Pizza Hut 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K 21

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis of Financial Condition and Results of Operations

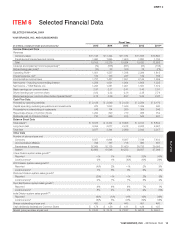

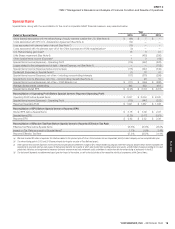

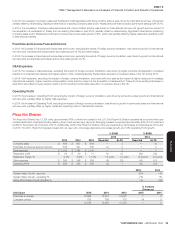

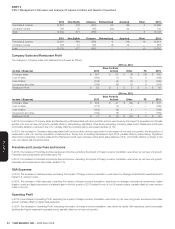

Company Sales and Restaurant Profit

The changes in Company sales and Restaurant profit were as follows:

Income / (Expense)

2015 vs. 2014

2014

Store Portfolio

Actions Other FX 2015

Company sales $ 6,821 $ 363 $ (262) $ (133) $ 6,789

Cost of sales (2,207) (102) 108 42 (2,159)

Cost of labor (1,407) (70) 63 28 (1,386)

Occupancy and other (2,198) (108) 97 42 (2,167)

Restaurant Profit $ 1,009 $ 83 $ 6 $ (21) $ 1,077

Income / (Expense)

2014 vs. 2013

2013

Store Portfolio

Actions Other FX 2014

Company sales $ 6,800 $ 358 $ (322) $ (15) $ 6,821

Cost of sales (2,258) (104) 151 4 (2,207)

Cost of labor (1,360) (75) 26 2 (1,407)

Occupancy and other (2,132) (124) 52 6 (2,198)

Restaurant Profit $ 1,050 $ 55 $ (93) $ (3) $ 1,009

In 2015, the increase in Company sales and Restaurant profit associated with store portfolio actions was driven by net new unit growth partially offset

by the impact of refranchising. Significant other factors impacting Company sales and/or Restaurant profit were labor efficiencies and lower utilities,

partially offset by wage inflation of 8%, company same-store sales declines of 4% and commodity inflation of 1%. See the Summary at the beginning

of this section for discussion of China sales.

In 2014, the increase in Company sales and Restaurant profit associated with store portfolio actions was driven by net new unit growth. Significant other

factors impacting Company sales and/or Restaurant profit were wage rate inflation of 9% and same-store sales declines of 5% which led to inefficiencies

in Cost of sales, partially offset by labor efficiencies and lower advertising expense.

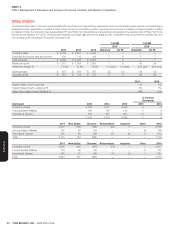

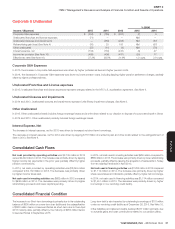

Franchise and License Fees and Income

In 2015, the increase in Franchise and license fees and income, excluding the impact of foreign currency translation, was driven by the impact

of refranchising and net new unit growth, partially offset by franchise and license same-store sales declines of 2%.

In 2014, the increase in Franchise and license fees and income, excluding the impact of foreign currency translation, was driven by the impact

of refranchising, partially offset by franchise and license same-store sales declines of 4%.

G&A Expenses

In 2015 and 2014, the increase in G&A expenses, excluding the impact of foreign currency translation, was driven by higher compensation costs due

to wage inflation and higher headcount.

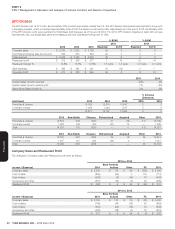

Operating Profit

In 2015, the increase in Operating Profit, excluding the impact of foreign currency translation, was driven by net new unit growth and lower restaurant

operating costs, partially offset by same-store sales declines, decreased Other income due to lower insurance recoveries related to the 2012 poultry

supply incident and higher closure and impairment expenses. See the Summary at the beginning of this section for discussion of China sales.

In 2014, the decrease in Operating Profit, excluding the impact of foreign currency translation, was driven by same-store sales declines, higher restaurant

operating costs and higher G&A expenses, partially offset by net new unit growth and increased Other income due to an insurance recovery related to

the 2012 poultry supply incident.