Pizza Hut 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement42

Proxy Statement

EXECUTIVE COMPENSATION

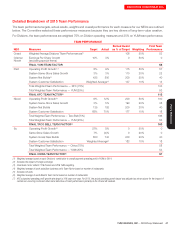

B. Compensation Changes for 2015

The Committee made significant compensation changes for 2015, including changes to CEO pay:

•

Consideration of pay philosophy, benchmark data

and pay decisions. During 2015, the Committee

considered the Company’s pay philosophy, benchmarking

practices and use of market data. Based on this review,

the Committee decided that beginning in September

2015 it would review market data and make decisions

for each executive officer most often within a range of

the market median for each element of compensation,

including base, bonus target and long-term incentive

target. In addition to the market data, the Committee will

continue to take into account the role, level of responsibility,

experience, individual performance and future potential

in setting compensation. Prior to this change the Committee

targeted compensation for all NEOs at the 50

th

percentile

for salary, 75th percentile for annual bonus and 50th

percentile for long term incentive compensation.

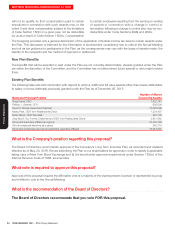

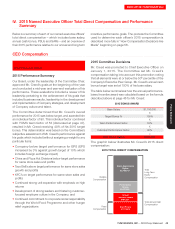

•CEO total direct compensation set below median of

our Executive Peer Group. Mr.Creed was appointed

CEO by the Board of Directors effective January 1, 2015.

The Committee reviewed compensation for internal peers

and a range of market data for quick service restaurant

CEOs and CEOs of YUMs Executive Peer Group, which

is comprised of the companies listed on page 58. Because

Mr.Creed was new to his role, the Committee set

Mr.Creed’s total direct compensation below the median

CEO compensation of YUM’s Executive Peer Group.

Long-Term

Incentive

Base

Target Bonus

2015 CEO Pay

$4,300,000

$1,100,000

$1,650,000

2015 CEO Pay

vs. Peer Group

<50th percentile

Total

Direct Compensation $7,050,000 <50th percentile

<50th percentile

50th percentile

Note: The Long-Term Incentive value does not match the Summary Compensation Table due to the value of SARs/Options for this table being determined based on the full

10-year term for the CEO rather than the expected term of all SARs/Options granted by the Company.

•

Executive Chairman pay will target median

compensation philosophy. Mr.Novak retired as CEO

effective December 31, 2014 and was appointed Executive

Chairman of the YUM Board of Directors effective January

1, 2015. Based on the Committee’s review of a variety

of external and internal factors, the Committee targeted

total compensation and set pay at the 50th percentile,

which was based on executive chairs in the Fortune 250

who were not founders of their companies.

•Updated the Company’s Executive Peer Group. The

Committee removed OfficeMax, Darden, H.J. Heinz

Company and JC Penney and added Starwood, Hilton,

Office Depot and Kraft to the Executive Peer Group in

order to better align the size of the peer group companies

with YUM.

•

Aligned ownership guidelines with market best practice.

Our ownership guidelines in effect for 2015 are described

at page 58. The Committee determined it was appropriate

to adjust the guidelines beginning in 2015 to be more in

line with market practice. The guidelines in effect prior to

2015 had been in place for many years, and the increase

in the Company’s stock price over these years had resulted

in the guidelines exceeding market practice by a wide

margin. For 2015, under the revised ownership guidelines

Mr.Creed and Mr.Novak were required to own 100,000

shares and our Chief Financial Officer and Division CEOs

were required to own 30,000 shares. As a multiple of

salary, this represents over six times for Mr.Creed and

Mr.Novak and over three times for the Chief Financial

Officer and Division CEOs. At these multiples of salary,

the new guidelines are above the median for YUM’s

Executive Peer Group.