Pizza Hut 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

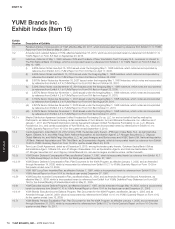

YUM! BRANDS, INC.-2015 Form10-K 65

Form 10-K

PART II

ITEM 9AControls and Procedures

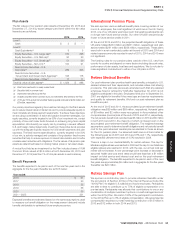

NOTE19 Selected Quarterly Financial Data (Unaudited)

2015

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,179 $ 2,659 $ 2,968 $ 3,339 $11,145

Franchise and license fees and income 443 446 459 612 1,960

Total revenues 2,622 3,105 3,427 3,951 13,105

Restaurant profit 382 411 539 454 1,786

Operating Profit(a) 506 371 603 441 1,921

Net Income – YUM! Brands, Inc. 362 235 421 275 1,293

Basic earnings per common share 0.83 0.54 0.97 0.64 2.97

Diluted earnings per common share 0.81 0.53 0.95 0.63 2.92

Dividends declared per common share — 0.82 — 0.92 1.74

2014

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,292 $ 2,758 $ 2,891 $ 3,383 $11,324

Franchise and license fees and income 432 446 463 614 1,955

Total revenues 2,724 3,204 3,354 3,997 13,279

Restaurant profit 441 428 429 344 1,642

Operating Profit(b) 571 479 550 (43) 1,557

Net Income – YUM! Brands, Inc. 399 334 404 (86) 1,051

Basic earnings per common share 0.89 0.75 0.91 (0.20) 2.37

Diluted earnings per common share 0.87 0.73 0.89 (0.20) 2.32

Dividends declared per common share 0.37 0.37 — 0.82 1.56

(a) Includes losses associated with refranchising of equity markets outside of the U.S. of $73 million, $20 million and $3 million in the second, third and fourth quarters, respectively,

costs associated with the KFC U.S. Acceleration Agreement of $2 million, $8 million, $21 million and $41 million in the first, second, third and fourth quarters, respectively, and net

U.S.refranchising gains of $7 million, $1 million, $16 million and $51 million in the first, second, third and fourth quarters, respectively. See Note 4.

(b) Includes a non-cash charge of $463 million in the fourth quarter related primarily to the impairment of Little Sheep intangible assets. See Note 4.

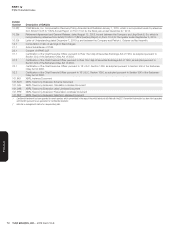

ITEM 9 Changes In and Disagreements

withAccountants on Accounting

andFinancial Disclosure

None.

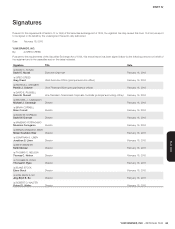

ITEM 9A Controls and Procedures

Evaluation of Disclosure Controls and Procedures

The Company has evaluated the effectiveness of the design and operation

of its disclosure controls and procedures pursuant to Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934 as of the end of the

period covered by this report. Based on the evaluation, performed under

the supervision and with the participation of the Company’s management,

including the Chief Executive Officer (the “CEO”) and the Chief Financial

Officer (the “CFO”), the Company’s management, including the CEO and

CFO, concluded that the Company’s disclosure controls and procedures

were effective as of the end of the period covered by this report.