PG&E 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.water intake or discharge at certain facilities, and mitigation

measures associated with electric and magnetic fields.

Generally, the Utility has recovered the costs of complying

with environmental laws and regulation in the Utility’s

rates, subject to reasonableness review.

California legislation, AB 32, imposes a statewide limit

on the emission of GHG that must be achieved by 2020.

The CARB is developing “cap-and-trade” regulations that

would establish state-wide annual caps on GHG emissions

(from 2012 to 2020), allocate the rights to emit GHGs

among utilities, and allow for the purchase and sale of

emission allowances through a CARB-managed auction,

among other provisions. Depending on the final form of

regulations, the Utility could incur significant additional

costs to ensure that it complies with the new rules if they

become effective as planned on January 1, 2012. In

addition, the Utility expects that its cost to procure

electricity from other generation providers will reflect their

costs of compliance and the actual market price of

emission allowances. Although these costs are expected to

be passed through to customers, there can be no assurance

that the CPUC will permit full recovery of these costs.

These costs may change if federal or regional cap-and-trade

programs are adopted.

In addition, the Utility already has significant liabilities

(currently known, unknown, actual, and potential) related

to environmental contamination at current and former

Utility facilities, including natural gas compressor stations

and former MGP sites, as well as at third-party-owned sites.

(See “Environmental Matters” above.) The CPUC has

established a special ratemaking mechanism under which

the Utility is authorized to recover 90% of environmental

costs associated with hazardous waste without a

reasonableness review. There is no guarantee that the

CPUC will not discontinue or change this ratemaking

mechanism in the future. In addition, this ratemaking

mechanism does not apply to remediation costs associated

with the Hinkley natural gas compressor site, or to costs or

losses the Utility may incur as a result of claims for

property damage or personal injury.

The Utility’s environmental compliance and

remediation costs could increase, and the timing of its

future capital expenditures may accelerate, if standards

become stricter, regulation increases, other potentially

responsible parties cannot or do not contribute to cleanup

costs, conditions change, or additional contamination is

discovered. If the Utility must pay materially more than the

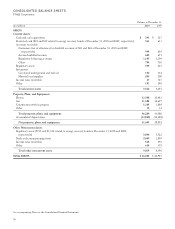

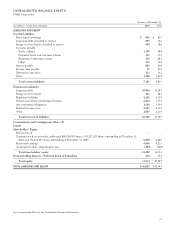

amount that it currently has accrued on its Consolidated

Balance Sheets to satisfy its environmental remediation

obligations, and if the Utility cannot recover those or other

costs of complying with environmental laws in its rates in a

timely manner, or at all, PG&E Corporation’s and the

Utility’s financial condition, results of operations, and cash

flow would be materially adversely affected.

The operationand decommissioning of the Utility’s nuclear

powerplants expose it to potentially significant liabilities and

capital expenditures that it may not be able to recoverfrom its

insurance orothersources, adversely affecting its financial

condition,results of operations, and cash flow.

Operating and decommissioning the Utility’s nuclear

power plants expose it to potentially significant liabilities

and capital expenditures, including not only the risk of

death, injury, and property damage from a nuclear accident

but matters arising from the storage, handling, and disposal

of radioactive materials, including spent nuclear fuel;

stringent safety and security requirements; public and

political opposition to nuclear power operations; and

uncertainties related to the regulatory, technological, and

financial aspects of decommissioning nuclear plants when

their licenses expire. The Utility maintains insurance and

decommissioning trusts to reduce the Utility’s financial

exposure to these risks. However, the costs or damages the

Utility may incur in connection with the operation and

decommissioning of nuclear power plants could exceed the

amount of the Utility’s insurance coverage and other

amounts set aside for these potential liabilities. In addition,

as an operator of two operating nuclear reactor units, the

Utility may be required under federal law to pay up to

$235 million of liabilities arising out of each nuclear

incident occurring not only at the Utility’s Diablo Canyon

facility but at any other nuclear power plant in the United

States.

The NRC has issued operating licenses for Diablo

Canyon that expire in 2024 for Unit 1 and 2025 for Unit 2.

In November 2009, the Utility requested that the NRC

renew each of these licenses for an additional 20 years. The

Utility expects the license renewal process to take many

years, as the NRC conducts detailed environmental,

seismic, and safety-related studies and holds public

hearings. The NRC has broad authority to impose licensing

and safety-related requirements that could require the

Utility to incur significant capital expenditures in

connection with the re-licensing process.

The NRC also has issued a license for the Utility to

construct a dry cask storage facility to store spent nuclear

fuel on site at Diablo Canyon. Although the dry cask

storage facility is complete and the initial movement of

spent fuel has occurred, an appeal of the NRC license is

still pending.

If one or both units at Diablo Canyon were shut down

pursuant to an NRC order; to comply with NRC licensing,

52