Pizza Hut 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2016Proxy Statement56

Proxy Statement

EXECUTIVE COMPENSATION

elected to continue to provide them, noting that this practice

is consistent with how we treat other executives on foreign

assignment. Mr.Su’s agreement stipulates that the following

will be provided:

• Housing, commodities and utilities allowances

• Tax preparation services

•

Tax equalization to Hong Kong with respect to income

attributable to certain SARs/options exercises and to

distributions of deferred income

On August 19, 2015, Mr.Su retired as Chairman and CEO

of the China Division and assumed the role of Executive

Advisor to the new CEO of the China Division, Micky Pant.

Mr.Su retired as an employee of the Company on

February15, 2016. At the time of his retirement as Chairman

and CEO of the China Division, the Company agreed to

make tax equalization payments to Mr.Su (as if he were a

resident of Hong Kong) for China income tax incurred by

him with respect to his stock option and SAR exercises

and deferral plan payouts up to a maximum of $5 million.

At the end of 2015, Mr.Su had benefitted from approximately

$3.2 million in tax equalization payments under the agreement

as reported at page 54.

VI. How Compensation Decisions Are Made

Shareholder Outreach, Engagement and 2015 Vote on NEO Compensation

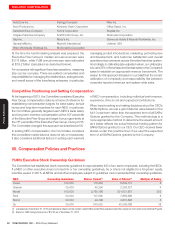

At our 2015 Annual Meeting of Shareholders, 65% of votes

cast on our annual advisory vote on NEO compensation

were in favor of our NEOs’ compensation program, as

disclosed in our 2015 proxy statement. During 2015, we

continued our shareholder outreach program to better

understand our investors’ opinions on our compensation

practices and respond to their questions. Committee

members and management team members from

compensation, investor relations and legal continued to be

directly involved in engagement efforts during 2015 that

served to reinforce our open door policy. The efforts included:

•

Contacting the top 100 shareholders, representing

ownership of approximately 46% of our shares

•

Meeting with shareholders representing 17% of our shares

•Dialogue with proxy advisory firm

•Investor road shows and conferences

•Presenting shareholder feedback to the Committee

•Considering letters from shareholders

Our annual engagement efforts allow many shareholders

the opportunity to provide feedback. The Committee carefully

considers shareholder and advisor feedback, among other

factors discussed in this CD&A, in making its compensation

decisions. Shareholder feedback, including the 2015 voting

results on NEO compensation, has influenced and reinforced

a number of compensation design changes over the years,

including:

•

Moving away from above-market benchmarking for

CEOpay

•

Adjusting CEO long-term incentives from 100% SARs/

Options to a mix comprised of 75% SARs/Options and

25% PSUs

•

Moving away from EPS to TSR-based targets under PSU

awards thus, removing duplicative measures between

the bonus and long-term incentive plan

Shareholder feedback further influenced the changes to our

compensation program for 2015 described above. The Company

and the Committee appreciate the feedback from our

shareholders and plan to continue these engagement efforts.

Role of the Committee

Compensation decisions are ultimately made by the

Committee using its judgment, focusing primarily on each

NEO’s performance against his financial and strategic

objectives, qualitative factors and the Company’s overall

performance. The Committee considers the total

compensation of each NEO and retains discretion to make

decisions that are reflective of overall business performance

and each executive’s strategic contributions to the business.

In making its compensation decisions, the Committee

typically follows the annual process described below: