Pizza Hut 2015 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 45

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

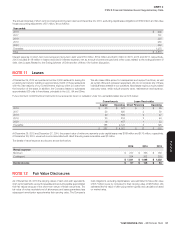

As a result of the use of derivative instruments, the Company is exposed

to risk that the counterparties will fail to meet their contractual obligations.

To mitigate the counterparty credit risk, we only enter into contracts with

carefully selected major financial institutions based upon their credit

ratings and other factors, and continually assess the creditworthiness of

counterparties. At December 26, 2015 and December 27, 2014, all of

the counterparties to our interest rate swaps, foreign currency swaps and

foreign currency forwards had investment grade ratings according to the

three major ratings agencies. To date, all counterparties have performed

in accordance with their contractual obligations.

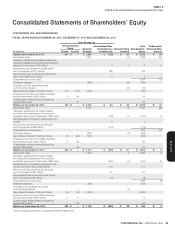

Common Stock Share Repurchases. From time to time, we repurchase

shares of our Common Stock under share repurchase programs authorized

by our Board of Directors. Shares repurchased constitute authorized,

but unissued shares under the North Carolina laws under which we are

incorporated. Additionally, our Common Stock has no par or stated value.

Accordingly, we record the full value of share repurchases, upon the trade

date, against Common Stock on our Consolidated Balance Sheet except

when to do so would result in a negative balance in such Common Stock

account. In such instances, on a period basis, we record the cost of any

further share repurchases as a reduction in retained earnings. Due to the

large number of share repurchases of our stock over the past several

years, our Common Stock balance is frequently zero at the end of any

period. Accordingly, $1,124 million, $725 million and $640 million in share

repurchases were recorded as a reduction in Retained Earnings in 2015,

2014 and 2013, respectively. See Note 15 for additional information on

our share repurchases.

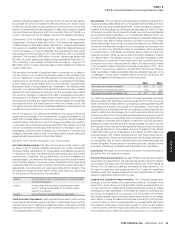

Pension and Post-retirement Medical Benefits. We measure and recognize

the overfunded or underfunded status of our pension and post-retirement

plans as an asset or liability in our Consolidated Balance Sheet as of our

fiscal year end. The funded status represents the difference between the

projected benefit obligations and the fair value of plan assets, which is

calculated on a plan-by-plan basis. The projected benefit obligation and

related funded status are determined using assumptions as of the end of

each year. The projected benefit obligation is the present value of benefits

earned to date by plan participants, including the effect of future salary

increases, as applicable. The difference between the projected benefit

obligations and the fair value of plan assets that has not previously been

recognized in our Consolidated Statement of Income is recorded as a

component of Accumulated other comprehensive income (loss).

The net periodic benefit costs associated with the Company’s defined

benefit pension and post-retirement medical plans are determined using

assumptions regarding the projected benefit obligation and, for funded

plans, the market-related value of plan assets as of the beginning of each

year. We have elected to use a market-related value of plan assets to

calculate the expected return on assets in net periodic benefit costs. We

recognize differences in the fair value versus the market-related value of

plan assets evenly over five years. For each individual plan we amortize into

pension expense the net amounts in Accumulated other comprehensive

income (loss), as adjusted for the difference between the fair value and

market-related value of plan assets, to the extent that such amounts

exceed 10% of the greater of a plan’s projected benefit obligation or

market-related value of assets, over the remaining service period of active

participants in the plan or, for plans with no active participants, over the

expected average life expectancy of the inactive participants in the plan.

We record a curtailment when an event occurs that significantly reduces

the expected years of future service or eliminates the accrual of defined

benefits for the future services of a significant number of employees. We

record a curtailment gain when the employees who are entitled to the

benefits terminate their employment; we record a curtailment loss when

it becomes probable a loss will occur.

We recognize settlement gains or losses only when we have determined

that the cost of all settlements in a year will exceed the sum of the service

and interest costs within an individual plan.

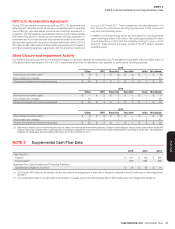

NOTE3 Earnings Per Common Share (“EPS”)

2015 2014 2013

Net Income – YUM! Brands, Inc. $ 1,293 $ 1,051 $ 1,091

Weighted-average common shares outstanding (for basic calculation) 436 444 452

Effect of dilutive share-based employee compensation 7 9 9

Weighted-average common and dilutive potential common shares outstanding

(for diluted calculation) 443 453 461

Basic EPS $ 2.97 $ 2.37 $ 2.41

Diluted EPS $ 2.92 $ 2.32 $ 2.36

Unexercised employee stock options and stock appreciation rights (in millions) excluded from the

diluted EPS computation(a) 4.5 5.5 4.9

(a) These unexercised employee stock options and stock appreciation rights were not included in the computation of diluted EPS because to do so would have been antidilutive for the periods

presented.