Pizza Hut 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

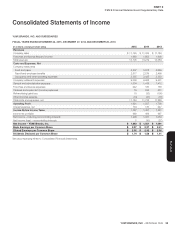

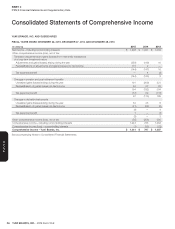

YUM! BRANDS, INC.-2015 Form10-K28

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity and Capital Resources

Operating in the retail food industry allows us to generate substantial cash

flows from the operations of our company-owned stores and from our

extensive franchise operations which require a limited YUM investment.

Net cash provided by operating activities has exceeded $2 billion each of

the last five fiscal years. These operating cash flows have largely funded

our historical capital spending and returns to shareholders in the form of

cash dividends and share repurchases.

To the extent operating cash flows plus other sources of cash such as

refranchising proceeds have not covered our desired levels of capital

spending and returns to shareholders, we have had borrowing capacity

to fund shortfalls. Net cash provided by operating activities, refranchising

proceeds, capital spending, repurchases of shares of Common Stock and

dividends paid on Common Stock each of the last three years are as follows:

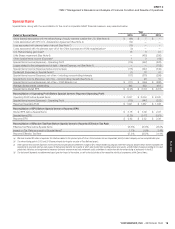

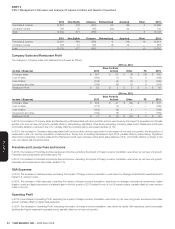

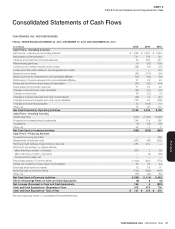

2015 2014 2013

Net Cash Provided by Operating Activities $ 2,139 $ 2,049 $ 2,139

Refranchising Proceeds 246 114 260

Capital spending (973) (1,033) (1,049)

Repurchase shares of Common Stock (1,200) (820) (770)

Dividends paid on Common Stock (730) (669) (615)

We generate a significant amount of cash from operating activities outside

the U.S. that we have used historically to fund our international development.

To the extent we have needed to repatriate international cash to fund our

U.S. discretionary cash spending, including returns to shareholders and

debt repayments, we have historically been able to do so in a tax-efficient

manner. If we experience an unforeseen decrease in our cash flows from

our U.S. businesses or are unable to refinance future U.S. debt maturities

we may be required to repatriate future international earnings at tax rates

higher than we have historically experienced.

As previously noted we intend to spin-off our China business from YUM

into an independent, publicly-traded company prior to the end of 2016.

Upon completion of the planned spin-off, YUM will become more of a

“pure play” franchisor with more stable earnings, higher profit margins,

lower capital requirements and stronger cash flow conversion.

YUM has announced its intention to return approximately $6.2 billion of

capital to shareholders prior to this planned spin-off, the majority of which

would be funded by incremental borrowings. We expect these incremental

borrowings to occur as the Company transitions to a non-investment grade

credit rating with a balance sheet more consistent with highly-levered peer

restaurant franchise companies.

As part of our intention to return up to $6.2 billion to shareholders, we

began increasing our rate of share repurchases in October, 2015. In

December, 2015 we entered into a $1.5 billion short-term credit facility

to help fund these share repurchases, and there were $600 million of

outstanding borrowings related to this facility as of December 26, 2015.

We expect to borrow an additional $5.2 billion in 2016.

When we announced our recapitalization plan, our credit ratings were

lowered to non-investment grade by both Standard & Poor’s (BB) and

Moody’s Investor Services (Ba3). This downgrade did not significantly

impact our 2015 borrowing costs and we do not expect it to impact our

ability to execute our recapitalization plan or the balance of our planned

shareholder returns. While we do not anticipate any further downgrade

to our credit rating, such a downgrade would increase the Company’s

current borrowing costs and could impact the Company’s ability to access

the credit markets cost effectively if necessary. Based on the amount and

composition of our debt at December 26, 2015, our interest expense

would not materially increase on a full-year basis should we receive a

further one-level downgrade in our ratings.

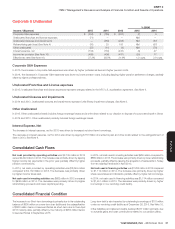

Borrowing Capacity

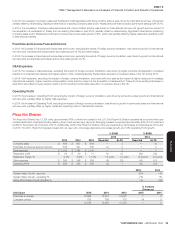

Our primary bank credit agreement comprises a $1.3 billion syndicated

senior unsecured revolving credit facility (the “Credit Facility”) which matures

in March 2017 and includes 24 participating banks with commitments

ranging from $23 million to $115 million. We believe the syndication reduces

our dependency on any one bank.

Under the terms of the Credit Facility, we may borrow up to the maximum

borrowing limit, less outstanding letters of credit or banker’s acceptances,

where applicable. At December 26, 2015, our unused Credit Facility

totaled $594 million net of outstanding letters of credit of $5 million and

outstanding borrowings of $701 million. The interest rate for borrowings

under the Credit Facility ranges from 1.00% to 1.75% over the “London

Interbank Offered Rate” (“LIBOR”). The exact spread over LIBOR under the

Credit Facility depends upon our performance against specified financial

criteria. Interest on any outstanding borrowings under the Credit Facility

is payable at least quarterly.

On December 8, 2015, we entered into a credit agreement providing for

an unsecured term loan facility (the “Short-Term Loan Credit Facility”) in

an amount up to $1.5 billion which matures in June 2016 with an option

for YUM to extend maturity for an additional three months and includes

three participating banks. This credit agreement is being used to fund a

portion of our planned capital returns to shareholders.

Under the terms of the Short-Term Loan Credit Facility, we may

borrow up to the full amount of the facility in up to three draws. At

December 26, 2015, our unused Short-term Loan Credit Facility totaled

$900 million net of outstanding borrowings of $600 million. The interest

rate for most borrowings under the Short-Term Loan Credit Facility ranges

from 1.00% to 1.75% over LIBOR. The exact spread over LIBOR under the

Short-Term Loan Credit Facility depends upon our performance against

specified financial criteria. Interest on any outstanding borrowings under the

Short-Term Loan Credit Facility is payable at least quarterly.

Both the Credit Facility and the Short-Term Loan Credit Facility are

unconditionally guaranteed by our principal domestic subsidiaries and

contain financial covenants relating to the maintenance of leverage and

fixed charge coverage ratios. The agreements for both credit facilities

also contain affirmative and negative covenants including, among other

things, limitations on certain additional indebtedness and liens, and certain

other transactions specified in the agreement. Given the Company’s

strong balance sheet and cash flows we were able to comply with all

debt covenant requirements at December 26, 2015 with a considerable

amount of cushion. Additionally, both facilities contain cross-default

provisions whereby our failure to make any payment on our indebtedness

in a principal amount in excess of $125 million, or the acceleration of

the maturity of any such indebtedness, will constitute a default under

such agreement.

The majority of our remaining long-term debt primarily comprises Senior

Unsecured Notes with varying maturity dates from 2016 through 2043 and

stated interest rates ranging from 3.75% to 6.88%. The notes represent

senior, unsecured obligations and rank equally in right of payment with

all of our existing and future unsecured unsubordinated indebtedness.

Amounts outstanding under Senior Unsecured Notes were $2.5 billion at

December26, 2015. Our Senior Unsecured Notes contain cross-default

provisions whereby the acceleration of the maturity of any of our indebtedness

in a principal amount in excess of $50 million will constitute a default under

the Senior Unsecured Notes unless such indebtedness is discharged, or

the acceleration of the maturity of that indebtedness is annulled, within

30 days after notice.