PG&E 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

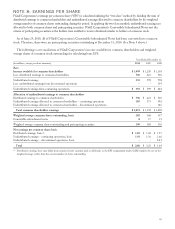

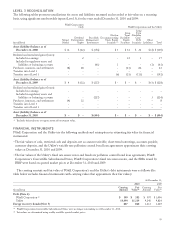

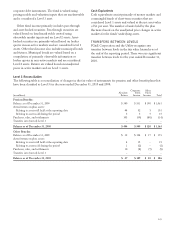

Fair Value Measurements at December 31, 2009

(in millions) Level 1 Level 2 Level 3 Total

Assets:

Money market investments $ 189 $ – $ 4 $ 193

Nuclear decommissioning trusts

U.S. equity securities (1) 762 6 – 768

Non-U.S. equity securities 344 – – 344

U.S. government and agency securities 653 51 – 704

Municipal securities 189 – 90

Other fixed income securities – 108 – 108

Total nuclear decommissioning trusts (2) 1,760 254 – 2,014

Rabbi trusts

Equity securities 21 – – 21

Life insurance contracts 60 – – 60

Total rabbi trusts 81 – – 81

Long-term disability trust

U.S. equity securities (1) 52 23 – 75

Corporate debt securities (1) – 113 – 113

Total long-term disability trust 52 136 – 188

Total assets $ 2,082 $ 390 $ 4 $ 2,476

Liabilities:

Dividend participation rights (3) $–$–$12$12

Price risk management instruments (Note 10)

Electric (4) 2 73 157 232

Gas (5) 1 – 60 61

Total price risk management instruments 3 73 217 293

Other liabilities –– 3 3

Total liabilities $ 3 $ 73 $ 232 $ 308

(1) Level 2 balances include commingled funds, which are composed primarily of securities traded publicly on exchanges. Price quotes for the assets

held by the funds are readily observable and available.

(2) Excludes deferred taxes on appreciation of investment value.

(3) The dividend participation rights were associated with PG&E Corporation’s Convertible Subordinated Notes, which were no longer outstanding as

of December 31, 2010.

(4) Balances include the impact of netting adjustments of $108 million to Level 1, $48 million to Level 2, and $19 million to Level 3. Includes natural

gas for electric portfolio.

(5) Balances include the impact of netting adjustments of $13 million to Level 3. Includes natural gas for core customers.

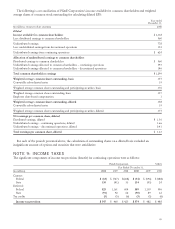

MONEY MARKET INVESTMENTS

PG&E Corporation invests in money market funds that

seek to maintain a stable net asset value. These funds

invest in high-quality, short-term, diversified money

market instruments, such as treasury bills, federal agency

securities, certificates of deposit, and commercial paper

with a maximum weighted average maturity of 60 days or

less. PG&E Corporation’s investments in these money

market funds are generally valued using unadjusted

quotes in an active market for identical assets and are thus

classified as Level 1 instruments. Money market funds are

recorded as cash and cash equivalents in PG&E

Corporation’s Consolidated Balance Sheets.

TRUST ASSETS

The assets held by the nuclear decommissioning trusts,

the rabbi trusts related to the non-qualified deferred

compensation plans, and the long-term disability trust are

composed primarily of equity securities and debt

securities. In general, investments held in the trusts are

exposed to various risks, such as interest rate, credit, and

market volatility risks. It is reasonably possible that

changes in the market values of investment securities

could occur in the near term, and such changes could

materially affect the trusts’ fair value.

93