Pizza Hut 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

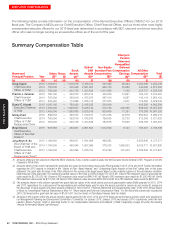

YUM! BRANDS, INC.-2016Proxy Statement64

Proxy Statement

EXECUTIVE COMPENSATION

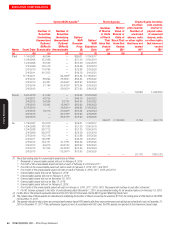

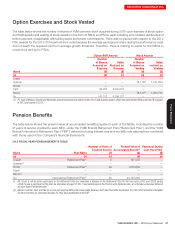

Grants of Plan-Based Awards

The following table provides information on stock options, SARs and PSUs granted in 2015 to each of the Company’s

NEOs. The full grant date fair value of these awards is shown in the Summary Compensation Table at page62.

Name

Grant

Date

Estimated Possible Payouts

Under Non-Equity Incentive

Plan Awards(1)

Estimated Future Payouts

Under Equity Incentive Plan

Awards(2)

All Other Option/

SAR Awards;

Number of

Securities

Underlying

Options

(#)(3)

Exercise or

Base Price

of Option/

SAR

Awards

($/Sh)(4)

Grant

Date Fair

Value($)(5)

Threshold

($)

Target

($)

Maximum

($)

Threshold

(#)

Target

(#)

Maximum

(#)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k)

Creed 2/6/2015 0 1,650,000 4,950,000

2/6/2015 194,982 73.93 3,108,013

2/6/2015 — 14,541 29,082 1,075,016

Grismer 2/6/2015 0 840,000 2,520,000

2/6/2015 105,396 73.93 1,680,012

2/6/2015 — 5,682 11,364 420,070

Novak 2/6/2015 0 1,000,000 3,000,000

2/6/2015 136,034 73.93 2,168,382

2/6/2015 — 10,145 20,290 750,020

Pant 2/6/2015 0 1,003,096 3,009,288

2/6/2015 89,022 73.93 1,419,011

2/6/2015 — 4,802 9,604 355,012

Niccol 2/6/2015 0 630,000 1,890,000

2/6/2015 62,736 73.93 1,000,012

2/6/2015 68,475 73.93 1,091,491

2/6/2015 — 3,382 6,764 250,031

Su 2/6/2015 0 1,265,000 3,795,000

2/6/2015 115,057 73.93 1,834,009

2/6/2015 — 6,209 12,418 459,031

(1) Amounts in columns (c), (d) and (e) provide the minimum amount, target amount and maximum amount payable as annual incentive compensation

under the Yum Leaders’ Bonus Program based on the Company’s performance and on each executive’s individual performance during 2015. The

actual amount of annual incentive compensation awards are shown in column (g) of the Summary Compensation Table on page 62. The performance

measurements, performance targets, and target bonus percentages are described in the CD&A beginning on page 39 under the discussion of annual

incentive compensation.

(2) Reflects grants of PSU awards subject to performance-based vesting conditions in 2015. The PSU awards vest on December 31, 2017 and PSU award

payouts are subject to the Company’s achievement of specified relative total shareholder return (“TSR”) rankings against its peer group (which is the

S&P 500) during the performance period ending on December 31, 2017. The performance target for all the PSU awards granted to the NEOs in 2015 is

a 50% TSR percentile ranking for the Company, determined by comparing the Company’s relative TSR ranking against its peer group as measured at the

end of the performance period. If the 50% TSR percentile ranking target is achieved, 100% of the PSU award will pay out in shares of Company stock,

subject to executive’s election to defer PSU awards into the EID Program. If less than 40% TSR percentile ranking is achieved, there will be no payout.

If the Company’s TSR percentile ranking is 90% or higher, PSU awards pay out at the maximum, which is 200% of target. The terms of the PSU awards

provide that in case of a change in control during the first year of award, shares will be distributed assuming target performance was achieved subject to

reduction to reflect the portion of the performance period following the change in control. In case of a change in control after the first year of the award,

shares will be distributed assuming performance at the greater of target level or projected level at the time of the change in control subject to reduction

to reflect the portion of the performance period following the change in control.

(3) Amounts in this column reflect the number of SARs and stock options granted to executives during the Company’s 2015 fiscal year. SARs allow the

grantee to receive the number of shares of YUM common stock that is equal in value to the appreciation in YUM common stock with respect to the number

of SARs granted from the date of grant to the date of exercise. For each executive, the grants were made on February 6, 2015. SARs/stock options

become exercisable in equal installments on the first, second, third and fourth anniversaries of the grant date; except, however, 68,475 SARs granted

to Mr.Niccol become exercisable on the fifth anniversary of the grant date. The terms of each SAR/stock option grant provide that, in case of a change

in control, if an executive is employed on the date of a change in control and is involuntarily terminated on or within two years following the change in

control (other than by the Company for cause) then all outstanding awards become exercisable immediately.

Executives who have attained age 55 with 10 years of service who terminate employment may exercise SARs/stock options that were vested on their

date of termination through the expiration dates of the SARs/stock options (generally, the tenth anniversary following the SARs/stock options grant dates).

Vested SARs/stock options of grantees who die may also be exercised by the grantee’s beneficiary through the expiration dates of the vested SARs/

stock options and the grantee’s unvested SARs/stock options expire on the grantee’s date of death. If a grantee’s employment is terminated due to gross

misconduct, the entire award is forfeited. For other employment terminations, all vested or previously exercisable SARs/stock options as of the last day

of employment must be exercised within 90 days following termination of employment.

(4) The exercise price of the SARs/stock options granted in 2015 equals the closing price of YUM common stock on the grant date, February 6, 2015.