Pizza Hut 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

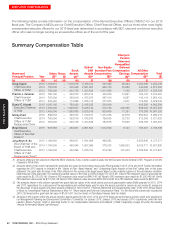

YUM! BRANDS, INC.-2016Proxy Statement 71

Proxy Statement

EXECUTIVE COMPENSATION

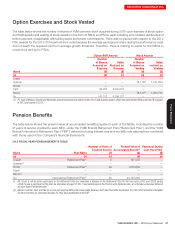

LRP

LRP Account Returns. The LRP provides an annual earnings

credit to each participant’s account based on the value of

participant’s account at the end of each year. Under the LRP,

Mr.Novak receives an annual earnings credit equal to 120%

of the applicable federal interest rate. Mr.Grismer, Mr.Niccol

and Mr.Pant receive an annual earnings credit equal to 5%.

The Company’s contribution (“Employer Credit”) for 2015 is

equal to 9.5% of salary plus target bonus for Mr.Novak,

Mr.Niccol and Mr.Grismer and 20% for Mr.Pant.

Distributions under LRP. Under the LRP, participants age55

or older are entitled to a lump sum distribution of their account

balance in the quarter following their separation of employment.

Participants under age55 with a vested LRP benefit combined

with any other deferred compensation benefits covered under

Code Section409A exceeds $15,000, will not receive a

distribution until the calendar quarter that follows the participant’s

55thbirthday.

TCN

TCN Account Returns. The TCN provides an annual earnings

credit to each participant’s account based on the value of

each participant’s account at the end of each year. Under

the TCN, Mr.Creed receives an annual earnings credit equal

to 5%. For Mr.Creed, the Employer Credit for 2015 was

equal to 15% of his salary plus target bonus.

Distributions under TCN. Under the TCN, participants age55

or older with a balance of $15,000 or more, are entitled to

a lump sum distribution of their account balance in the

quarter following their separation of employment. Participants

under age55 who separate employment with the Company

will receive interest annually and their account balance will

be distributed in the quarter following their 55thbirthday.

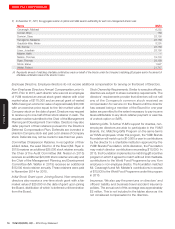

Name

Executive

Contributions

in Last FY

($)(1)

Registrant

Contributions

in Last FY

($)(2)

Aggregate

Earnings in

Last FY

($)(3)

Aggregate

Withdrawals/

Distributions

($)(4)

Aggregate

Balance at

Last FYE

($)(5)

(a) (b) (c) (d) (e) (f)

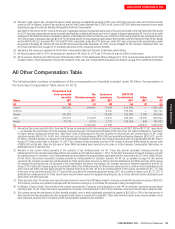

Creed — 412,500 215,583 16,049 9,883,463

Grismer 267,410 155,800 89,060 65,019 3,336,050

Novak 512,720 190,000 5,705,086 6,684 239,013,330

Pant 721,683 408,500 288,715 15,894 11,508,418

Niccol 669,630 349,560 90,856 199,584 3,860,857

Su 378,235 — 188,939 3,866,147 1,051,872

(1) Amounts in column (b) reflect amounts that were also reported as compensation in our Summary Compensation Table filed last year or, would have been

reported as compensation in our Summary Compensation Table last year if the executive were a NEO.

(2) Amounts in column (c) reflect Company contributions for EID Program matching contribution, LRP and/or TCN allocation as follows: Mr.Novak, $190,000 LRP

allocation; Mr.Grismer, $155,800 LRP allocation; Mr.Creed, $412,500 TCN allocation; Mr.Niccol, $126,350 LRP allocation and $223,210 EID matching

contribution, and Mr. Pant, $408,500 LRP allocation. See footnote 6 of the Summary Compensation Table for more detail.

(3) Amounts in column (d) reflect earnings during the last fiscal year on deferred amounts. All earnings are based on the investment alternatives offered under

the EID Program or the earnings credit provided under the LRP or the TCN described in the narrative above this table. The EID Program earnings are market

based returns and, therefore, are not reported in the Summary Compensation Table. For Messrs. Grismer, Pant and Niccol, of their earnings reflected in this

column, $12,861, $42,979 and $8,123 respectively were deemed above market earnings accruing to each of their accounts under the LRP. For Mr.Creed,

of his earnings reflected in this column, $23,096 were deemed above market earnings accruing to his account under the TCN. Mr.Novak receives a market

rate of interest on his account under the LRP. For above market earnings on nonqualified deferred compensation, see the “Change in Pension Value and

Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table.

(4) All amounts shown in column (e) were distributed in accordance with the executive’s deferral election, except in the case of the following amounts distributed

to pay payroll taxes due upon their account balance under the EID Program, LRP or TCN for 2015.

Creed 16,049

Grismer 65,019

Novak 6,684

Pant 15,894

Niccol 69,469