Pizza Hut 2015 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 43

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

valuation allowance against the carrying amount of deferred tax assets,

we consider the amount of taxable income and periods over which it must

be earned, actual levels of past taxable income and known trends and

events or transactions that are expected to affect future levels of taxable

income. Where we determine that it is more likely than not that all or a

portion of an asset will not be realized, we record a valuation allowance.

In November, 2015 the FASB issued ASU No. 2015-17, Balance Sheet

Classification of Deferred Taxes (ASU 2015-17) to simplify the presentation

of deferred taxes on the balance sheet. ASU 2015-17 requires organizations

that present a classified balance sheet to classify all deferred taxes as

noncurrent assets or noncurrent liabilities. We have elected to early adopt

this guidance as of December 26, 2015 and restate our 2014 comparable

balances. This resulted in $93 million of current deferred tax assets and

$2million of current deferred tax liabilities being reclassified at December27,

2014, resulting in an increase to Deferred income taxes – long term of

$82 million and a corresponding decrease to Other liabilities and deferred

credits of $9 million.

We recognize the benefit of positions taken or expected to be taken in

our tax returns in our Income tax provision when it is more likely than

not (i.e. a likelihood of more than fifty percent) that the position would be

sustained upon examination by tax authorities. A recognized tax position

is then measured at the largest amount of benefit that is greater than

fifty percent likely of being realized upon settlement. We evaluate these

amounts on a quarterly basis to ensure that they have been appropriately

adjusted for audit settlements and other events we believe may impact

the outcome. Changes in judgment that result in subsequent recognition,

derecognition or a change in measurement of a tax position taken in a prior

annual period (including any related interest and penalties) are recognized

as a discrete item in the interim period in which the change occurs. We

recognize accrued interest and penalties related to unrecognized tax

benefits as components of our Income tax provision.

We do not record a U.S. deferred tax liability for the excess of the book

basis over the tax basis of our investments in foreign subsidiaries to the

extent that the basis difference results from earnings that meet the indefinite

reversal criteria. This criteria is met if the foreign subsidiary has invested,

or will invest, the undistributed earnings indefinitely. The decision as to the

amount of undistributed earnings that we intend to maintain in non-U.S.

subsidiaries considers items including, but not limited to, forecasts and

budgets of financial needs of cash for working capital, liquidity plans and

expected cash requirements in the United States.

See Note 16 for a further discussion of our income taxes.

Fair Value Measurements. Fair value is the price we would receive to sell

an asset or pay to transfer a liability (exit price) in an orderly transaction

between market participants. For those assets and liabilities we record

or disclose at fair value, we determine fair value based upon the quoted

market price, if available. If a quoted market price is not available for

identical assets, we determine fair value based upon the quoted market

price of similar assets or the present value of expected future cash flows

considering the risks involved, including counterparty performance risk if

appropriate, and using discount rates appropriate for the duration. The

fair values are assigned a level within the fair value hierarchy, depending

on the source of the inputs into the calculation.

Level 1 Inputs based upon quoted prices in active markets

for identical assets.

Level 2 Inputs other than quoted prices included within

Level 1 that are observable for the asset, either

directly or indirectly.

Level 3 Inputs that are unobservable for the asset.

Cash and Cash Equivalents. Cash equivalents represent funds we have

temporarily invested (with original maturities not exceeding three months),

including short-term, highly liquid debt securities. Cash and overdraft

balances that meet the criteria for right of setoff are presented net on our

Consolidated Balance Sheet.

Receivables. The Company’s receivables are primarily generated from

ongoing business relationships with our franchisees and licensees as a result

of franchise, license and lease agreements. Trade receivables consisting of

royalties from franchisees and licensees are generally due within 30 days

of the period in which the corresponding sales occur and are classified as

Accounts and notes receivable on our Consolidated Balance Sheet. Our

provision for uncollectible franchisee and licensee receivable balances is

based upon pre-defined aging criteria or upon the occurrence of other

events that indicate that we may not collect the balance due. Additionally,

we monitor the financial condition of our franchisees and licensees and

record provisions for estimated losses on receivables when we believe

it probable that our franchisees or licensees will be unable to make their

required payments. While we use the best information available in making

our determination, the ultimate recovery of recorded receivables is also

dependent upon future economic events and other conditions that may

be beyond our control. We recorded $6 million, $3 million and $2 million

in net provisions within Franchise and license expenses in 2015, 2014

and 2013, respectively, related to uncollectible franchise and license

trade receivables. Trade receivables that are ultimately deemed to be

uncollectible, and for which collection efforts have been exhausted, are

written off against the allowance for doubtful accounts.

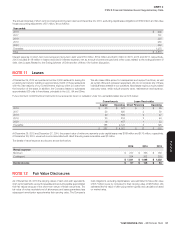

2015 2014

Accounts and notes receivable $ 393 $ 337

Allowance for doubtful accounts (16) (12)

Accounts and notes receivable, net $ 377 $ 325

Our financing receivables primarily consist of notes receivables and direct

financing leases with franchisees which we enter into from time to time. As

these receivables primarily relate to our ongoing business agreements with

franchisees and licensees, we consider such receivables to have similar risk

characteristics and evaluate them as one collective portfolio segment and

class for determining the allowance for doubtful accounts. We monitor the

financial condition of our franchisees and licensees and record provisions

for estimated losses on receivables when we believe it is probable that our

franchisees or licensees will be unable to make their required payments.

Balances of notes receivable and direct financing leases due within one year

are included in Accounts and notes receivable while amounts due beyond

one year are included in Other assets. Amounts included in Other assets

totaled $23 million (net of an allowance of $4million) and $21 million (net

of an allowance of $1 million) at December26, 2015 and December27,

2014, respectively. Financing receivables that are ultimately deemed to

beuncollectible, and for which collection efforts have been exhausted, are

written off against the allowance for doubtful accounts. Interest income

recorded on financing receivables has historically been insignificant.

Inventories. We value our inventories at the lower of cost (computed on

the first-in, first-out method) or market.

Property, Plant and Equipment. We state PP&E at cost less accumulated

depreciation and amortization. We calculate depreciation and amortization

on a straight-line basis over the estimated useful lives of the assets as

follows: 5 to 25 years for buildings and leasehold improvements, 3 to

20 years for machinery and equipment and 3 to 7 years for capitalized

software costs. We suspend depreciation and amortization on assets

related to restaurants that are held for sale.

Leases and Leasehold Improvements. The Company leases land,

buildings or both for certain of its restaurants worldwide. The length of our

lease terms, which vary by country and often include renewal options, are

an important factor in determining the appropriate accounting for leases

including the initial classification of the lease as capital or operating and

the timing of recognition of rent expense over the duration of the lease.

We include renewal option periods in determining the term of our leases

when failure to renew the lease would impose a penalty on the Company

in such an amount that a renewal appears to be reasonably assured at

the inception of the lease. The primary penalty to which we are subject

is the economic detriment associated with the existence of leasehold

improvements which might be impaired if we choose not to continue the