Pizza Hut 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 31

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

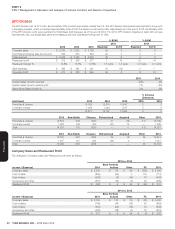

During 2015, the Company’s reporting units with the most significant

refranchising activity and recorded goodwill were KFC India, Taco Bell

U.S. and KFC China. Within KFC India, 86 restaurants were refranchised

(representing 42% of beginning-of-year company units) and less than

$1million in goodwill was written off (representing 25% of beginning-of-year

goodwill). Within Taco Bell U.S., 65 restaurants were refranchised

(representing 7% of beginning-of-year company units) and $2 million in

goodwill was written off (representing 2% of beginning-of-year goodwill).

Within KFC China, 52 restaurants were refranchised (representing 1%

of beginning-of-year company units) and less than $1 million in goodwill

was written off (representing less than 1% of beginning-of-year goodwill).

See Note 2 for a further discussion of our policies regarding goodwill.

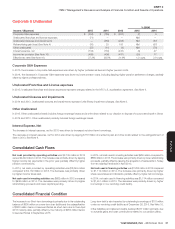

Self-Insured Property and Casualty Losses

We record our best estimate of the remaining cost to settle incurred

self-insured property and casualty losses. The estimate is based on the

results of an independent actuarial study and considers historical claim

frequency and severity as well as changes in factors such as our business

environment, benefit levels, medical costs and the regulatory environment

that could impact overall self-insurance costs. Additionally, our reserve

includes a risk margin to cover unforeseen events that may occur over

the several years required to settle claims, increasing our confidence level

that the recorded reserve is adequate.

See Note 18 for a further discussion of our insurance programs.

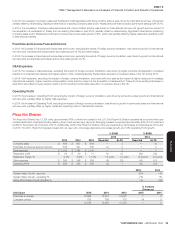

Pension Plans

Certain of our employees are covered under defined benefit pension

plans. Our two most significant plans are in the U.S. and combined had

a projected benefit obligation (“PBO”) of $1,134 million and a fair value of

plan assets of $1,004 million at December 26, 2015.

The PBO reflects the actuarial present value of all benefits earned to date

by employees and incorporates assumptions as to future compensation

levels. Due to the relatively long time frame over which benefits earned to

date are expected to be paid, our PBOs are highly sensitive to changes in

discount rates. For our U.S. plans, we measured our PBOs using a discount

rate of 4.90% at December 26, 2015. This discount rate was determined

with the assistance of our independent actuary. The primary basis for our

discount rate determination is a model that consists of a hypothetical

portfolio of ten or more corporate debt instruments rated Aa or higher by

Moody’s or S&P with cash flows that mirror our expected benefit payment

cash flows under the plans. We exclude from the model those corporate

debt instruments flagged by Moody’s or S&P for a potential downgrade

(if the potential downgrade would result in a rating below Aa by both Moody’s

and S&P) and bonds with yields that were two standard deviations or

more above the mean. In considering possible bond portfolios, the model

allows the bond cash flows for a particular year to exceed the expected

benefit payment cash flows for that year. Such excesses are assumed to

be reinvested at appropriate one-year forward rates and used to meet the

benefit payment cash flows in a future year. The weighted-average yield of

this hypothetical portfolio was used to arrive at an appropriate discount rate.

We also ensure that changes in the discount rate as compared to the prior

year are consistent with the overall change in prevailing market rates and

make adjustments as necessary. A 50 basis-point increase in this discount

rate would have decreased these U.S. plans’ PBOs by approximately

$70 million at our measurement date. Conversely, a 50 basis-point decrease in

this discount rate would have increased our U.S. plans’ PBOs by approximately

$80 million at our measurement date.

The pension expense we will record in 2016 is also impacted by the

discount rate, as well as the long-term rates of return on plan assets and

mortality assumptions we selected at our measurement date. We expect

pension expense for our U.S. plans to decrease approximately $35 million

in 2016. The decrease is primarily driven by a decrease in amortization

of net loss due to lower net unrecognized losses in Accumulated other

comprehensive income. Lower net unrecognized losses in Accumulated

other comprehensive income are primarily a result of a higher discount rate

at our 2015 measurement date. A 50 basis-point change in our discount

rate assumption at our measurement date would impact our 2016 U.S.

pension expense by approximately $6 million.

Our estimated long-term rate of return on U.S. plan assets is based upon

the weighted-average of historical returns for each asset category. Our

expected long-term rate of return on U.S. plan assets, for purposes of

determining 2016 pension expense, at December 26, 2015 was 6.75%.

We believe this rate is appropriate given the composition of our plan assets

and historical market returns thereon. A 100 basis point change in our

expected long-term rate of return on plan assets assumption would impact

our 2016 U.S. pension expense by approximately $10 million. Additionally,

every 100 basis point variation in actual return on plan assets versus our

expected return of 6.75% will impact our unrecognized pre-tax actuarial

net loss by approximately $10 million.

A decrease in discount rates over time has largely contributed to an

unrecognized pre-tax actuarial net loss of $138 million included in

Accumulated other comprehensive income (loss) for these U.S. plans at

December 26, 2015. We will recognize approximately $6 million of such

loss in net periodic benefit cost in 2016 versus $45 million recognized in

2015. See Note 13.

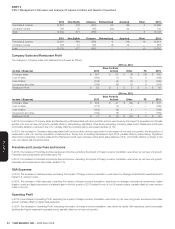

Income Taxes

At December 26, 2015, we had valuation allowances of approximately

$250 million to reduce our $1.2 billion of deferred tax assets to amounts

that are more likely than not to be realized. The net deferred tax assets

primarily relate to temporary differences in profitable U.S. federal, state and

foreign jurisdictions, net operating losses in certain foreign jurisdictions,

the majority of which do not expire, and U.S. foreign tax credit carryovers

that expire 10 years from inception and for which we anticipate having

foreign earnings to utilize. In evaluating our ability to recover our deferred

tax assets, we consider future taxable income in the various jurisdictions

as well as carryforward periods and restrictions on usage. The estimation

of future taxable income in these jurisdictions and our resulting ability

to utilize deferred tax assets can significantly change based on future

events, including our determinations as to feasibility of certain tax planning

strategies. Thus, recorded valuation allowances may be subject to material

future changes.

As a matter of course, we are regularly audited by federal, state and foreign

tax authorities. We recognize the benefit of positions taken or expected

to be taken in our tax returns in our Income Tax Provision when it is more

likely than not that the position would be sustained upon examination by

these tax authorities. A recognized tax position is then measured at the

largest amount of benefit that is greater than fifty percent likely of being

realized upon settlement. At December 26, 2015 we had $98 million of

unrecognized tax benefits, $89 million of which are temporary in nature

and, if recognized, would not impact the effective tax rate. We evaluate

unrecognized tax benefits, including interest thereon, on a quarterly basis to

ensure that they have been appropriately adjusted for events, including audit

settlements, which may impact our ultimate payment for such exposures.

We have investments in foreign subsidiaries where the carrying values for

financial reporting exceed the tax basis. We have not provided deferred

tax on the portion of the excess that we believe is indefinitely reinvested,

as we have the ability and intent to indefinitely postpone these basis

differences from reversing with a tax consequence. We estimate that our

total temporary difference upon which we have not provided deferred tax

is approximately $2.3 billion at December 26, 2015. A determination of

the deferred tax liability on this amount is not practicable.

If our intentions regarding our ability and intent to postpone these basis

differences from reversing with a tax consequence change, deferred tax

may need to be provided that could materially impact the provision for

income taxes.

See Note 16 for a further discussion of our income taxes.