award will only provide value to Mr.Novak and Mr.Creed if shareholders receive value through

stock price appreciation, and PSU’s will only pay out if our three-year Total Shareholder Return (“TSR”) hits threshold

performance.