Pizza Hut 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K52

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

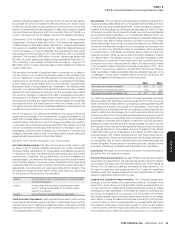

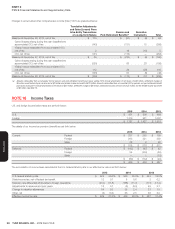

Recurring Fair Value Measurements

The Company has interest rate swaps accounted for as fair value hedges,

foreign currency forwards and swaps accounted for as cash flow hedges and

other investments, all of which are required to be measured at fair value on a

recurring basis. Interest rate swaps are used to reduce our exposure to interest

rate risk and lower interest expense for a portion of our fixed-rate debt and

our interest rate swaps meet the shortcut method requirements and thus no

ineffectiveness has been recorded. Our foreign currency forwards and swaps

are used to reduce our exposure to cash flow volatility arising from foreign

currency fluctuations associated with certain foreign currency denominated

intercompany short-term receivables and payables. The notional amount,

maturity date and currency of these forwards and swaps match those of

the underlying receivables or payables and we measure ineffectiveness by

comparing the cumulative change in the fair value of the forward or swap

contract with the cumulative change in the fair value of the hedged item. The

following table presents fair values for those assets and liabilities measured

at fair value on a recurring basis and the level within the fair value hierarchy

in which the measurements fall. No transfers among the levels within the

fair value hierarchy occurred during the years ended December 26, 2015 or

December 27, 2014.

Fair Value

Level 2015 2014

Foreign Currency Forwards and Swaps, net 2 $ 19 $ 24

Interest Rate Swaps, net 2 2 10

Other Investments 1 21 21

Total $ 42 $ 55

The fair value of the Company’s foreign currency forwards and swaps and interest rate swaps were determined based on the present value of expected future

cash flows considering the risks involved, including nonperformance risk, and using discount rates appropriate for the duration based upon observable inputs.

The other investments include investments in mutual funds, which are used to offset fluctuations in deferred compensation liabilities that employees have

chosen to invest in phantom shares of a Stock Index Fund or Bond Index Fund. The other investments are classified as trading securities in Other assets in

our Consolidated Balance Sheet and their fair value is determined based on the closing market prices of the respective mutual funds as of December26, 2015

and December 27, 2014.

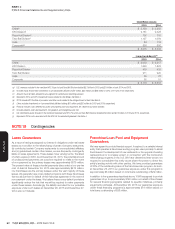

Non-Recurring Fair Value Measurements

The following table presents expense recognized from all non-recurring fair value

measurements during the years ended December 26, 2015 and December27,

2014. Other than the Little Sheep impairments (See Note 4), these amounts

relate to restaurants or groups of restaurants that were impaired either as a

result of our semi-annual impairment review or when it was more likely than

not a restaurant or restaurant group would be refranchised and exclude fair

value measurements made for restaurants that were subsequently closed or

refranchised prior to those respective year-end dates.

2015 2014

Little Sheep impairments(a) $ — $ 463

Refranchising related impairment(b) — 9

Restaurant-level impairment(c) 61 46

Total $ 61 $ 518

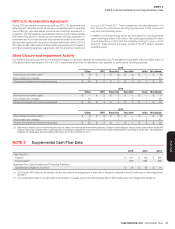

(a) Except for the Little Sheep trademark, which had a carrying value of $56 million at December 26, 2015, the remaining carrying value of assets measured at fair value due to the 2014 Little Sheep

impairments (Level 3) is insignificant. See Note 4 for further discussion. Our 2014 fair value estimate of the Little Sheep trademark was determined using a relief-from-royalty valuation approach

that included future revenues as a significant input and a discount rate of 13% as our estimate of the required rate-of-return that a third party buyer would expect to receive when purchasing

the trademark. The primary drivers of the trademark’s fair value are franchise revenue growth and revenues associated with a wholly-owned business that sells seasoning to retail customers.

Franchise revenue growth reflected annual same store sales growth of 4% and approximately 35 new franchise units per year, partially offset by approximately 25franchise closures per year.

The retail seasoning business was forecasted to generate sales growth consistent with historical results. Our 2015 fair value estimate exceeded its carrying value using similar assumptions and

methods as those used in 2014.

(b) Refranchising related impairment results from writing down the assets of restaurants or restaurant groups offered for refranchising. The fair value measurements used in our impairment evaluation

are based on either actual bids received from potential buyers (Level 2), or on estimates of the sales prices we anticipated receiving from a buyer for the restaurant or restaurant groups (Level 3).

(c) Restaurant-level impairment charges are recorded in Closures and impairment (income) expenses and resulted primarily from our semi-annual impairment evaluation of long-lived assets of

individual restaurants that were being operated at the time of impairment and had not been offered for refranchising. The fair value measurements used in these impairment evaluations were

based on discounted cash flow estimates using unobservable inputs (Level 3). The remaining net book value of assets measured at fair value during the years ended December 26, 2015 and

December27, 2014 is insignificant.

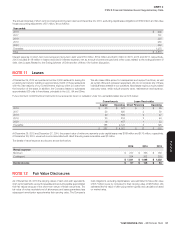

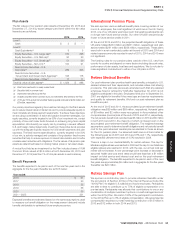

NOTE13 Pension, Retiree Medical and Retiree Savings Plans

U.S. Pension Plans

We sponsor qualified and supplemental (non-qualified) noncontributory

defined benefit plans covering certain full-time salaried and hourly U.S.

employees. The qualified plan meets the requirements of certain sections

of the Internal Revenue Code and provides benefits to a broad group of

employees with restrictions on discriminating in favor of highly compensated

employees with regard to coverage, benefits and contributions. The

supplemental plans provide additional benefits to certain employees. We

fund our supplemental plans as benefits are paid.

The most significant of our U.S. plans is the YUM Retirement Plan (the

“Plan”), which is a qualified plan. Our funding policy with respect to the

Plan is to contribute amounts necessary to satisfy minimum pension

funding requirements, including requirements of the Pension Protection

Act of 2006, plus additional amounts from time to time as are determined

to be necessary to improve the Plan’s funded status. We do not expect to

make any significant contributions to the Plan in 2016. We currently expect

to make $13 million in benefit payments from our primary unfunded U.S.

non-qualified plan in 2016. Our two significant U.S. plans were previously

amended such that any salaried employee hired or rehired by YUM after

September 30, 2001 is not eligible to participate in those plans.