Pizza Hut 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 53

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

We do not anticipate any plan assets being returned to the Company during 2016 for any U.S. plans.

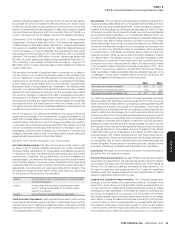

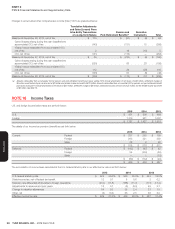

Obligation and Funded Status at Measurement Date:

The following chart summarizes the balance sheet impact, as well as benefit obligations, assets, and funded status associated with our two significant

U.S. pension plans. The actuarial valuations for all plans reflect measurement dates coinciding with our fiscal year end.

2015 2014

Change in benefit obligation

Benefit obligation at beginning of year $ 1,301 $ 1,025

Service cost 18 17

Interest cost 55 54

Plan amendments 28 1

Curtailments (2) (2)

Special termination benefits 1 3

Benefits paid (50) (65)

Settlements(a) (16) (17)

Actuarial (gain) loss (196) 290

Administrative expense (5) (5)

Benefit obligation at end of year $ 1,134 $ 1,301

Change in plan assets

Fair value of plan assets at beginning of year $ 991 $ 933

Actual return on plan assets (10) 124

Employer contributions 94 21

Settlement payments(a) (16) (17)

Benefits paid (50) (65)

Administrative expenses (5) (5)

Fair value of plan assets at end of year $ 1,004 $ 991

Funded status at end of year $ (130) $ (310)

(a) For discussion of the settlement payments and settlement losses, see Components of net periodic benefit cost below.

Amounts recognized in the Consolidated Balance Sheet:

2015 2014

Accrued benefit liability – current $ (13) $ (11)

Accrued benefit liability – non-current (117) (299)

$ (130) $ (310)

The accumulated benefit obligation was $1,088 million and $1,254 million at December 26, 2015 and December 27, 2014, respectively.

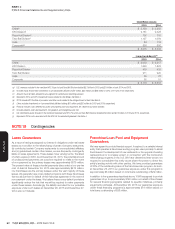

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

2015 2014

Projected benefit obligation $ 101 $ 1,301

Accumulated benefit obligation 88 1,254

Fair value of plan assets — 991

Information for pension plans with a projected benefit obligation in excess of plan assets:

2015 2014

Projected benefit obligation $ 1,134 $ 1,301

Accumulated benefit obligation 1,088 1,254

Fair value of plan assets 1,004 991