Pizza Hut 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 17

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

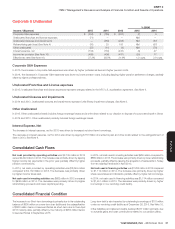

of YUM in mainland China, with exclusive rights to the KFC, Pizza Hut

and Taco Bell concepts. Upon completion of the planned spin-off, YUM

will become more of a “pure play” franchisor with more stable earnings,

higher profit margins, lower capital requirements and stronger cash flow

conversion. Consistent with this strategy YUM is targeting 96% franchisee

ownership of its restaurants by the end of 2017.

YUM has announced its intention to return substantial capital to shareholders

prior to this planned spin-off, the majority of which will be funded by

incremental borrowings. With this recapitalization, the Company is

transitioning to a non-investment grade credit rating with a balance sheet

more consistent with highly-levered peer restaurant franchise companies.

Moreover, this will allow for an ongoing return-of-capital framework that will

seek to optimize the Company’s long-term growth rate on a per-share basis.

Completion of the spin-off will be subject to certain conditions, including

receiving final approval from the YUM Board of Directors, receipt of

various regulatory approvals, receipt of an opinion of counsel with respect

to certain tax matters, the effectiveness of filings related to public listing

and applicable securities laws, and other terms and conditions as may

be determined by the Board of Directors. There can be no assurance

regarding the ultimate timing of the proposed transaction or that the

transaction will be completed.

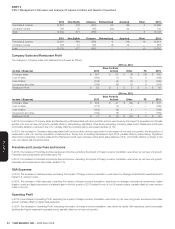

Our historical ongoing earnings growth model has targeted a 10% earnings

per share (“EPS”) growth rate, which was based on Operating Profit growth

targets of 15% in China, 10% for our KFC Division, 8% for our Pizza Hut

Division, and 6% for our Taco Bell Division. See the Division discussions

within the Results of Operations section of this MD&A for further details

on our Divisions’ 2015 targets.

YUM’s 2016 Operating Profit is expected to grow 10% in constant currency,

including the impact of 2016 having a 53rd week. While we expect to spin

off our China business prior to the end of 2016, this target assumes our

China business will remain part of YUM through the end of 2016. YUM’s

2016 target is based on Operating Profit growth instead of EPS growth

given the uncertainties surrounding the specific timing and pricing of our

2016 shareholder capital returns.

Subsequent to the spin-off of our China business, we are targeting about

15% ongoing EPS growth for the new China entity and about 15% ongoing

total shareholder return for the remaining ongoing YUM business. The new

China entity’s 15% EPS growth includes contributions from both Operating

Profit and financial strategies such as share repurchases. YUM’s 15%

total shareholder return includes ongoing Operating Profit growth targets

of 10% for our KFC Division, 8% for our Pizza Hut Division and 6% for

our Taco Bell Division, which are consistent with our historical ongoing

earnings growth model. The 15% total shareholder return also includes 1%

to 2% growth from the China license fee, 3% to 5% growth from financial

strategies and approximately 2% yield from dividends.

We intend for this MD&A to provide the reader with information that will assist

in understanding our results of operations, including performance metrics

that management uses to assess the Company’s performance. Throughout

this MD&A, we commonly discuss the following performance metrics:

•

The Company provides certain percentage changes excluding the

impact of foreign currency translation (“FX” or “Forex”). These amounts

are derived by translating current year results at prior year average

exchange rates. We believe the elimination of the foreign currency

translation impact provides better year-to-year comparability without

the distortion of foreign currency fluctuations.

•

System sales growth includes the results of all restaurants regardless

of ownership, including company-owned, franchise, unconsolidated

affiliate and license restaurants that operate our Concepts, except for

non-company-owned restaurants for which we do not receive a sales-

based royalty. Sales of franchise, unconsolidated affiliate and license

restaurants typically generate ongoing franchise and license fees for

the Company at a rate of 4% to 6% of sales. Franchise, unconsolidated

affiliate and license restaurant sales are not included in Company sales

on the Consolidated Statements of Income; however, the franchise and

license fees are included in the Company’s revenues. We believe system

sales growth is useful to investors as a significant indicator of the overall

strength of our business as it incorporates all of our revenue drivers,

Company and franchise same-store sales as well as net unit growth.

•

Same-store sales growth is the estimated percentage change in sales

of all restaurants that have been open and in the YUM system one

year or more.

•

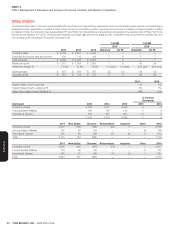

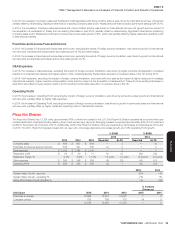

Company Restaurant profit (“Restaurant profit”) is defined as Company

sales less expenses incurred directly by our Company-owned restaurants

in generating Company sales. Company restaurant margin as a percentage

of sales is defined as Restaurant profit divided by Company sales. Within

the Company Sales and Restaurant Profit analysis, Store Portfolio

Actions represent the net impact of new unit openings, acquisitions,

refranchising and store closures, and Other primarily represents the

impact of same-store sales as well as the impact of changes in costs

such as inflation/deflation.

•

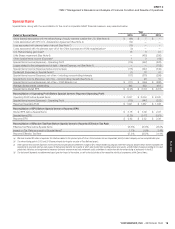

In addition to the results provided in accordance with U.S. Generally

Accepted Accounting Principles (“GAAP”) throughout this MD&A, the

Company provides non-GAAP measurements which present operating

results on a basis before Special Items. The Company uses earnings

before Special Items as a key performance measure of results of

operations for the purpose of evaluating performance internally and

Special Items are not included in any of our segment results. This

non-GAAP measurement is not intended to replace the presentation

of our financial results in accordance with GAAP. Rather, the Company

believes that the presentation of earnings before Special Items provides

additional information to investors to facilitate the comparison of past

and present results, excluding those items that the Company does

not believe are indicative of our ongoing operations due to their size

and/or nature.

•

All Note references herein refer to the Notes to the Financial Statements.

Tabular amounts are displayed in millions of U.S. dollars except per

share and unit count amounts, or as otherwise specifically identified.

Percentages may not recompute due to rounding.

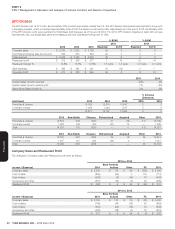

Results of Operations

Summary

All comparisons within this summary are versus the same period a year

ago and exclude the impact of Special Items. All system sales growth

and Operating Profit comparisons exclude the impact of foreign currency.

2015 diluted EPS increased 3% to $3.18 per share versus our target of

10% growth, as sales and profits at our China Division did not recover as

strongly as expected and adverse foreign currency translation significantly

impacted reported earnings.

We expected China Division sales and profits to grow significantly in the

second half of 2015 as we recovered from the adverse publicity in July

2014 surrounding improper food handling practices of a former supplier.

China Division sales initially turned significantly positive as we lapped the

July 2014 supplier incident, but overall sales in the second half of 2015

trailed our expectations, particularly at Pizza Hut Casual Dining. KFC China

grew same stores sales 3% in Q3 and 6% in Q4, while Pizza Hut Casual

Dining same-store sales declined 1% in Q3 and 8% in Q4. For the year

China Division same-store sales declined 4%.