Pizza Hut 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2015 Form10-K46

Form 10-K

PART II

ITEM 8Financial Statements and Supplementary Data

NOTE4 Items Affecting Comparability of Net Income and Cash Flows

Little Sheep Impairment

On February 1, 2012 we acquired an additional 66% interest in Little Sheep

Group Limited (“Little Sheep”) for $540 million, net of cash acquired of

$44million, increasing our ownership to 93%. The primary assets recorded

as a result of the acquisition and resulting consolidation of Little Sheep

were the Little Sheep trademark and goodwill of approximately $400million

and $375 million, respectively.

Sustained declines in sales and profits in 2013 resulted in a determination

that the Little Sheep trademark, goodwill and certain restaurant level PP&E

were impaired during the quarter ended September 7, 2013. As a result,

we recorded impairment charges to the trademark, goodwill and PP&E

of $69 million, $222 million and $4 million, respectively, during the quarter

ended September 7, 2013.

The Little Sheep business continued to underperform during 2014 with

actual average-unit sales volumes and profit levels significantly below those

assumed in our 2013 estimation of the Little Sheep trademark and reporting

unit fair values. As a result, a significant number of Company-operated

restaurants were closed or refranchised during 2014 with future plans calling

for further focus on franchise-ownership for the Concept. We tested the

Little Sheep trademark and goodwill for impairment in the fourth quarter

of 2014 pursuant to our accounting policy. As a result of comparing the

trademark’s 2014 fair value estimate of $58 million to its carrying value of

$342 million, we recorded a $284 million impairment charge. Additionally,

after determining the 2014 fair value estimate of the Little Sheep reporting

unit was less than its carrying value we wrote off Little Sheep’s remaining

goodwill balance of $160 million. The Company also evaluated other

Little Sheep long-lived assets for impairment and recorded $14 million

of restaurant-level PP&E impairment and a $5 million impairment of our

equity method investment in a meat processing business that supplies

lamb to Little Sheep.

The losses related to Little Sheep that have occurred concurrent with our

trademark and goodwill impairments in 2014 and 2013, none of which

have been allocated to any segment for performance reporting purposes,

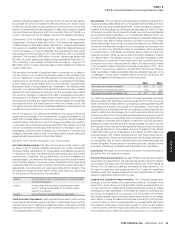

are summarized below:

2014 2013 Income Statement Classification

Impairment of Goodwill $ 160 $ 222 Closures and Impairment (income) expense

Impairment of Trademark 284 69 Closures and Impairment (income) expense

Impairment of PP&E 14 4 Closures and Impairment (income) expense

Impairment of Investment in Little Sheep Meat 5 — Closures and Impairment (income) expense

Tax Benefit (76) (18) Income tax provision

Loss Attributable to Non-Controlling Interest (26) (19) Net Income (loss) noncontrolling interests

Net Loss $ 361 $ 258 Net Income – YUM! Brands, Inc.

Losses Related to the Extinguishment

ofDebt

During the fourth quarter of 2013, we completed a cash tender offer

to repurchase $550 million of our Senior Unsecured Notes due either

March 2018 or November 2037. This transaction resulted in $120 million

of losses as a result of premiums paid and other costs, $118 million of

which was classified as Interest expense, net in our Consolidated Statement

of Income. The repurchase of the Senior Unsecured Notes was funded

primarily by proceeds of $599 million received from the issuance of new

Senior Unsecured Notes.

Refranchising (Gain) Loss

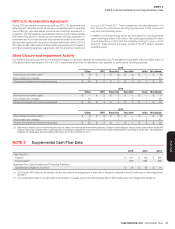

The Refranchising (gain) loss by reportable segment is presented below. We do not allocate such gains and losses to our segments for performance

reporting purposes.

Refranchising (gain) loss

2015 2014 2013

China $ (13) $ (17) $ (5)

KFC Division(a) 30 (18) (8)

Pizza Hut Division(a)(b) 55 4 (3)

Taco Bell Division (65) (4) (84)

India 3 2 —

Worldwide $ 10 $ (33) $ (100)

(a) In 2010 we refranchised our then-remaining Company-operated restaurants in Mexico. To the extent we owned it, we did not sell the real estate related to certain of these restaurants,

instead leasing it to the franchisee. During 2015, we sold the real estate for approximately $58 million. While these proceeds exceeded the book value of the real estate, the sale represented

a substantial liquidation of our Mexican foreign entities under GAAP. As such, the accumulated translation losses associated with our Mexican business were included in our loss on the sale.

We recorded charges of $80 million representing the excess of the sum of the book value of the real estate and other related assets and our accumulated translation losses over the sales

price. Consistent with the classification of the original market refranchising transaction, these charges were classified as Refranchising (gain) loss. Refranchising losses of $40 million were

associated with both the KFC and Pizza Hut Divisions.

Our KFC and Pizza Hut Divisions earned approximately $2 million and $1 million, respectively, of rental income in 2015 and $3 million and $1 million, respectively, of rental income in 2014

related to this real estate that transferred to the buyer subsequent to the sale of the real estate. We continue to earn U.S. dollar-denominated franchise fees, most of which are sales-based

royalties, under our existing franchise contracts with our Mexico franchisee.

(b) During 2015 we recognized charges of $16 million within Refranchising (gain) loss associated with the refranchising of our company-owned Pizza Hut restaurants in Korea. While additional

gains or losses may occur as the refranchising plans move forward, such amounts are not expected to be material at this time.