Pizza Hut 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement 43

Proxy Statement

EXECUTIVE COMPENSATION

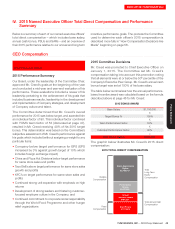

C. Relationship between Company Pay and Performance

To focus on both the short and long-term success of the Company, our NEOs’ target compensation includes a significant

portion, approximately 80%, that is “at-risk” pay, where the compensation paid is determined based on Company results.

If short-term and long-term financial and operational target goals are not achieved, then performance-related compensation

will decrease. If target goals are exceeded, then performance-related compensation will increase. As demonstrated below,

our target pay mix for NEOs emphasizes our commitment to “at-risk” pay in order to tie pay to performance.

4MAR201521365491

CEO TARGET PAY MIX—2015 ALL OTHER NEO TARGET PAY MIX—2015

Base Salary

23%

Annual Bonus

24%

84%

Long-Term

Equity Incentive

At-Risk

At-Risk

53%

77%

Annual Bonus

23%

Base Salary

16%

Long-Term

Equity Incentive

61%

Annual Bonus reflects 2015 Performance

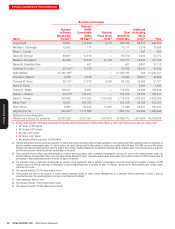

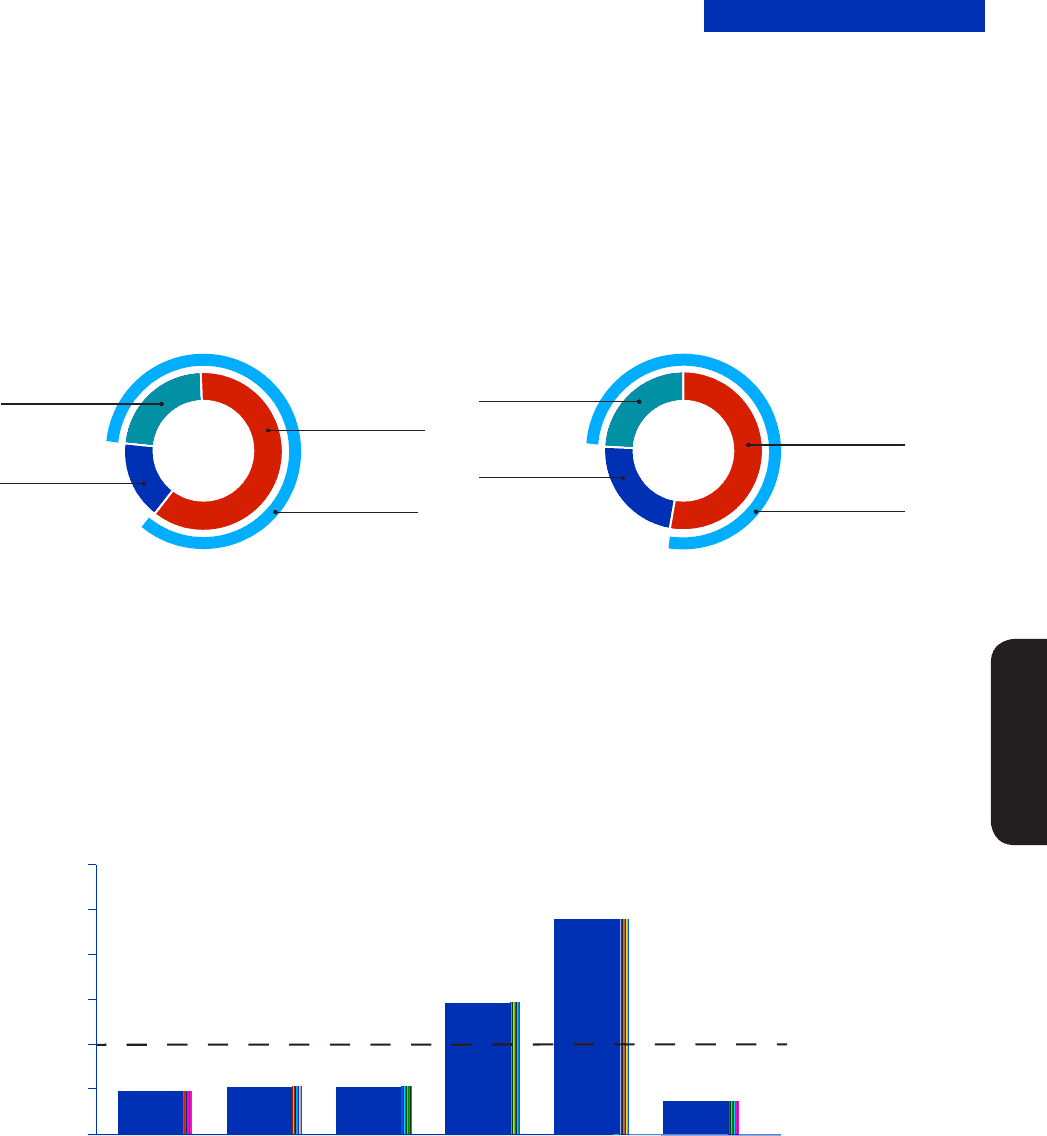

The NEOs annual performance reflects the results of the business that the NEO was leading. For Messrs. Creed, Grismer

and Novak, annual performance is tied to that of YUM. For the other NEOs, annual performance is weighted 75% for the

business that each NEO was leading and 25% for YUM performance. Therefore, bonus payouts for Messrs. Creed,

Grismer, Novak and Su were all below target. Two NEOs received above target bonuses: Mr.Pant, whose compensation

reflects the strong performance of the KFC Division where he was the CEO for over half the year and Mr.Niccol, who led

the Taco Bell Division to perform significantly above target on all performancemetrics.

NEO ACTUAL BONUS VS. TARGET

CREED

Actual (%)

NOVAK

Target

Bonus

48% 53%

147%

NICCOL SU

53%

GRISMER

240%

PANT

37%

PSU Awards did not Pay Out in 2015

Long-term incentive grants are valued based on grant date value and are meant to be incentive opportunities based on

future performance. Therefore, values in the Summary Compensation Table do not represent the value that may ultimately

be realized by the executive. Realized value will be determined by actual performance over succeeding years. This means

that, consistent with our pay-for performance philosophy, in the case of SARs/Options, our stock price must increase

and, in the case of PSUs, we must attain certain performance thresholds before our executives realize any value. As shown

below, our 2012 PSU award under our Performance Share Plan did not pay out to our NEOs in 2015 since the Company’s